As the end of the year draws near, it is time to stock take the total passive income I collected in 2025. My passive income ideas or sources come from the dividend payout from my stock investments, interest from Singapore Savings Bond and Singapore Treasury Bills (T-Bills). I have excluded the interest payout from Fixed Deposits as I currently do not track those.

As the end of the year draws near, it is time to stock take the total passive income I collected in 2025. My passive income ideas or sources come from the dividend payout from my stock investments, interest from Singapore Savings Bond and Singapore Treasury Bills (T-Bills). I have excluded the interest payout from Fixed Deposits as I currently do not track those.

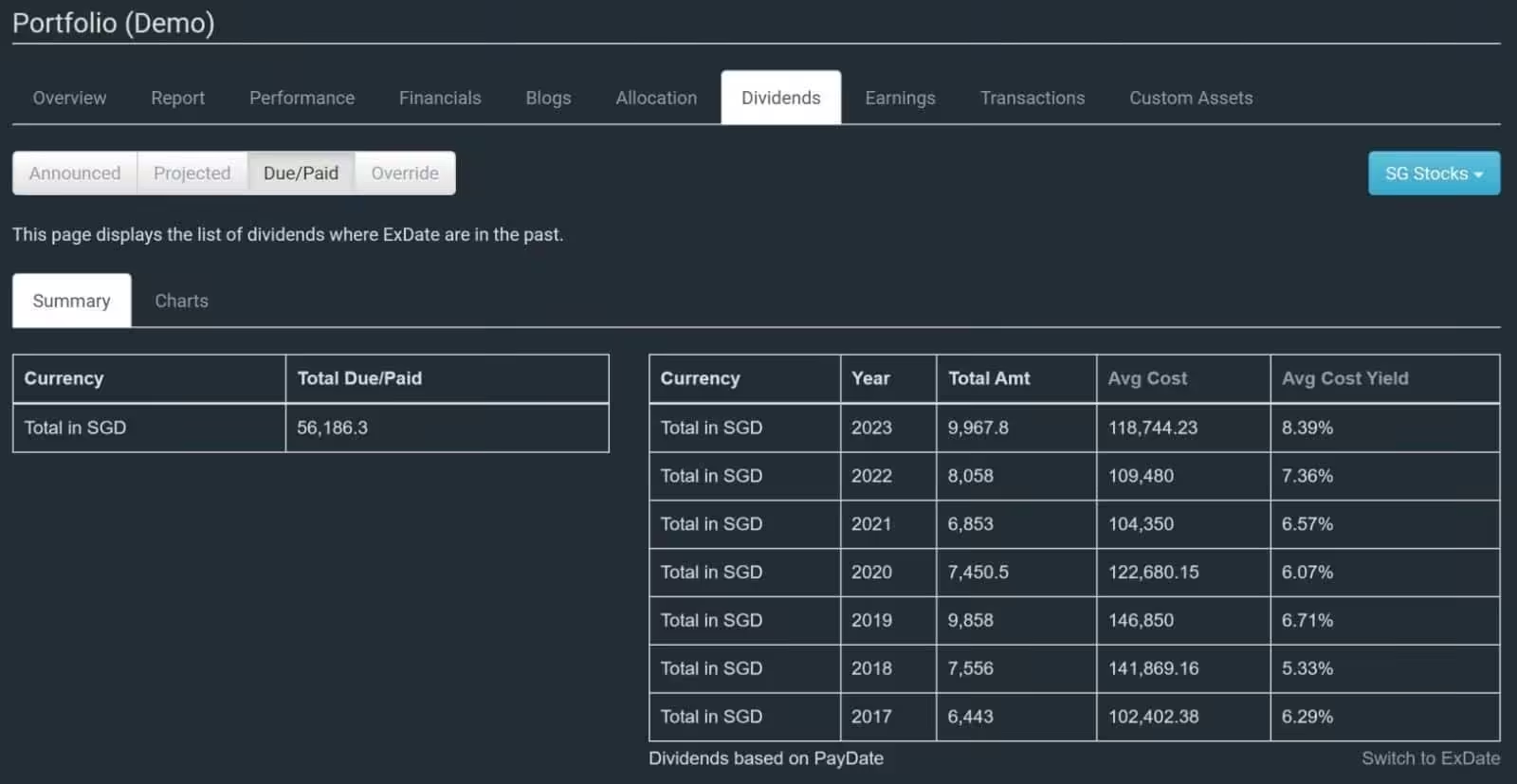

The total passive income that I have collected in 2023 and 2024 is S$$16,606.89 and S$19,705.08 respectively. With all the stocks and REITs in my stock portfolio announcing their dividend payout in 2025, I am excited to share that the total passive income that I collected in 2025 is $20,289.89. The amount is an increase of 2.97% as compared to S$19,705.08 of passive income I have collected in the year 2024.

Why is building passive income important? Retirement is the withdrawal from one’s position or occupation or from one’s active working life. Building my passive income helps brings me a step closer to FIRE. FIRE is short for Financial Independence, Retire Early. With the Ministry of Manpower raising the retirement age to 64, it does not mean you have to work until the minimum age. This is where FIRE comes into play. FIRE is a major life goal as I wanted the luxury to be able to choose whether to work before the statutory retirement age. To be able to retire early, it is important for me to

