Are you searching for the best Singapore REITs to invest in December 2025? Real Estate Investment Trusts (REITs) in Singapore continue to be one of the most reliable ways to build long-term passive income. Over the past year, I personally earned S$19,000 in dividends, all of which were reinvested back into the market. This disciplined reinvestment strategy, combined with the power of compounding, helped me reach a major financial milestone I set five years ago.

Why Singapore REITs Are Attractive in 2025

- Consistent dividend payouts: Most REITs distribute dividends quarterly or semi-annually, providing a steady cash flow.

- Accessibility for investors: REITs are simple to understand and easy to add to any portfolio.

- Passive income potential: Dividends can be reinvested to accelerate compounding or used to support lifestyle goals.

For investors looking to grow wealth sustainably, Singapore REITs remain one of the most straightforward and effective tools in the market. Whether you are building a retirement plan or aiming to increase your passive income, December 2025 offers strong opportunities to explore quality REITs that align with your financial goals.

Why Stock Screening Matters for REIT Investors

If you are planning to buy Singapore REITs in 2025, the first step is identifying which REITs fit your portfolio. One of the most effective techniques in REIT investing is stock screening, a systematic process that filters through a wide universe of REITs based on specific financial criteria.

In Singapore, stock screening helps narrow down potential REIT opportunities by focusing on key metrics such as:

- Dividend yield – to evaluate passive income potential

- Price-to-Earnings (P/E) ratio – to assess valuation

- Gearing levels – to measure financial stability and risk

- Market capitalization & sector exposure – to diversify effectively

Benefits of Using REIT Screening Tools

With today’s abundance of online screening platforms, investors can:

- Generate a shortlist of high-quality REITs that match investment goals

- Compare REITs side by side for yields, valuations, and leverage

- Make data-driven decisions backed by transparent financial metrics

For anyone serious about building sustainable passive income through Singapore REITs, stock screening is an indispensable tool. By leveraging these platforms, you can confidently select REITs that align with your financial objectives and long-term wealth strategy.

To streamline my REIT selection process, I rely on the Stocks Café Stock Screener. It helps me filter for REITs that meet my predefined investment criteria, allowing me to focus on a curated shortlist worth deeper analysis.

Here are the key parameters I use to screen for dividend-paying REITs. Please feel free to adjust them based on your own risk tolerance and investment goals:

- Market Capitalization: ≥ S$1 billion

- Current Dividend Yield: Between 5% and 10%

- Price-to-Book Ratio: ≤ 3

This approach ensures I am targeting REITs with solid fundamentals, attractive yields, and reasonable valuations, ideal for building a sustainable passive income portfolio.

Market capitalization

Market capitalization, commonly known as “market cap” is a foundational metric used to assess a company’s size and market value. It’s calculated by multiplying the current share price by the total number of outstanding shares.

This figure helps classify companies into three main categories:

- Large-cap stocks: These are well-established firms with a track record of stable performance, such as Apple or Microsoft. They’re generally considered lower-risk investments due to their scale and resilience.

- Mid-cap stocks: Representing companies in their growth phase, mid-caps offer higher upside potential but may carry more volatility compared to large-cap stocks.

- Small-cap stocks: Typically, newer and less proven, small-caps can deliver substantial growth but with increased risk and sensitivity to market shifts.

Investors use market cap to gauge a company’s relative size, benchmark it against peers, and build diversified portfolios tailored to their risk appetite and financial goals. That said, market cap is just one piece of the puzzle. A well-rounded analysis should also consider fundamentals like revenue, earnings, industry dynamics, and long-term growth prospects.

Current Dividend Yield

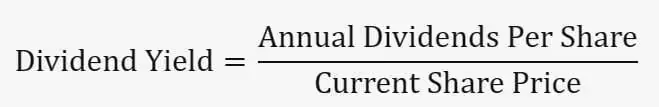

Dividend yield is a key financial ratio that indicates how much a company returns to shareholders in the form of dividends, relative to its current stock price. It is a useful metric for income-focused investors evaluating the attractiveness of dividend-paying stocks. The formula is:

A higher yield may signal strong income potential, but it is important to assess sustainability and underlying fundamentals before investing.

Price / Book (PB Ratio)

The price-to-book (P/B) ratio is a commonly used valuation metric that compares a company’s market price to its book value. It helps investors gauge whether a stock is trading at a premium or discount relative to its net asset value. The formula is P/B Ratio = Market Price Per Share / Book Value Per Share.

A P/B ratio below 1 may suggest the stock is undervalued, meaning it is trading for less than the value of its assets. Conversely, a higher P/B ratio could indicate overvaluation, assuming all other factors remain constant. While useful, the P/B ratio should be considered alongside other financial metrics and qualitative factors for a more complete investment picture.

Singapore REITs to Buy in December 2025

Using the Stocks Café Stock Screener, I filtered for Singapore-listed REITs that meet my dividend-focused criteria:

- Market Capitalization ≥ S$1 billion

- Dividend Yield between 5% and 10%

- Price-to-Book Ratio ≤ 3

This screening helps me focus on REITs with solid fundamentals, attractive yields, and reasonable valuations. Here is the shortlist generated in December 2025: