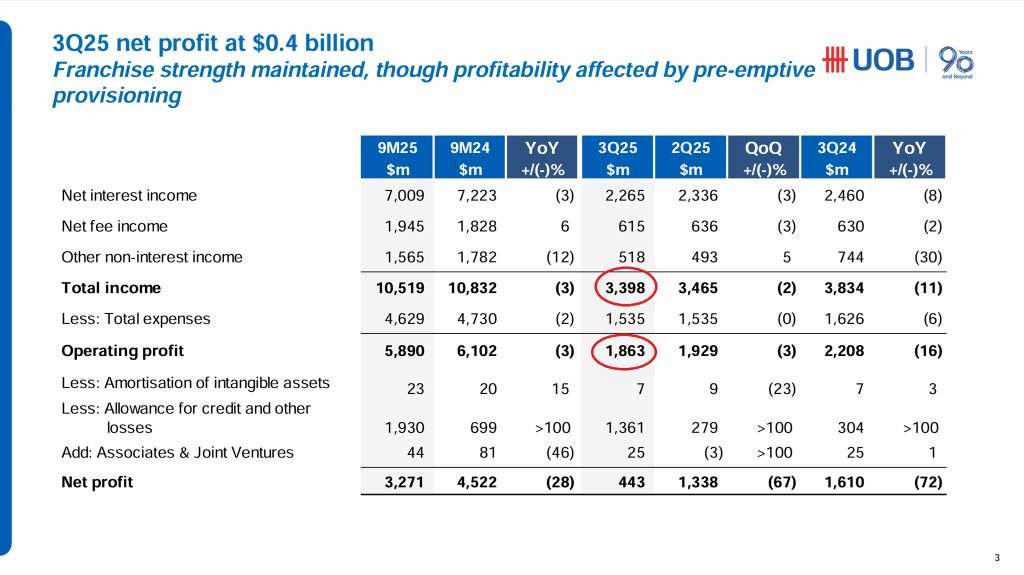

United Overseas Bank (UOB) reported its financial results for the third quarter of 2025, and the headline numbers immediately caught attention. Net profit fell 72% year-on-year to S$443 million, a steep decline that might alarm casual observers. Yet, the drop was not driven by deterioration in the bank’s core business. Instead, management made the deliberate choice to set aside S$615 million in pre-emptive general allowances, a move designed to strengthen provision coverage and reinforce balance sheet resilience in the face of ongoing macroeconomic uncertainties.

Operating profit before allowances stood at S$1.9 billion, down 16% year-on-year but still reflecting the strength of UOB’s diversified franchise. Both Group Retail and Group Wholesale Banking segments continued to show progress, with growth in wealth assets under management, card billings, and quality loan expansion. Global Markets also contributed positively, leveraging client demand for hedging and investment solutions.

Total income for the quarter came in at S$3.4 billion, down 11% compared to the same period last year. Net interest income fell 8% to S$2.3 billion, as UOB grappled with significant margin compression. The bank’s net interest margin contracted by 23 basis points year-on-year to 1.82%, reflecting the impact of lower benchmark rates on asset yields.

Despite these headwinds, UOB’s loan book continued to expand. Customer loans grew 5% year-on-year to S$351 billion, underscoring the bank’s ability to deepen its franchise across ASEAN markets. Asset quality remained stable, with the non-performing loan ratio edging up only slightly to 1.6%, a testament to disciplined risk management.

