T Bill Singapore 2026 is now available. The announcement date, auction date and issue date of Singapore Treasury Bills (T bill) is now available on Monetary Authority of Singapore (MAS) website. In 2025, I collected a total passive income of $20,289.89. A small portion of my passive income comes from investing my spare cash into Singapore Treasury Bills (T bill).

Do you know what are Singapore Treasury Bills? Singapore Treasury Bills are short-term debt instruments issued by the Singapore government to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

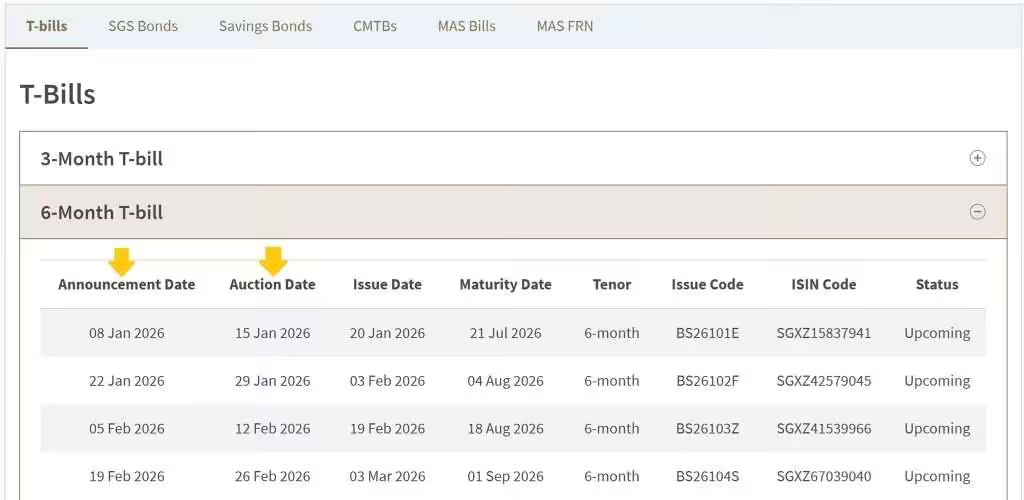

Investors can purchase these bills directly from the Singapore government or through designated financial institutions. Treasury Bills are often used by investors as a low-risk, liquid investment option with a fixed return. The announcement date and auction date of each issue of T bill can be found at Monetary Authority of Singapore (MAS) website under Auctions and Issuance Calendar. The issuance calendar 2026 is already available.

