Have you ever wondered what is the return if you invest in every issue of T Bill Singapore in 2025? T Bills also known as MAS T Bills are short-term debt instruments issued by the Singapore government via the Monetary Authority of Singapore to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. T bills are often used by investors as a low-risk, liquid investment option with a fixed return. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

Have you ever wondered what is the return if you invest in every issue of T Bill Singapore in 2025? T Bills also known as MAS T Bills are short-term debt instruments issued by the Singapore government via the Monetary Authority of Singapore to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. T bills are often used by investors as a low-risk, liquid investment option with a fixed return. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

I am curious if the returns from T Bill Singapore can beat the returns offered by fixed deposits and high yielding saving accounts which are also low risk in nature. Let me do a back test based on the T Bills issued in the first half of the year 2025. If I invest S$1,000 in each issue of T Bill, what will be the total interest I will receive by the end of 2025? This will help me make better decision on where to place my money in 2026.

How To Buy T Bill Singapore?

Singapore Treasury Bills can be purchased either with cash, CPF Ordinary Account funds, or SRS savings, and the process is designed to be straightforward for individual investors. You begin by applying through internet banking with any of the three local banks DBS, OCBC, or UOB. You can also submit an application at an ATM if you prefer an offline method.

Applications must be submitted before each bank’s cut-off time, which is typically one business day before the auction. When you apply, you choose between a competitive bid, where you specify the yield, you are willing to accept, or a non-competitive bid, where you accept the eventual cut-off yield determined at auction. T bills are issued at a discount, meaning you pay less upfront and receive the full-face value at maturity.

Once the auction concludes, you can check your allocation results through your bank’s platform. If your bid is successful, the purchase amount is deducted from your bank account, CPF-OA, or SRS accordingly. The T-bill will then appear in your CDP account if purchased with cash, or in your CPF/SRS statement if purchased using those funds. At maturity, either six months or one year depending on the tenor, the government pays you the full-face value, and your return is simply the difference between what you paid and what you receive.

Banks like DBS also provide step-by-step guidance on their platforms to help you navigate the application process smoothly.

Buy T Bill Singapore from January to June 2025

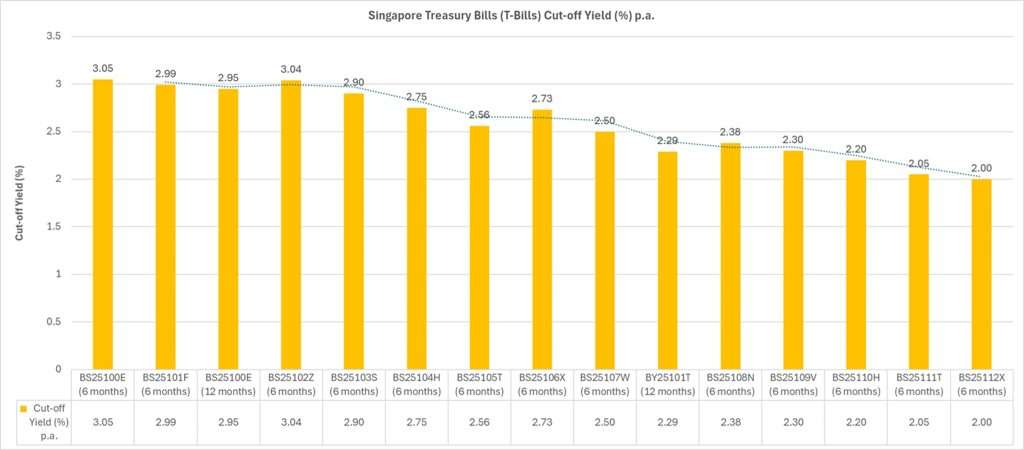

From January 2025 to June 2025, there are 15 issues of T Bill Singapore. The maturity date of the last issue of T Bill in June (BS25112X) falls on 23rd December 2025. If I invest the minimum amount of S$1,000 into each issue of T Bill, I will receive a total of S$167.25 by December 2025. I have excluded the interests received from BS25100E and BY25101T because they matured in 12 months and thus the maturity date is in January 2026.

Based on S$13,000 invested and interest return of S$167.25, the percentage return is 1.2865%.

| Issue Code | Issue Date | Maturity Date | Auction Tenor (Month) | Cut-off Yield (%) p.a. |

