On 7th November 2024, Paragon REIT announced their 3QFY2024 business updates. In 3QFY2024, Paragon REIT’s gross revenue grew 3.43% to S$223.0 million as compared to S$215.6 million in 3QFY2023.

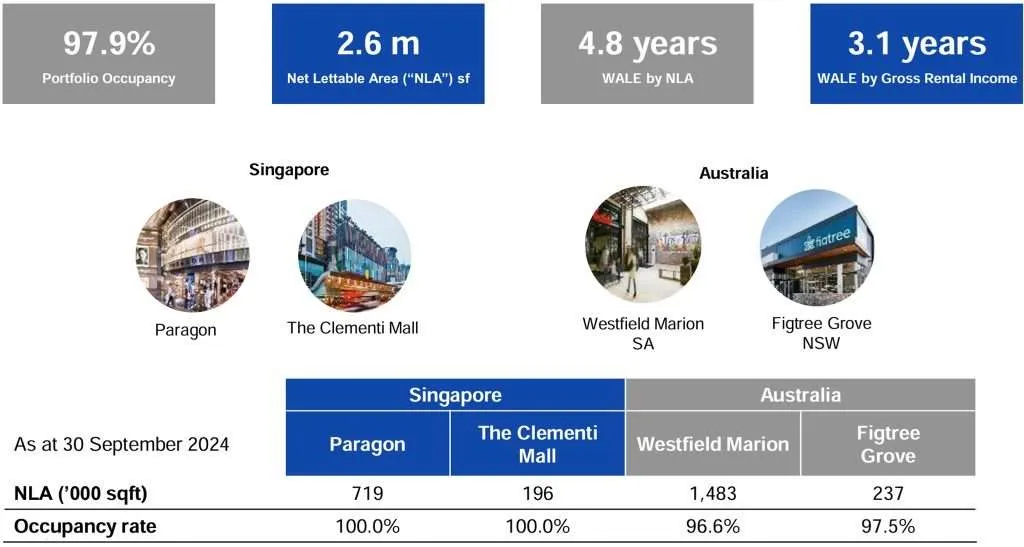

The Rail Mall’s divestment was completed on 15th August 2024. Since the divestment of The Rail Mall, Paragon REIT’s portfolio is left with 2 retail malls in Singapore and 2 retail malls in Australia. In Singapore, the malls are Paragon and The Clementi Mall.

In Australia, the malls are Westfield Marion SA and Figtree Grove NSW.

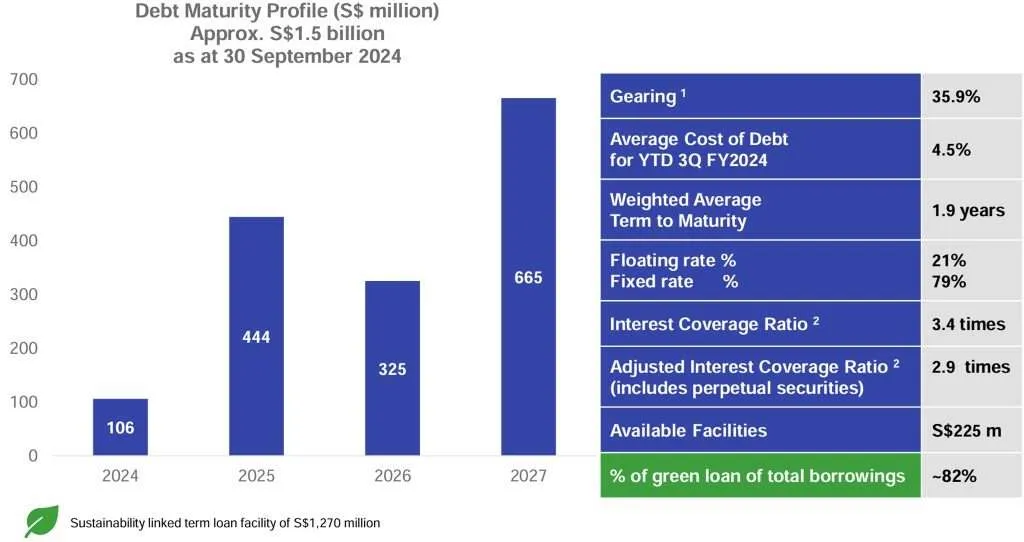

Debt

As of 30th September 2024, Paragon REIT’s gearing stood at 35.9%. Gearing, also known as leverage, is the ratio of a real estate investment trust (REIT)’s debt to its total property value.

The current gearing was higher as compared to 1HFY2024. This was because of the announcement on 10th July 2024 to redeem 100% of the principal amount of S$300 million in perpetual securities that were issued in August 2019.