T Bill Singapore 2026 Calendar

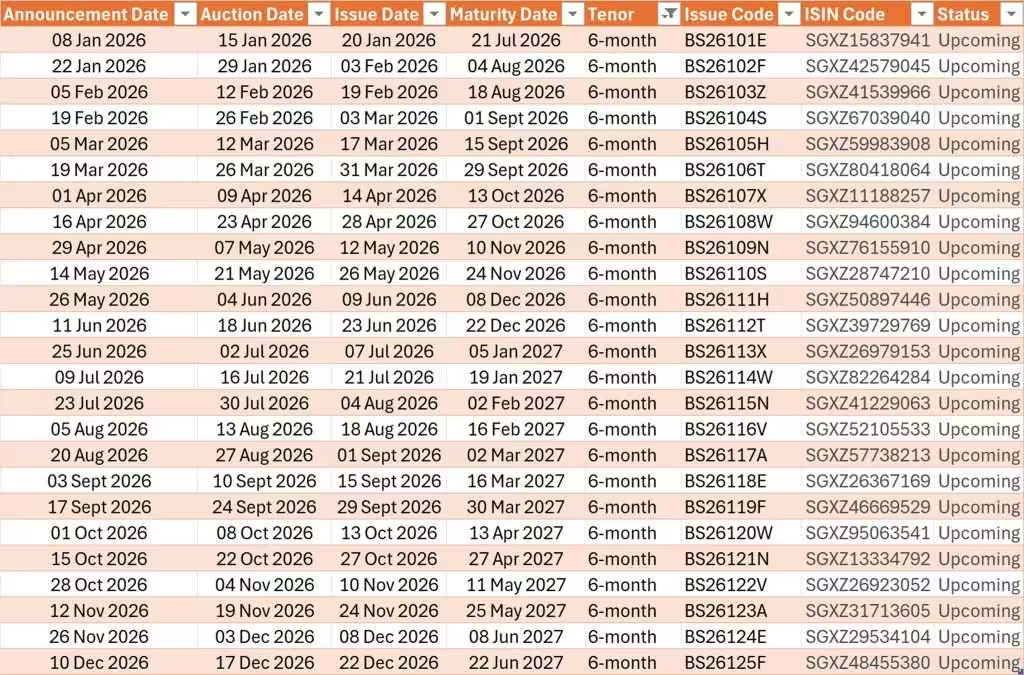

For convenience, I am sharing the Singapore Treasury Bills (T-Bills) Auction and Issuance Calendar here. If you need the Treasury Bill results such as the status of each issuance, please refer to Treasury Bills at MAS website – Auctions and Issuance Calendar.

