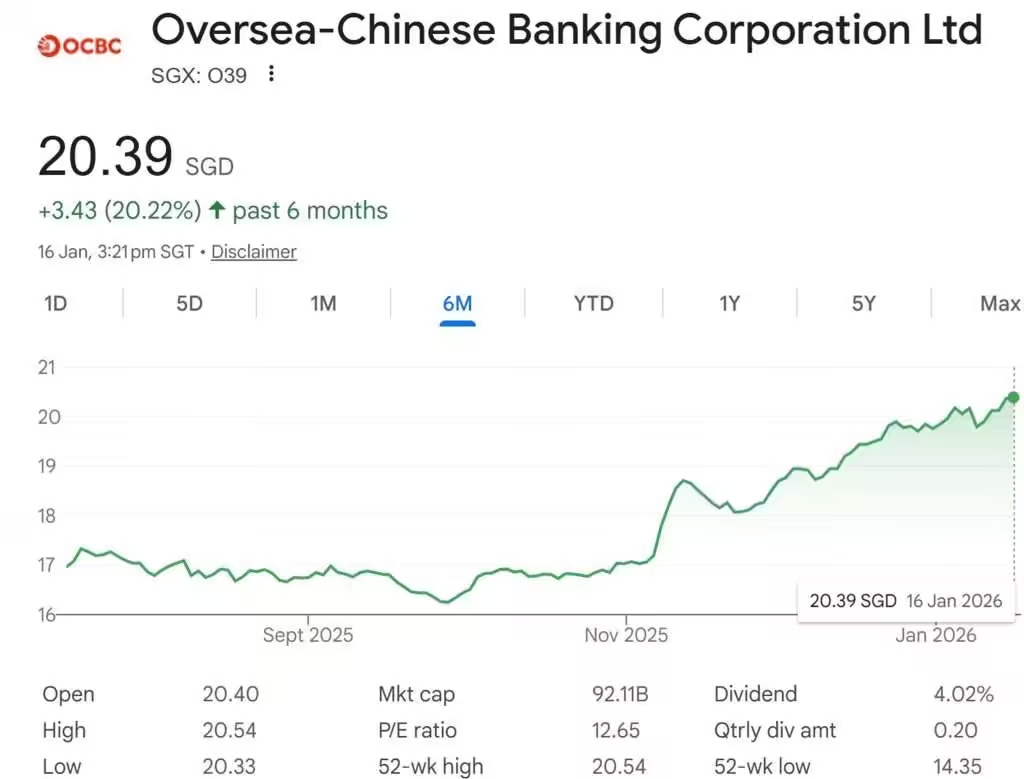

OCBC’s share price has climbed past S$20 in recent weeks, marking one of its strongest runs in years and placing the bank near record territory. This rise has occurred alongside a broader rally in Singapore bank stocks, with both DBS and OCBC pushing to new highs. OCBC traded around S$20.10 on 15th January 2026, after touching a new peak of S$20.25 earlier in the week. The move reflects a combination of sector‑wide momentum, resilient financial results, and shifting investor expectations as interest rates begin to ease.

The most recent financial results available, OCBC’s third‑quarter 2025 earnings provide important context for the bank’s current valuation. OCBC reported a net profit of S$1.98 billion for the quarter ended Sept 30, beating the Bloomberg consensus forecast of S$1.79 billion. Although profit was largely unchanged from the S$1.97 billion recorded a year earlier, the bank outperformed expectations due to stronger non‑interest income and lower allowances. Non‑interest income rose 15 percent year‑on‑year to S$1.57 billion, supported by broad‑based growth in fees, trading income, and insurance contributions. Total allowances fell 18 percent to S$139 million, reflecting stable asset quality and an unchanged non‑performing loan ratio of 0.9 percent.

At the same time, OCBC’s net interest income declined 9 percent to S$2.23 billion as net interest margin compressed by 34 basis points to 1.84 percent amid a softening rate environment. Outgoing CEO Helen Wong noted that the bank is focusing on asset growth and deposit management to defend net interest income, acknowledging that interest‑rate cycles are inherently volatile and cannot be relied upon indefinitely for margin expansion.

OCBC Share Price

The share‑price rally is also tied to broader sector dynamics. Analysts cited in recent coverage point to a multi‑week surge in Singapore bank stocks driven by stable earnings, strong capital positions, and expectations of attractive dividends in a lower‑rate environment. With the US Federal Reserve having cut rates three times in 2025 and projecting at least one more cut in 2026, investors have been rotating into high‑quality dividend‑paying stocks such as Singapore banks. Morningstar’s Asia equity research director noted that banks’ dividend yields around 5 percent are being viewed as proxies for Singapore government bonds as interest rates fall.

OCBC’s dividend expectations have played a specific role in its outperformance. Analysts highlighted that OCBC paid out 50 percent of earnings in the first half of 2025, leaving room for a larger second‑half payout to meet its full‑year target of a 60 percent payout ratio. This has led some investors to position ahead of the bank’s upcoming full‑year results, expected in February 2026.

However, not all recent news has been supportive. JP Morgan downgraded OCBC from “overweight” to “neutral” on 9th January 2026, arguing that the stock’s nearly 20 percent gain over the past six months has already priced in many of the positives, including wealth‑management inflows and strong capital buffers. The analysts noted that OCBC is trading at 1.45 times forward book value for an 11.8 percent return on equity, suggesting limited room for further re‑rating unless new catalysts emerge. They also pointed out that credit growth remains muted, and that non‑interest income trends are well understood, reducing the likelihood of upside surprises in the near term.

The bank’s ongoing share‑buyback programme has also been highlighted. JP Morgan estimates that OCBC still has around S$630 million left to deploy by the end of 2026 but does not expect the bank to accelerate capital returns beyond what has already been communicated. The analysts added that they do not see excess capital being paid out at a faster pace, though they expect new CEO Tan Teck Long to provide more clarity when OCBC reports its full‑year results next month.

Despite the mixed analyst views, the share‑price performance reflects confidence in OCBC’s fundamentals. The bank continues to maintain strong asset quality, stable profitability, and diversified income streams. Its wealth‑management businesses including Bank of Singapore, Great Eastern, and Lion Global have benefited from Singapore’s growing role as a regional wealth hub, contributing to fee income and supporting earnings resilience.

The macroeconomic backdrop remains a key variable. OCBC’s management has cautioned that 2026 may bring slower economic growth across several markets, with geopolitical tensions and shifting trade policies adding uncertainty to demand and supply chains. Even so, the bank maintains its 2025 financial targets, including mid‑single‑digit loan growth and a cost‑to‑income ratio in the low 40s, suggesting confidence in its operational footing.

OCBC’s move above S$20 is therefore best understood not as a speculative surge, but as the result of steady financial performance, supportive sector trends, and investor positioning ahead of expected dividend announcements. Whether the stock can sustain or extend these levels will depend on the bank’s upcoming full‑year results, the trajectory of global interest rates, and the strength of regional economic conditions.

For now, the data shows a bank performing consistently, navigating a shifting rate cycle, and benefiting from investor demand for stability and yield all of which have contributed to its recent share‑price strength.