- Start planning early, be prudent in your savings and accumulate a larger nest egg for your retirement years.

- Estimate your monthly expenses during your retirement years. (Need versus Wants).

- Build multiple sources of passive income to mitigate against longevity and inflation.

Even if you are not aiming for FIRE, the passive income can also be useful in other ways. Passive income can help pay off your bills or give you an overseas vacation holiday treat. I just came back from my vacation in Japan and having passive income help to pay for some of my travel expenses.

How Do I Track my Passive Income?

Tracking passive income from REITs, Singapore Savings Bonds, and Singapore Treasury Bills is effortless with Stocks Cafe. Its automated dividend tracking feature keeps a precise record of your payouts. Based on your portfolio, Stocks Cafe provides a clear overview of dividends due, dividends paid, upcoming announcements, projected amounts, and your complete dividend history.

Next, I shall share my sources passive income.

Build Passive Income with Singapore Savings Bonds (SSB)

Buying Singapore Savings Bond is a low risk and great way to build my passive income. Despite relatively modest yields, SSBs are low-risk investments, perfect for conservative investors seeking steady growth. Singapore Savings Bonds are fully backed by the Singapore Government. You can always get your investment amount back in full, with no capital loss. Due to the “step‑up” feature of Singapore Savings Bond, the longer you hold them, the higher your effective return. Each individual can invest up to S$200,000, inclusive of both cash and SRS contributions.

This month’s issue of Singapore Savings Bonds (SBJAN26) gives you a decent effective return of 1.99% p.a. over 10 years.

