On 5th August 2024, PARAGON REIT released its 1H2024 financial results. If you are looking for a REIT whereby the management is prudent and disciplined in capital management, PARAGON REIT may be the REIT you are looking for. No other REIT has such a low gearing of 29.0%.

If PARAGON REIT is a stranger to you, PARAGON REIT has a portfolio of five assets in Singapore and Australia. In Singapore, the assets are Paragon, The Clementi Mall and The Rail Mall.

In Australia, PARAGON REIT owns a 50% freehold interest in Westfield Marion Shopping Centre, the largest regional shopping centre in Adelaide, South Australia. PARAGON REIT also owns an 85% interest in Figtree Grove Shopping Centre, a freehold sub regional shopping centre in Wollongong, New South Wales, Australia.

I have been a long-term holder of PARAGON REIT since SPH REIT. At times, I wish the management can be more aggressive in terms of their acquisition to unlock more value to its unitholders. Past years Distribution Per Unit (DPU) was stable but flat.

Side note: To the reader that cursed me for REITs with high gearing, the downside of REIT with low gearing is flat DPU.

Let us take a look below at PARAGON REIT 1H2024 financial results.

PARAGON REIT 1H2024 Financial Results

In 1H2024, PARAGON REIT’s Gross Revenue and Net Property Income (NPI) increased by 3.0% year-on-year to S$147.4 million and 4.5% year-on-year to S$110.8 million respectively.

Distribution to unitholders for 1H2024 decreased by 3.8% primarily due to higher management fees payable in cash. It was shared that the payment of management fees in cash was to prevent the dilution of unitholder’s return.

A Distribution Per Unit (DPU) of 2.32 cents was declared for 1H2024, representing a 4.1% decline in DPU year-on-year.

| 1H2024 (S$’000) |

1H2023 (S$’000) |

Change (%) | |

| Gross Revenue | 147,362 | 143,084 | 3.0 |

| Net Property Income | 110,847 | 106,057 | 4.5 |

| Distributable income to unitholders | 60,404 | 70,631 | (14.5) |

| Distribution to unitholders | 65,865 | 68,498 | (3.8) |

| Distribution Per Unit (“DPU”) (cents) | 2.32 | 2.42 | (4.1) |

Debt

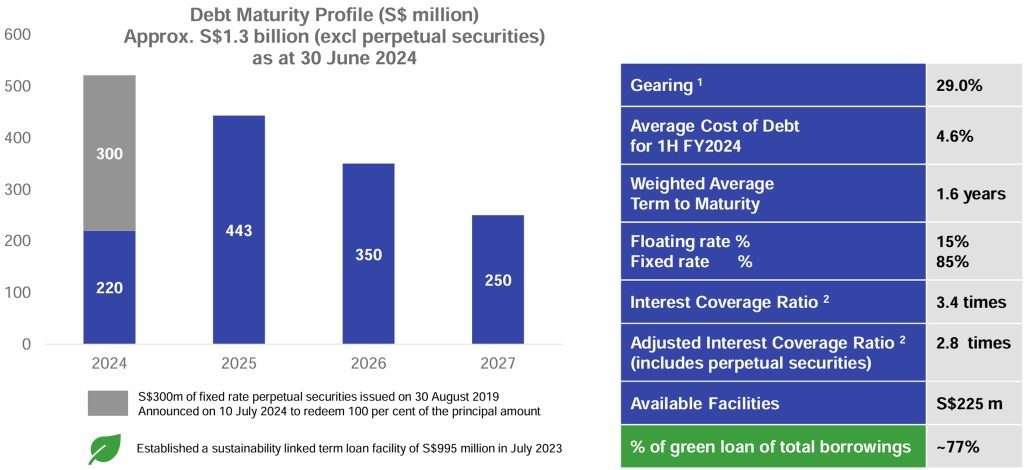

As of 30th June 2024, PARAON REIT had a total borrowing of S$1.3 billion. Gearing stood at extremely low 29.0%. Gearing, also known as leverage, is the ratio of a real estate investment trust (REIT)’s debt to its total property value.

Fixed debt percentage remained at 85% to mitigate against the impact of rising interest rates. Debt maturity profile stood at a weighted average term to maturity of 1.6 years. Average cost of debt was 4.6% for 1H FY2024.