Invested Amount | Interest |

| BS25100E | 7-Jan-25 | 8-Jul-25 | 6 | 3.05 | S$1,000 | S$15.25 |

| BS25101F | 21-Jan-25 | 22-Jul-25 | 6 | 2.99 | S$1,000 | S$14.95 |

| BS25100E | 28-Jan-25 | 27-Jan-26 | 12 | 2.95 | S$1,000 | S$29.50 |

| BS25102Z | 4-Feb-25 | 5-Aug-25 | 6 | 3.04 | S$1,000 | S$15.20 |

| BS25103S | 18-Feb-25 | 19-Aug-25 | 6 | 2.90 | S$1,000 | S$14.50 |

| BS25104H | 4-Mar-25 | 2-Sep-25 | 6 | 2.75 | S$1,000 | S$13.75 |

| BS25105T | 18-Mar-25 | 16-Sep-25 | 6 | 2.56 | S$1,000 | S$12.80 |

| BS25106X | 1-Apr-25 | 30-Sep-25 | 6 | 2.73 | S$1,000 | S$13.65 |

| BS25107W | 15-Apr-25 | 14-Oct-25 | 6 | 2.50 | S$1,000 | S$12.50 |

| BY25101T | 22-Apr-25 | 21-Apr-26 | 12 | 2.29 | S$1,000 | S$22.90 |

| BS25108N | 29-Apr-25 | 28-Oct-25 | 6 | 2.38 | S$1,000 | S$11.90 |

| BS25109V | 13-May-25 | 11-Nov-25 | 6 | 2.30 | S$1,000 | S$11.50 |

| BS25110H | 27-May-25 | 25-Nov-25 | 6 | 2.20 | S$1,000 | S$11.00 |

| BS25111T | 10-Jun-25 | 9-Dec-25 | 6 | 2.05 | S$1,000 | S$10.25 |

| BS25112X | 24-Jun-25 | 23-Dec-25 | 6 | 2.00 | S$1,000 | S$10.00 |

Buy T Bill Singapore from July to December 2025

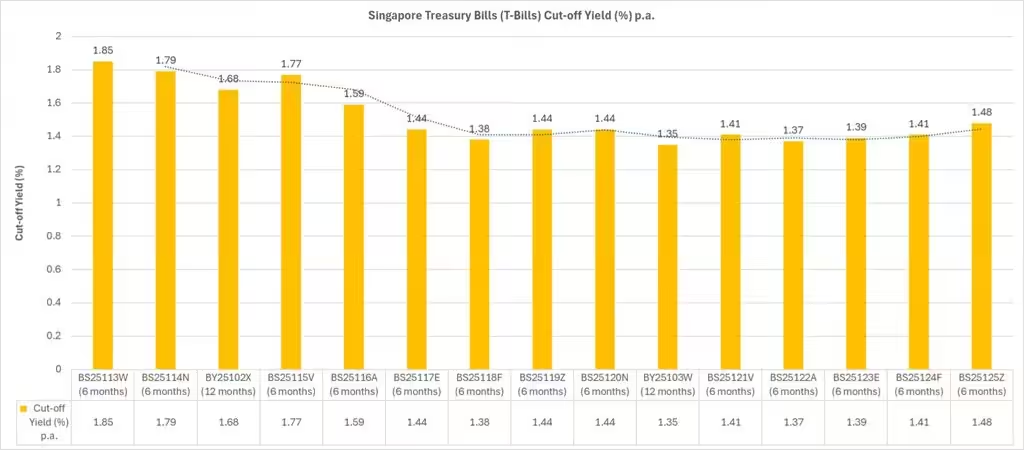

By July 2025, BS25100E would mature and I will receive back my principal of S$1,000. For the second half of 2025, I will invest S$2,000 in each issue of T Bill which comprised of the principal received from each issue of T Bill invested in first half of 2025.

By June 2026, the total interest I would receive is $250, excluding the interest from 12 months T Bill BY25102X and BY25103W as they matured after June 2026. The total interest received comprised of the interest received from 12 months T Bill BS25100E and BY25101T invested in first half of 2025.

Based on S$28,000 invested and interest return of S$250, the percentage return is 0.8929%.

| Issue Code | Issue Date | Maturity Date | Auction Tenor (Month) | Cut-off Yield (%) p.a. |

