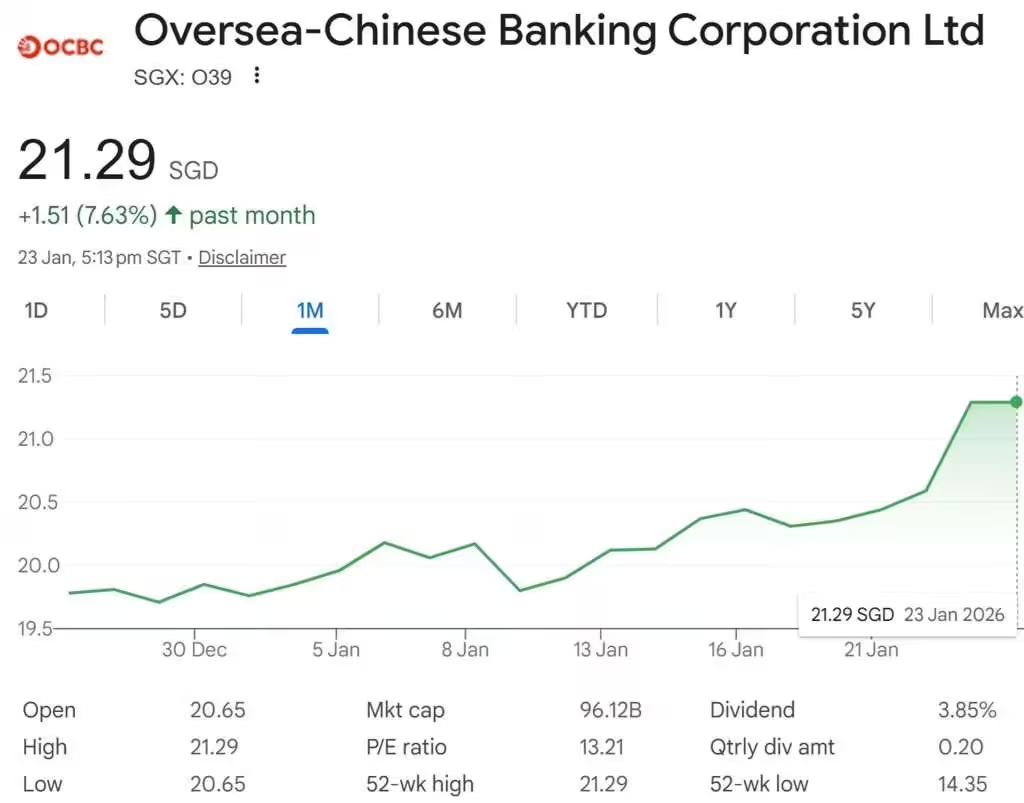

OCBC’s share price surpassed the S$21 threshold on 23rd January 2026, reaching an intraday high of S$21.29 before stabilising at S$21.23 during mid‑day. This move represents a new record for the counter and occurred alongside broad strength across Singapore’s banking sector.

The rise in OCBC’s share price coincided with simultaneous rallies in UOB and DBS, which collectively pushed the Straits Times Index (STI) to an all‑time high of 4,888.96 during morning trade. The banking sector’s heavy weighting in the STI amplified the impact of these moves, with OCBC contributing to the index’s upward momentum.

Trading turnover for the three local banks increased in January compared with the preceding six months, indicating heightened institutional participation. OCBC recorded the strongest net inflows among the local lenders, reflecting sustained demand from larger market participants.

Analyst Revisions and Valuation Drivers

A key catalyst behind OCBC’s breakout was a series of analyst upgrades. Macquarie Capital assigned OCBC an “outperform” rating with a target price of S$21.50, citing stronger fee‑income momentum relative to peers. The firm also noted that expectations for DBS were already elevated, leaving OCBC with comparatively more room for positive earnings surprises.

These revisions occurred in parallel with upgrades for UOB, signalling a broader reassessment of Singapore banks’ earnings trajectories. Analysts highlighted that Singapore’s banking sector stands to benefit from continued wealth‑management inflows, supported by the city‑state’s positioning as a regional safe‑haven. OCBC was specifically identified as a beneficiary of these structural trends.

Macro and Earnings‑Cycle Considerations

The share‑price movement also reflects shifting expectations around the upcoming earnings season. Macquarie projected stability in net interest margins for the first quarter of 2026, even as it flagged potential headwinds for sector‑wide earnings growth later in the year. Within this environment, OCBC’s fee‑income trajectory and wealth‑management flows were viewed more favourably than those of its peers.

Additionally, institutional investors have been responding to the banks’ strong fundamentals. Over the past three years, the three local banks collectively generated more than S$8 billion in quarterly net interest income and reached a historic S$5 billion in non‑interest income in the third quarter of 2025. These metrics reinforced confidence in the sector’s resilience and supported the upward re‑rating of OCBC.

Conclusion

OCBC’s break above S$21 is the result of converging factors: sector‑wide momentum, increased institutional inflows, favourable analyst revisions, and stable macro‑financial conditions heading into the 2026 earnings cycle. While the sustainability of the rally will depend on upcoming financial results and broader interest‑rate dynamics, the current price action reflects a reassessment of OCBC’s relative earnings potential within Singapore’s banking landscape.