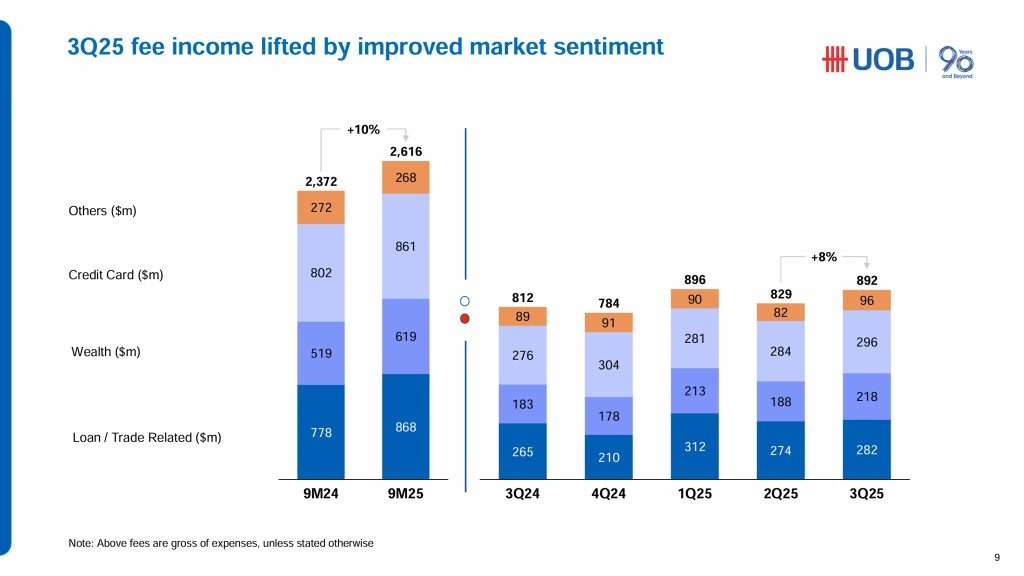

Fee Income and Non-Interest Revenue

Fee income provided a bright spot. It rose 8% quarter-on-quarter, driven by broad-based growth across wealth management, cards, and loan-related activities. Customer-related treasury income reached a new high, reflecting strong client demand for hedging and investment solutions. However, on a year-on-year basis, non-interest income fell 17.5% to S$1.13 billion, largely due to weaker trading and investment income compared to the record levels achieved in the prior year.

Capital Strength

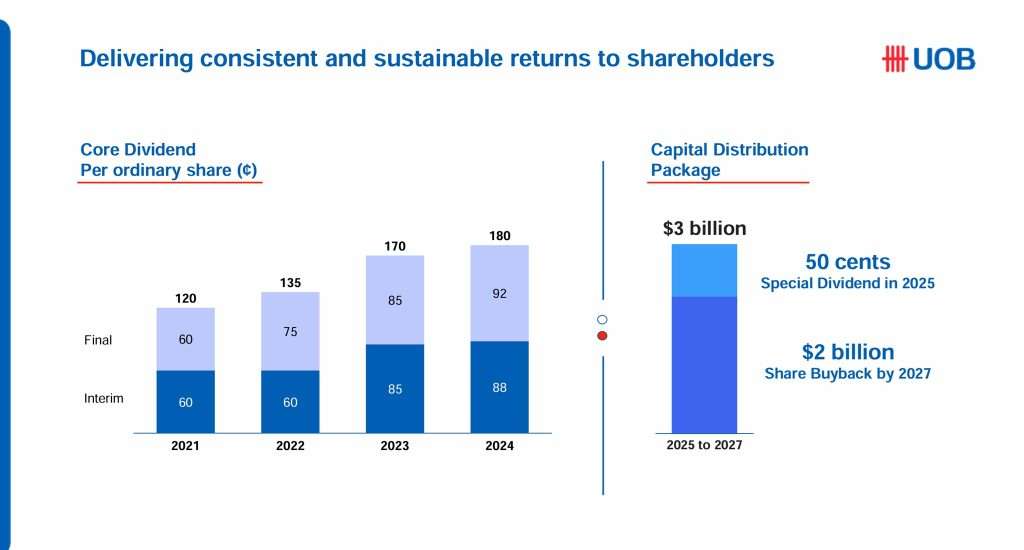

From a capital perspective, UOB remains well-positioned. The Common Equity Tier 1 (CET1) ratio is a measure of a bank’s core equity capital relative to its risk-weighted assets. UOB’s Common Equity Tier 1 (CET1) ratio stood at 14.6%, up 0.9 percentage points year-on-year, reinforcing the bank’s ability to absorb shocks and support growth. Importantly, management emphasized that the pre-emptive allowances will not affect the final dividend for 2025, signalling confidence in its capital strength and commitment to shareholder returns.

CEO’s Perspective

Deputy Chairman and CEO Wee Ee Cheong framed the results as evidence of resilience. He highlighted that UOB’s proactive provisioning enhances flexibility to navigate headwinds while sustaining long-term growth. The bank’s strategy remains focused on balance sheet strength, disciplined investment, and seizing opportunities across ASEAN, which continues to be a key growth engine despite global uncertainties.

Guidance for 2026

Looking ahead, UOB has provided guidance that suggests continued margin pressure into 2026. Management expects low single-digit loan growth and a full-year net interest margin in the range of 1.75% to 1.80%, indicating further compression before stabilization. On the positive side, fee income is projected to grow at high single- to double-digit rates, supported by wealth management and card activities. Operating expenses are expected to rise only in the low single digits, reflecting ongoing cost discipline.