Weighted Average Term to Maturity (WAM) stood at 1.9 years. The short weighted average term to maturity reduced interest rate risks as shorter-term debt securities are less sensitive to interest rate changes compared to longer-term securities. This also means Paragon REIT is less likely to experience significant value fluctuations due to interest rate movements.

On top of that, 79% of its borrowings are hedged at fixed interest rates which mitigate against sudden interest rate hikes.

Occupancy

Overall portfolio occupancy stood at 97.9%. As you can see from the above, Paragon REIT’s Singapore assets achieved 100% occupancy while Westfield Marion and Figtree Grove’s occupancy are at 96.6% and 97.5% respectively.

Lease Expiry

The portfolio weighted average lease expiry stood at 4.8 years by net lettable area and 3.1 years by

gross rental income, translating to a well distributed lease expiry profile with low concentration risk.

As you observed from the charts above, the leases expiring in FY2025 are low. This means the manager is proactive in terms of management of lease expires.

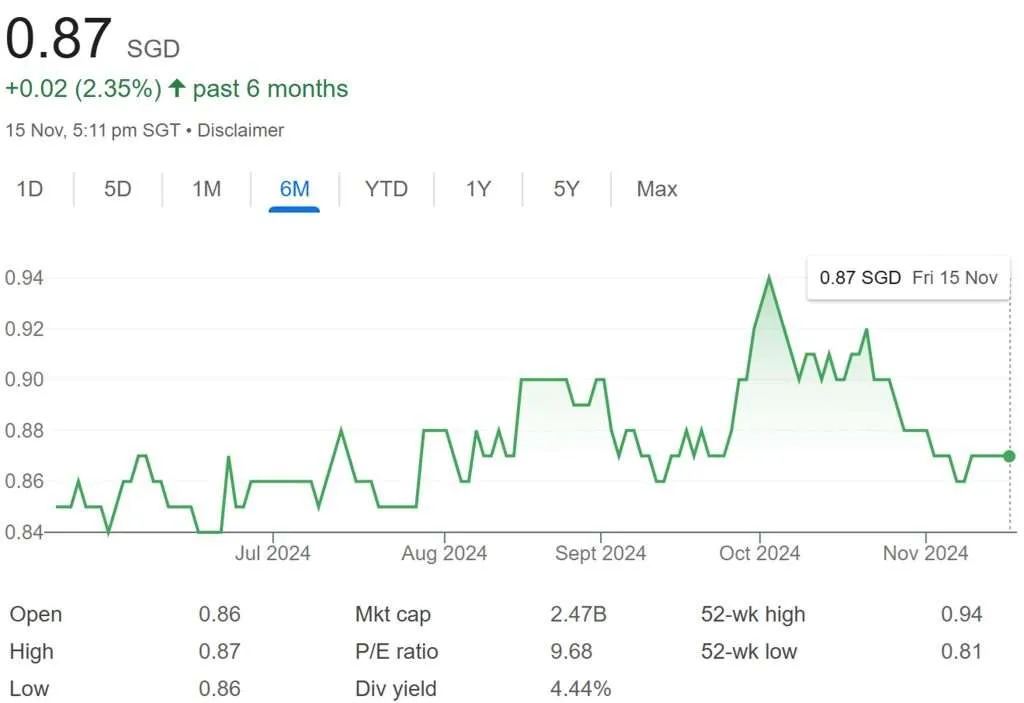

PARAGON REIT Share Price and Current Dividend Yield

Based on PARAGON REIT share price of S$0.87 on 15th November 2024 and FY2023 full year distribution of 5.02 cents, this translates to a current dividend yield of 5.77%.

Having said that, do expect FY2024 full year dividends to be lower because of the absence of contribution from The Rail Mall.

Summary of Paragon REIT 3QFY2024 Business Updates

As you can see from the above chart, visitor traffic and tenant sales are mixed across its malls. Despite having higher visitor traffic at Paragon mall, tenant sales were lower as compared to 3Q FY2023. On the other hand, visitor traffic was lower at Westfield Marion, but tenant sales were higher.

Again, let me summarize the pros and cons.

The pros are

- Gross revenue grew 3.43% to S$223.0 million.

- Despite an increase, gearing remained acceptable at 35.9%.

- 79% of its borrowings are hedged at fixed interest rates.

- Short Weighted Average Term to Maturity (WAM) at 1.9 years.

- High portfolio occupancy at 97.9%.

- Current dividend yield of 5.77%.

The cons are

- Only 4 assets in its portfolio, limiting growth.

- Mixed visitor traffic and tenant sales.