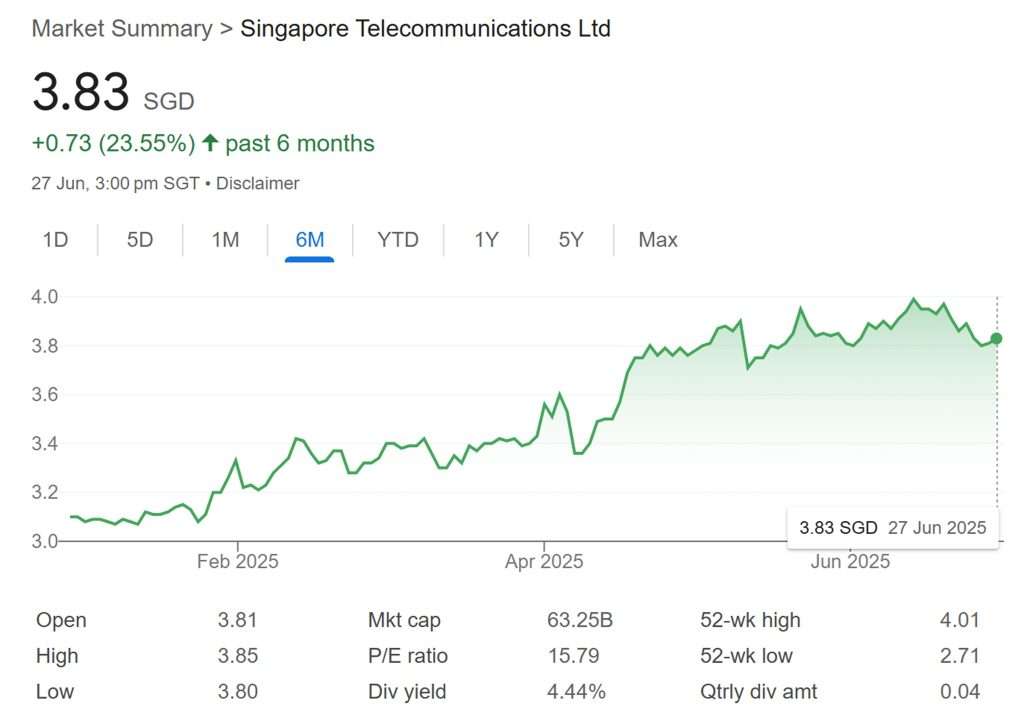

Singtel (SGX: Z74) has recently experienced a notable surge in its share price, reaching a five-year high. This rally is not merely a fleeting upward trend but rather a testament to the company’s strategic reset, robust financial performance, and a clear commitment to enhancing shareholder value. Several key factors have converged to fuel investor confidence and drive the stock upwards.

At this point of writing, Singtel (SGX: Z74) makes up 1.36% of my stock portfolio. I bought Singtel in 2018. Since then, the share price of Singtel was on a downtrend due to the competitiveness of the Telco business in Singapore. I am glad to see Singtel share price climb back up.

Below, let us take a look at the list of factors on what fuel investor confidence and drive the share price of Singtel upwards.

Strong Financial Results and Singtel Dividend Boost

A primary catalyst for Singtel’s recent share price appreciation has been its impressive financial performance, particularly for the fiscal year ended March 31, 2025. The company reported a net profit of S$4.02 billion, a more than fivefold increase from the previous year. While this significant jump was largely attributed to a net exceptional gain of S$1.55 billion, primarily from the partial divestment of its Comcentre headquarters, it nevertheless showcased the company’s ability to unlock value from its assets.

Furthermore, Singtel’s underlying net profit, which forms the basis for its core dividends, also saw a healthy 9% increase to S$2.47 billion. This strong performance allowed the company to propose a final dividend of 10 cents per share, bringing the total Singtel dividends for FY2025 to 17 cents, an increase from 15 cents in the prior year. This bump in dividends, alongside an enhanced dividend policy, has significantly appealed to income-focused investors.

Aggressive Capital Recycling and Share Buyback Program

Singtel’s proactive approach to capital management has been a significant driver of its recent stock performance. The company has demonstrated a strong commitment to its capital recycling strategy, raising its mid-term target from S$6 billion to an ambitious S$9 billion. This strategy involves divesting non-core assets to unlock capital, which can then be redeployed for growth, debt reduction, and shareholder returns.

A key development in this strategy was the divestment of a 1.2% stake in its Indian associate, Bharti Airtel, for S$2 billion in mid-May 2025.This transaction alone helped Singtel achieve more than half of its initial S$6 billion target, providing a clear signal to the market that the company is actively executing its plans.

Adding to this positive sentiment, Singtel announced its first-ever share buyback program of up to S$2 billion over three years. This program, to be funded by excess capital from asset recycling proceeds, signals management’s confidence in Singtel’s long-term value and its dedication to improving total shareholder returns by reducing the number of outstanding shares.

Operational Improvements and Growth Areas

Beyond the one-off gains and capital management initiatives, underlying operational improvements have also contributed to Singtel’s positive momentum. Robust performances from key segments like Optus in Australia and NCS (National Computer Systems) have been noted. Optus, for instance, saw a significant jump in EBIT, driven by improvements in its mobile business and effective cost management. NCS also experienced strong growth in its earnings before interest and taxes, fuelled by demand for digital services and cost optimization.

Singtel’s strategic focus on developing new growth engines in ICT and digital services, leveraging its 5G leadership, and unlocking the value of its infrastructure assets under its “Singtel28” growth plan, has also been well-received by the market. The company aims for further operating profit growth in FY2026, supported by continued cost discipline and expansion in these promising areas.

Investor Confidence and Analyst Outlook

The combination of strong financial results, a clear capital management strategy, and operational improvements has significantly bolstered investor confidence in Singtel. Analysts have largely maintained positive ratings, with many increasing their price targets for the stock. The market sees Singtel’s efforts in achieving a more optimal capital structure and its enhanced dividend policy as clear indicators of its commitment to shareholder value.

While the competitive landscape in Singapore’s mobile segment and potential currency weakness in regional markets remain factors to watch, Singtel’s recent performance underscores a successful pivot towards value creation. The recent surge in Singtel stock price reflects a renewed investor optimism in the telco giant’s ability to navigate market challenges and deliver sustained returns.