The Bigger Picture

The broader narrative here is one of cautious optimism. While headline profit plunged, the underlying franchise remains robust. UOB’s decision to front-load provisions demonstrates prudence, ensuring that the bank is well-prepared for potential sector-specific headwinds. At the same time, growth in loans, wealth assets, and fee income shows that the bank continues to expand its core businesses.

For investors, the key takeaway is that UOB is prioritizing resilience over short-term earnings. The assurance that dividends remain unaffected is significant, as it signals management’s confidence in the bank’s capital position. For customers, the results underscore UOB’s commitment to supporting clients across ASEAN, even as global uncertainties persist.

Dividend and Shareholder Returns

UOB shared that the deliberate choice to set aside S$615 million in pre-emptive general allowances will not affect the final dividend payment for 2025.

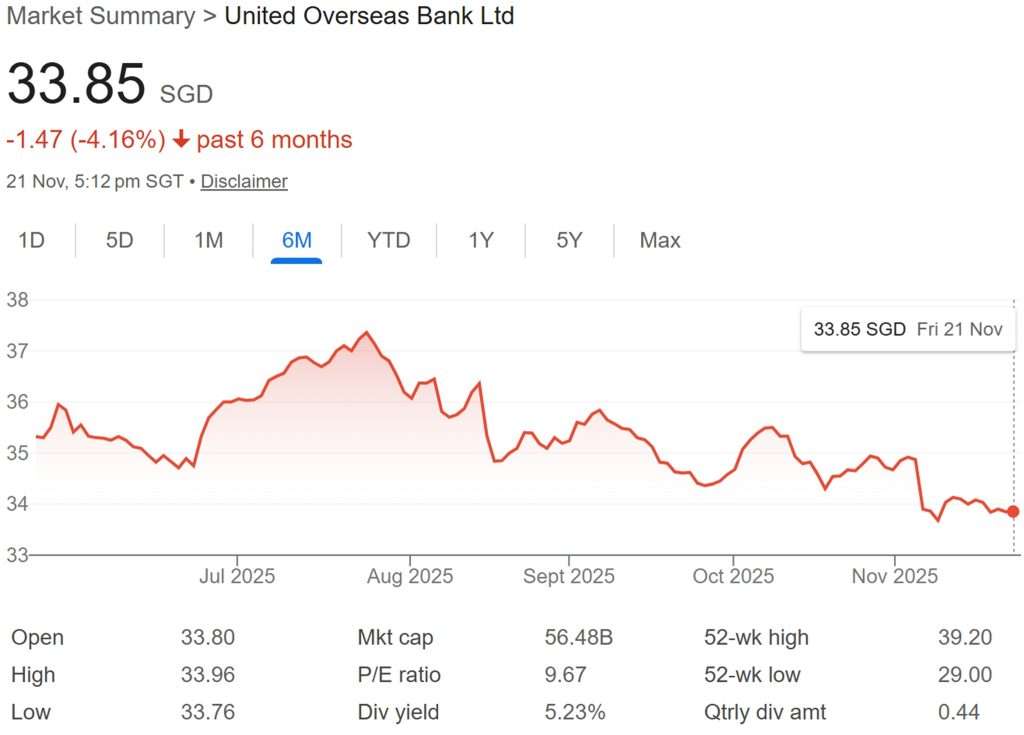

UOB share price closed at S$33.85 on 21st November 2025. Based on UOB share price of S$33.85 and F2024 full year distribution of 230 cents, UOB current dividend yield is 6.79%.

Excluding the special dividend of 50 cents paid in FY2024, UOB current dividend yield works out to be 5.32%.

Conclusion of UOB 3Q 2025 Financial Results

In many ways, UOB’s third-quarter 2025 performance reflects the broader challenges facing banks in a lower-rate environment. Margin compression is a reality, but those with diversified income streams and disciplined risk management are better positioned to weather the storm. UOB’s proactive stance on provisioning, coupled with its strong capital base, suggests that it is not merely reacting to challenges but preparing strategically for the future.

As ASEAN economies continue to grow and financial markets evolve, UOB’s ability to balance prudence with expansion will be critical. The third-quarter results may look weak on the surface, but beneath the headline numbers lies a story of resilience, discipline, and long-term positioning. For stakeholders, that may be the most important message of all.