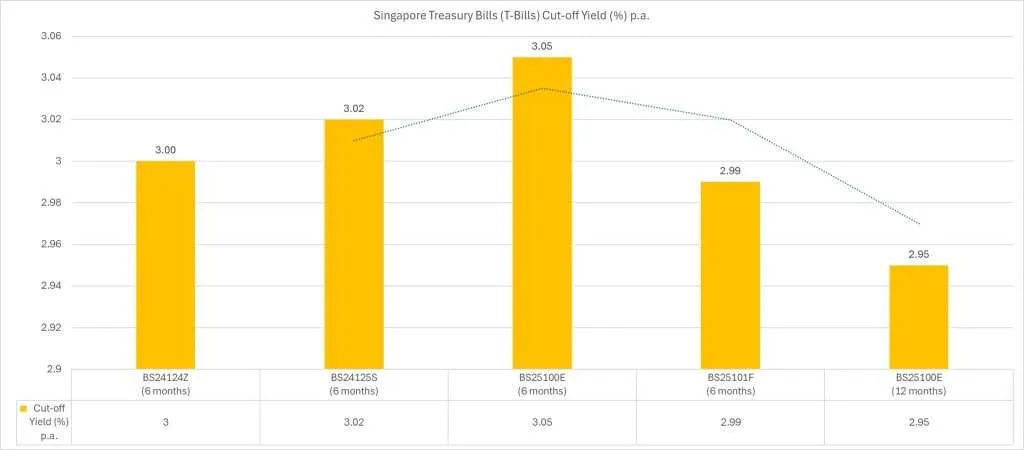

The cutoff yield for 1-Year Singapore Treasury Bills (SGS T Bills) BY25100H is 2.95% per annum. In terms of interest rates, Singapore Treasury Bills (SGS T Bills) offered higher interest rates than Singapore Savings Bond (SBFEB25) and most fixed deposits. SGS T Bills are low risk in nature and can be the next alternative place to grow your money.

This issue of Singapore Treasury Bill (BY25100H) is the first 12-month issue of SGS T Bill in 2025. Based on the above chart, the interest rate SGS T Bill was on a downtrend since the first issue in 2025.

Do you know why Singapore Treasury Bills can pay high interest rates? Singapore Treasury Bills can pay high interest rates for several reasons. Firstly, Singapore is known for its strong and stable economy, which makes its government bonds a safe investment option. Investors are willing to accept lower yields on bonds from countries with a stable economy, so Singapore can offer higher interest rates on its Treasury Bills to attract investors.

Additionally, the Monetary Authority of Singapore (MAS) actively manages its monetary policy to control inflation and ensure economic stability, which can lead to higher interest rates on government bonds.

Lastly, Singapore has a high credit rating, which means that investors have confidence in the government’s ability to repay its debts, allowing the government to offer higher interest rates on its Treasury Bills. Overall, these factors contribute to Singapore Treasury Bills being able to pay high interest rates.

If you still do not know what Singapore Treasury Bills are, find out further below.

What are Singapore Treasury Bills?

Singapore Treasury Bills are short-term debt instruments issued by the Singapore government to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

Investors can purchase these bills directly from the Singapore government or through designated financial institutions. Treasury Bills are often used by investors as a low-risk, liquid investment option with a fixed return.

The Announcement Date and Auction Date of Singapore Treasury Bills can be found at Monetary Authority of Singapore (MAS) website under Auctions and Issuance Calendar. The issuance calendar 2025 is available below. For convenience, you can also download a copy to keep on your computer’s desktop.

Singapore T-Bills Calendar

For convenience, I am sharing the Singapore Treasury Bills (T-Bills) Auction and Issuance Calendar here. If you need the Treasury Bill results such as the status of each issuance, please refer to Treasury Bills at MAS website – Auctions and Issuance Calendar.

6-Months T-Bills Calendar

1-year T-Bills Calendar

Tracking of Singapore Savings Bonds (SSB) and Treasury Bills (T-Bills) All in One Place

