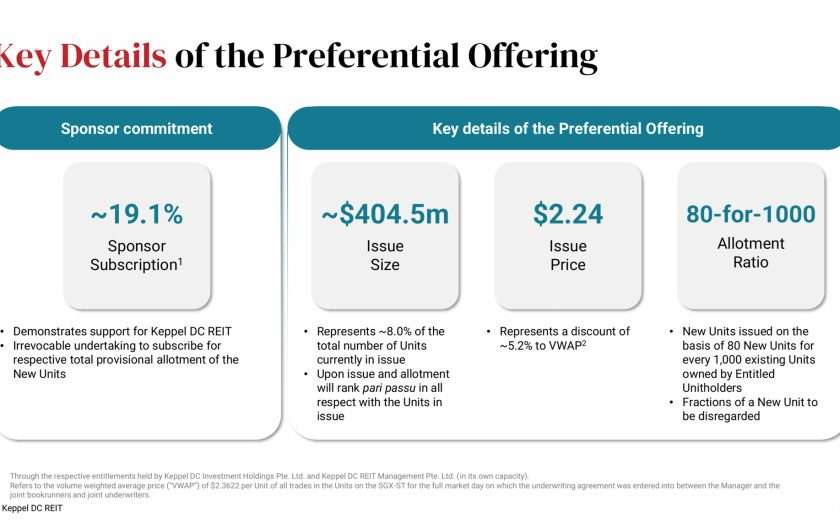

Keppel DC REIT has successfully concluded its fully underwritten, non-renounceable preferential offering, raising approximately S$404.5 million in gross proceeds. This capital raise marks a strategic milestone for the REIT as it continues to expand its …

Continue reading