Occupancy

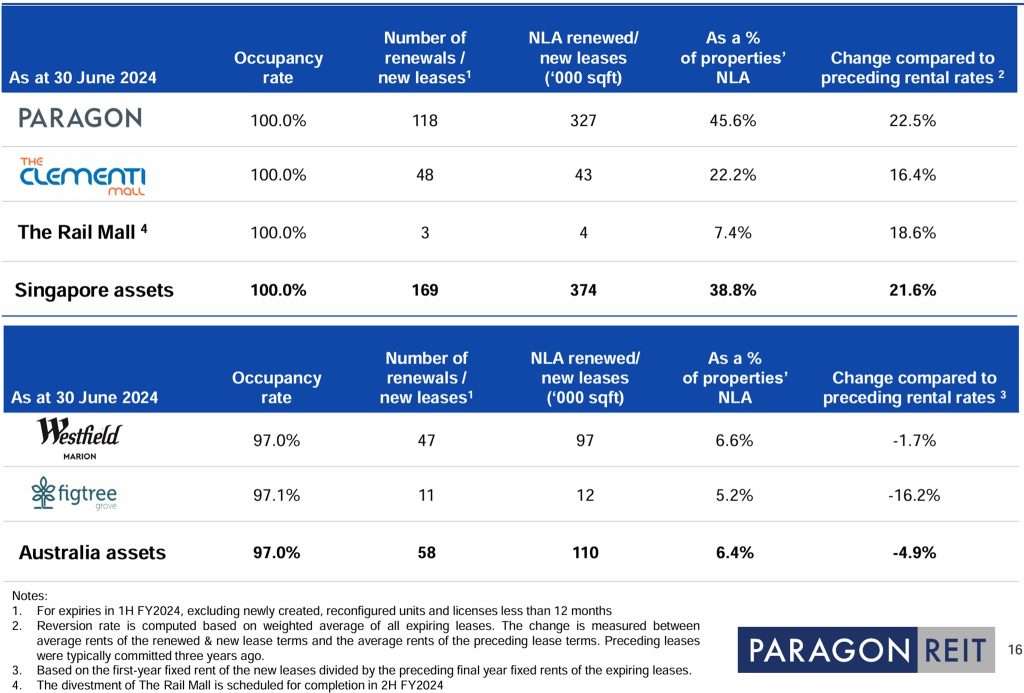

As of 30th June 2024, PARAGON REIT’s overall portfolio occupancy stood healthy at 98.1%. As you can see from above, its Singapore assets (Paragon, The Clementi Mall and The Rail Mall) achieved 100% occupancy.

As shared in my previous post, PARAGON REIT has divested The Rail Mall which will be completed in 2H2024. The net proceeds from the divestment will be deployed to reduce outstanding debt obligations, finance potential acquisitions and/or asset enhancement initiatives, and/or make distributions to unitholders.

It is noteworthy to mention that rental reversion rate improved to 19.1% for 1H2024 from 6.9% for 1H2023. The rental reversion rate refers to the change in rents upon lease renewal for a property. Specifically, it reflects the estimated increase or decrease in rent at review. Positive reversion occurs when there’s an estimated increase in rent at review, and the gross rent is below the estimated rental value.

The occupancy of PARAGON REIT’s Australia assets stood at 97%.

The portfolio weighted average lease expiry stood at 4.9 years by net lettable area and 2.9 years by

gross rental income, translating to a well distributed lease expiry profile with low concentration risk.

PARAGON REIT Share Price and Current Dividend Yield

Based on the 6-months chart above, you can observe that PARAGON REIT share price has been on an uptrend. Based on PARAGON REIT share price of S$0.87 on 8th August 2024 and FY2023 full year distribution of 5.02 cents, this translates to a current dividend yield of 5.77%.

Summary of PARAGON REIT 1H2024 Financial Results

Let us summarize the pros and cons based on PARAGON REIT 1H2024 Financial Results. The pros are:

- Gross Revenue and Net Property Income (NPI) increased by 3.0% year-on-year to S$147.4 million and 4.5% year-on-year to S$110.8 million respectively.

- Gearing stood at extremely low at 29.0%.

- Fixed debt percentage remained at 85% to mitigate against the impact of rising interest rates.

- Overall portfolio occupancy stood healthy at 98.1%.

- Rental reversion rate improved to 19.1% for 1H2024 from 6.9% for 1H2023.

- Well distributed lease expiry profile with low concentration risk.

- Acceptable current dividend yield of 5.77%.

The cons are:

- Distribution to unitholders for 1H2024 decreased by 3.8% primarily due to higher management fees payable in cash.

- A Distribution Per Unit (DPU) of 2.32 cents was declared for 1H2024, representing a 4.1% decline in DPU year-on-year.

Do you think the management fees should be paid in cash or units?