Invested Amount | Interest |

| BS25113W | 8-Jul-25 | 6-Jan-26 | 6 | 1.85 | S$2,000 | S$18.50 |

| BS25114N | 22-Jul-25 | 20-Jan-26 | 6 | 1.79 | S$2,000 | S$17.90 |

| BY25102X | 29-Jul-25 | 28-Jul-26 | 12 | 1.68 | S$2,000 | S$33.60 |

| BS25115V | 5-Aug-25 | 3-Feb-26 | 6 | 1.77 | S$2,000 | S$17.70 |

| BS25116A | 19-Aug-25 | 17-Feb-26 | 6 | 1.59 | S$2,000 | S$15.90 |

| BS25117E | 2-Sept-25 | 3-Mar-26 | 6 | 1.44 | S$2,000 | S$14.40 |

| BS25118F | 16-Sept-25 | 17-Mar-26 | 6 | 1.38 | S$2,000 | S$13.80 |

| BS25119Z | 30-Sept-25 | 31-Mar-26 | 6 | 1.44 | S$2,000 | S$14.40 |

| BS25120N | 14-Oct-25 | 14-Apr-26 | 6 | 1.44 | S$2,000 | S$14.40 |

| BY25103W | 21-Oct-25 | 20-Oct-26 | 12 | 1.35 | S$2,000 | S$27.00 |

| BS25121V | 28-Oct-25 | 28-Apr-26 | 6 | 1.41 | S$2,000 | S$14.10 |

| BS25122A | 11-Nov-25 | 12-May-26 | 6 | 1.37 | S$2,000 | S$13.70 |

| BS25123E | 25-Nov-25 | 26-May-26 | 6 | 1.39 | S$2,000 | S$13.90 |

| BS25124F | 9-Dec-25 | 9-Jun-26 | 6 | 1.41 | S$2,000 | S$14.10 |

| BS25125Z | 23-Dec-25 | 23-Jun-26 | 6 | 1.48 | S$2,000 | S$14.80 |

Conclusion on Return from T Bill Singapore in 2025

As you can see from the back test above, I earned an interest of S$167.25 based on S$13,000 invested into Singapore Treasury Bill. My percentage return is 1.2865%. As interest rate declined in the second half of 2025, the interest rate I would receive in June 2026 is S$250 based on S$28,000 invested. The return is only 0.8929%.

In December, RHB if offering customers an interest rate of 1.45% per annum for a 3-months or 6-months fixed deposit placement with minimum amount of S$20,000.

UOB had also revised its interest rates across all the tiers for its flagship high interest yielding savings account – UOB Stash Account. Based on an initial deposit balance of S$100,000 in your UOB Stash Account, you can earn up to S$1,500 interest a year by simply maintaining or increasing your Monthly Average Balance (MAB) each month. Below is how your bonus interest will add up.

| Monthly Average Balance | Base interest (p.a.) | Bonus interest (p.a.) | Total interest (p.a.) |

| First S$10,000 | 0.05% | 0.00% | 0.05% |

| Next S$30,000 | 0.05% | 1.35% | 1.40% |

| Next S$30,000 | 0.05% | 1.55% | 1.60% |

| Next S$30,000 | 0.05% | 1.95% | 2.00% |

| Above S$100,000 | 0.05% | 0.00% | 0.05% |

In my opinion, the return from T Bill Singapore is not as attractive as compared to fixed deposits and high yielding savings accounts. Having said that, fixed deposits and high yielding savings accounts demand a higher minimum amount before you can earn that higher interest rate.

If my capital is limited, I would still go for T Bill as traditional bank savings account earn a low interest rate of 0.05%. If you have a lump sum capital, I will invest them into fixed deposits or high yielding savings account for the higher interest rate.

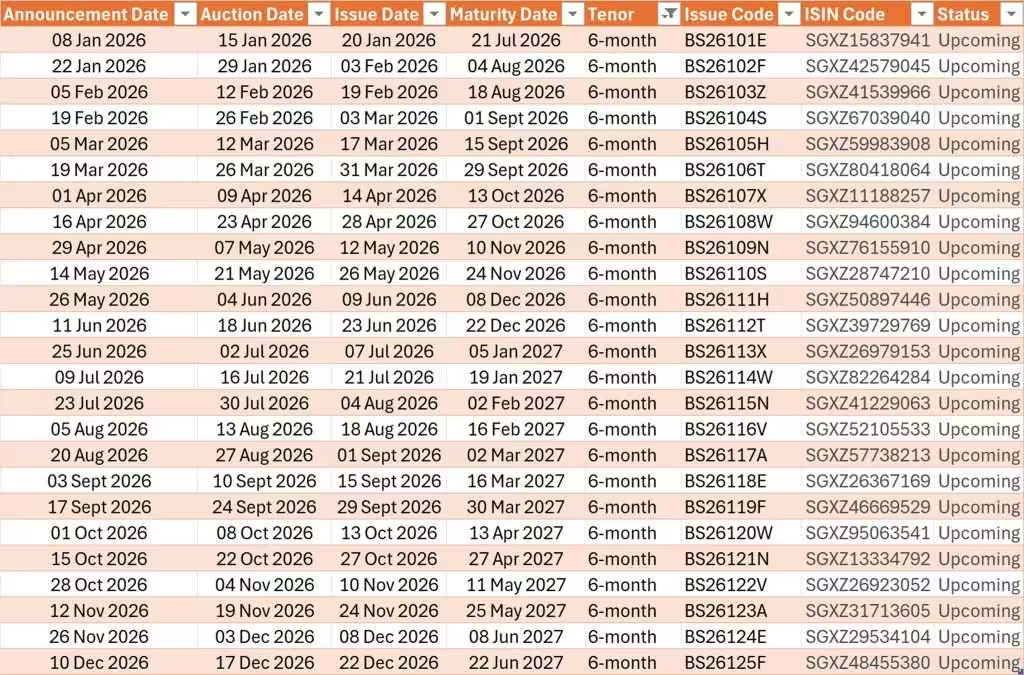

Singapore Treasury Bills (T-Bills) Auction and Issuance Calendar for 2026 is already available and you may find them below.