Build Passive Income with Singapore Treasury Bill

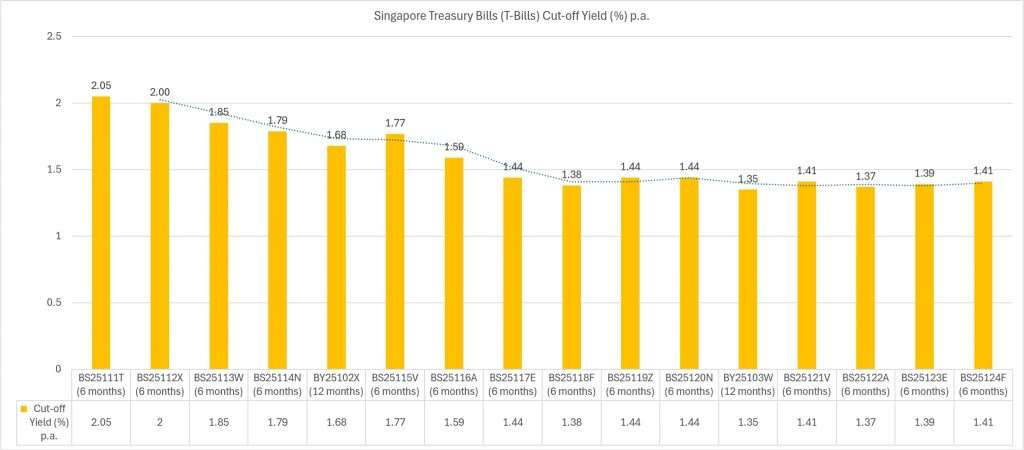

Treasury Bills (T-Bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. At maturity, investors receive the full-face value, making them a straightforward and secure investment.

The Singapore Government currently offers T-Bills in 6‑month and 1‑year tenors. In 2025, I continue to add T-Bills to my portfolio. Much like the Singapore Savings Bonds, T-Bills carry lower risk compared to equities, making them a practical option for parking spare funds while earning a safe return.

Build Passive Income by Investing in Dividend Paying Stocks

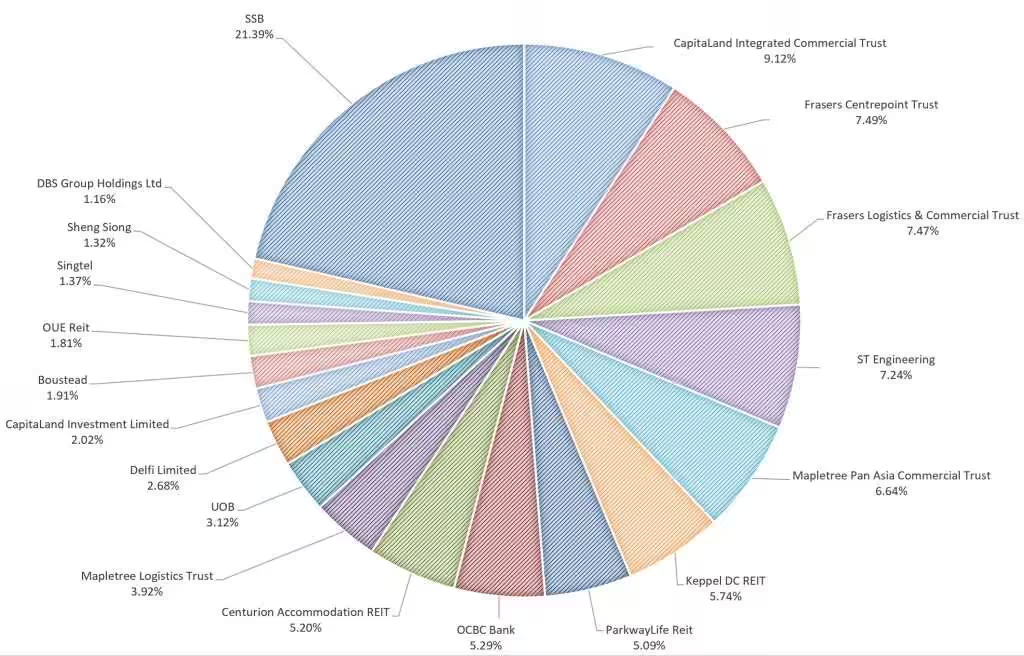

Each month, I review a list of dividend-paying REITs. In Singapore, Real Estate Investment Trusts remain one of the most dependable vehicles for building long-term passive income. Most REITs distribute dividends quarterly or semi-annually, offering investors a consistent stream of cash flow. These payouts can be reinvested to accelerate compounding or directed toward lifestyle goals, making REITs a versatile cornerstone of any income-focused portfolio.

New Passive Income Idea in 2025

This year, I launched a blog shop featuring a curated selection of finance-related books. Reading these titles is a great way to deepen your understanding of stock investing and personal finance. Each purchase made through my shop earns me a small commission via Amazon Affiliates. While the earnings are modest, they go a long way in helping me cover my blog’s hosting fees and keep the site running.

How are you building your passive income?