Six Months T Bill Calendar

One Year T Bill Calendar

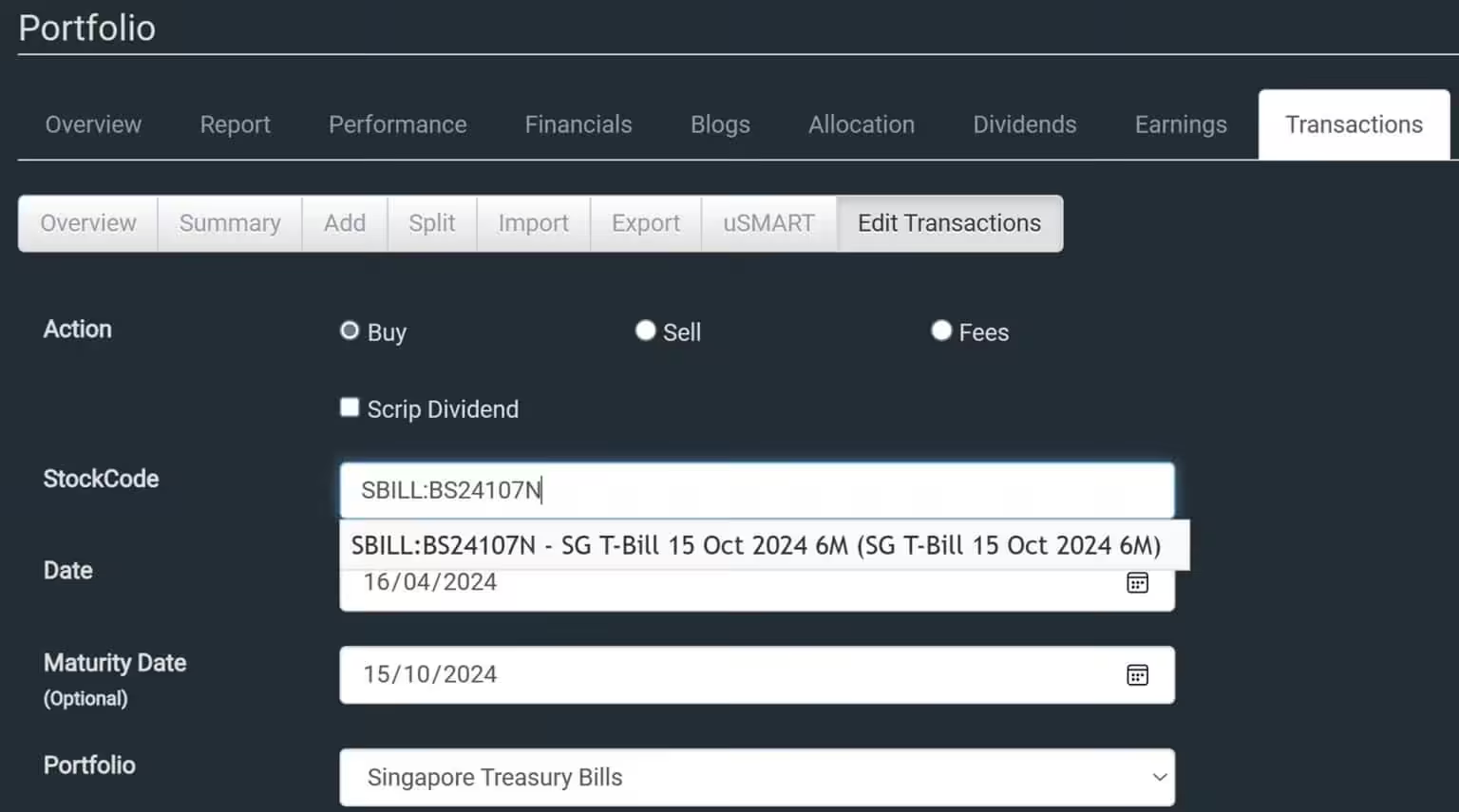

Tracking Treasury Bills (T-Bills)

Stocks Café is probably the only software that I know which allows you to track your purchased Singapore Savings Bonds and Treasury Bills (T-Bills) all in one place together with your stock investments. This makes it easy to track your total net investments.

Stocks Café allows you to create portfolios. You can use portfolio to different your investments. For example, I created three portfolios in Stocks Café, namely Stocks, Singapore Savings Bonds and Treasury Bills. This allow me to categorize how much I allocate for each investment.

How To Buy T Bill Singapore?

Singapore Treasury Bills can be purchased either with cash, CPF Ordinary Account funds, or SRS savings, and the process is designed to be straightforward for individual investors. You begin by applying through internet banking with any of the three local banks DBS, OCBC, or UOB. You can also submit an application at an ATM if you prefer an offline method.

Applications must be submitted before each bank’s cut-off time, which is typically one business day before the auction. When you apply, you choose between a competitive bid, where you specify the yield, you are willing to accept, or a non-competitive bid, where you accept the eventual cut-off yield determined at auction. T bills are issued at a discount, meaning you pay less upfront and receive the full-face value at maturity.

Once the auction concludes, you can check your allocation results through your bank’s platform. If your bid is successful, the purchase amount is deducted from your bank account, CPF-OA, or SRS accordingly. The T-bill will then appear in your CDP account if purchased with cash, or in your CPF/SRS statement if purchased using those funds. At maturity, either six months or one year depending on the tenor, the government pays you the full-face value, and your return is simply the difference between what you paid and what you receive.

Banks like DBS also provide step-by-step guidance on their platforms to help you navigate the application process smoothly.

Invest in T Bills Using SRS

In December 2025, I invested all my SRS funds into Singapore Treasury Bills. Investing your SRS funds into Singapore Treasury Bills offers a compelling way to enhance both the tax advantages of the SRS scheme and the stability of your retirement portfolio. Since idle SRS balances earn only 0.05% per year, allocating them to T-bills allows you to capture higher short‑term yields backed by the Singapore Government, one of the strongest credit ratings globally. This makes T-bills a low‑risk instrument that preserves capital while providing predictable returns, which is especially valuable for investors who want to grow their retirement savings without taking on equity‑level volatility. Because T-bills are issued at a discount and redeemed at face value, the return is straightforward and transparent, making them an attractive option for conservative or tax‑efficient planning.

Another key benefit is the flexibility T-bills offer within the SRS framework. Unlike long‑term investments that may lock up funds or expose you to market swings, six‑month or one‑year T-bills allow you to reinvest regularly based on prevailing interest rates, giving you the agility to respond to changing market conditions. This complements the deferred‑tax nature of SRS, where gains are tax‑deferred until withdrawal and potentially taxed at a lower rate during retirement. By combining the tax relief from SRS contributions with the safety and yield of T-bills, investors can create a disciplined, low‑risk strategy that steadily compounds retirement savings while maintaining control over liquidity and reinvestment timing.