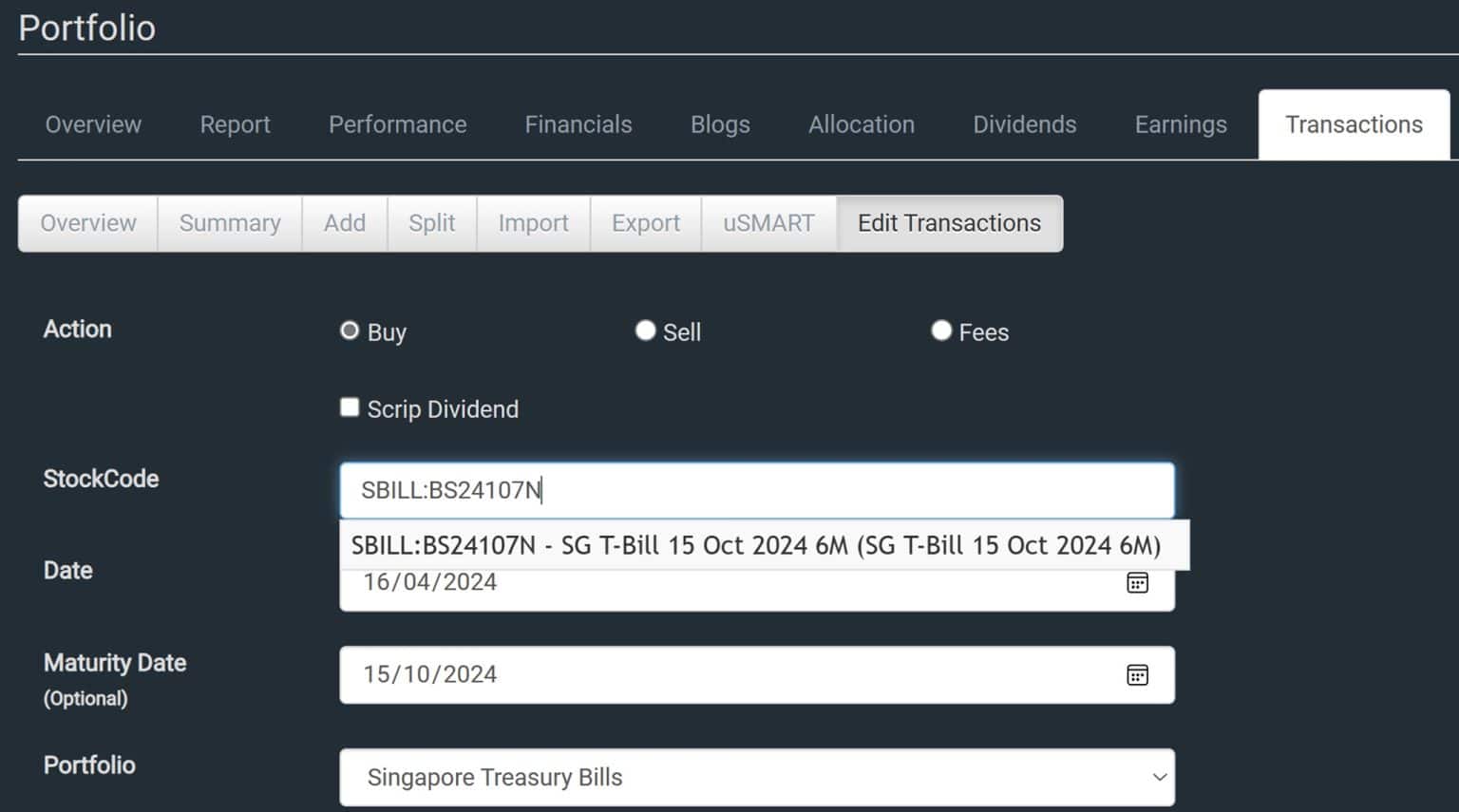

Stocks Café is probably the only software that I know which allows you to track your purchased Singapore Savings Bonds and Treasury Bills (T-Bills) all in one place together with your stock investments. This makes it easy to track your total net investments.

Stocks Café allows you to create portfolios. You can use portfolio to different your investments. For example, I created three portfolios in Stocks Café, namely Stocks, Singapore Savings Bonds and Treasury Bills. This allow me to categorize how much I allocate for each investment.

SGS T Bills Yield versus Fixed Deposits

As shared in my previous post about fixed deposits, MayBank2u Singapore is the only bank among the above list to continue offering interest rates above 3%. For a 6-month fixed deposit placement, MayBank2u is offering you 3.05% per annum and the placement must be done at the branch.

For a 12-month fixed deposit placement, MayBank2u is offering you 2.80% per annum but the placement must also be done at the branch.

If you compare MayBank2u 12-month fixed deposit against Singapore Treasury Bills (SGS T Bills) BY25100H, needless to say, SGS T Bill is the winner at 2.95% per annum.

SGS T Bills Yield versus UOB Stash Account Interest Rate

As shared previously, I am transferring my fixed deposit into UOB Stash Account to earn 5.00% per annum. Below are the tiered interest rates offered by UOB Stash Account.

| Monthly Average Balance | Base interest (p.a.) | Bonus interest (p.a.) | Total interest (p.a.) |

| First S$10,000 | 0.05% | 0.00% | 0.05% |

| Next S$30,000 | 0.05% | 1.95% | 2.00% |

| Next S$30,000 | 0.05% | 2.95% | 3.00% |

| Next S$30,000 | 0.05% | 4.95% | 5.00% |

| Above S$100,000 | 0.05% | 0.00% | 0.05% |

To decide between SGS T Bill and UOB Stash Account depends on how much cash you have. If I have 100K, I will probably go for UOB Stash Account. For anything lesser, I will settle for SGS T Bill.

Where is the Best Place to Park Your Money?

With falling fixed deposit interest rates, I will probably invest my money in SGS T Bills and high-interest rate savings account such as UOB Stash Account.

With the new elect US president, the outlook for Singapore REITs felt rather unstable as we do not know how his policies may shake the global market. One thing for sure will be his tariff policies which definitely will increase the volatility of markets worldwide. If you want to invest in something safer, then SGS T Bills are a suitable choice.

We should never put all our eggs in the same basket. As such, we should still continue to invest in a mix of stocks, REITs, bonds and treasury bills.

If I am to compare between Singapore Savings Bonds and Treasury Bills, I will probably go for Singapore Treasury Bills given the slightly higher returns. SGS T bill yield had always been higher than Singapore Savings Bond and Fixed Deposits.