Have you received news on OCBC 360 interest rates revision in August 2025? This is the second time OCBC is revising their interest rates in this year. In line with lower interest rate expectations, effective from 1st August 2025, OCBC will revise the interest rates for their flagship OCBC 360 account.

Have you received news on OCBC 360 interest rates revision in August 2025? This is the second time OCBC is revising their interest rates in this year. In line with lower interest rate expectations, effective from 1st August 2025, OCBC will revise the interest rates for their flagship OCBC 360 account.

As shared in my previous post on high interest savings accounts, OCBC 360 bank account is one of those high interest savings account in Singapore that offers customers a variety of benefits and features. With this account, customers can earn higher interest rates on their savings by fulfilling certain conditions, enjoy cashback rewards with the OCBC 360 credit card, and more.

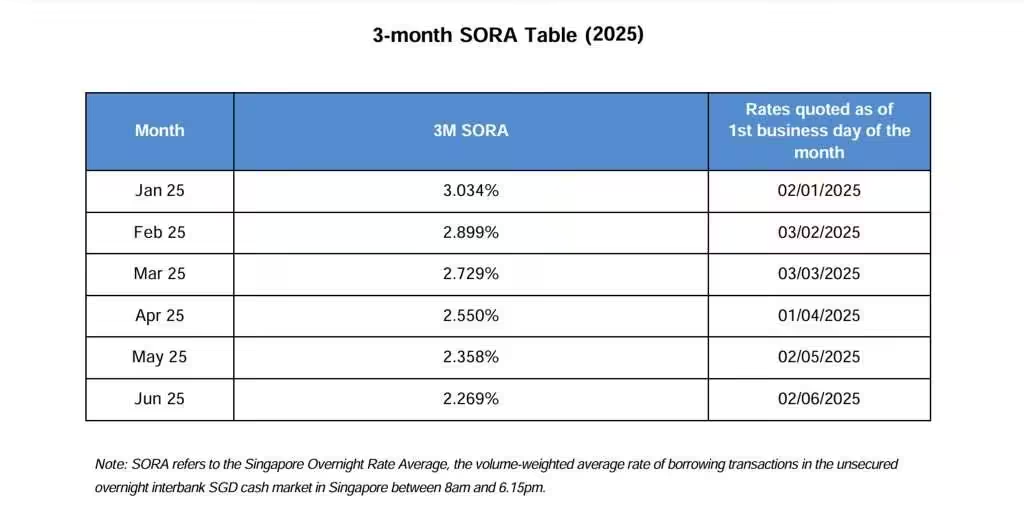

Why is OCBC revising their interest rates? As shared earlier, the bank is aligning themselves with lower interest rates expectations. As you can see from the below table, the SORA has been on the downtrend over the past 3 months.

Do you know what is SORA? Many years ago, SORA has replaced the Singapore Interbank Offered Rate (SIBOR), and Swap Offer Rate (SOR) as the key interest rate benchmark for Singapore dollar (S$) interest rate contracts. SORA is calculated and administered by the Monetary Authority of Singapore (MAS). It is published as a daily rate and a series of 1-month, 3-month and 6-month compounded rates on the MAS website.

While SORA is a key benchmark, savings account rates are not directly pegged to it in a simple way. Banks determine their own base interest rates, which may be influenced by overall market interest rate trends that SORA reflects.

Personally, I own an OCBC 360 high interest savings account. Thus, the change in interest rates is going to affect me in terms of interests received. With the revised interest rates across the categories, the OCBC 360 account will offer up to 5.45% a year on your first S$100,000 if you credit salary, save, spend, insure and invest with them. The base interest of 0.05% a year on the OCBC 360 bank account balance remained unchanged and 360 account holders will continue to earn this base interest regardless of whether you met the below bonus categories.

Let us take a look at the revised interest rates below.

| Bonus Interest Categories | First S$75,000 (a year) | Next S$25,000 (a year) |

| Salary Credit your salary of at least S$1,800 through GIRO/FAST/PayNow via GIRO/PayNow via FAST. |

1.20% | 2.40% |

| Save Increase your account balance by at least S$500 monthly. |

0.40% | 0.80% |

| Spend Charge at least S$500 to selected OCBC credit cards each month. |

0.40% | |

| Insure Buy a selected insurance product from OCBC. |

1.20% | 2.40% |

| Invest Buy a selected investment product from OCBC. |

1.20% | 2.40% |

| Grow Maintain an average daily balance of at least S$250,000. |

2.00% | |

The eligible credit cards in the spend category are the OCBC 365 Credit Card, OCBC INFINITY Card, OCBC NXT Card, OCBC 90°N Card and OCBC Rewards Card.

If you compare with the last revised interest rates, OCBC revised the interest rates across all the categories except for Insure and Invest categories.

My Thoughts on OCBC 360 Interest Rates Revision in August 2025

Under the prevailing weak interest rates market conditions, I am expecting other banks to also cut the interest rates for their saving accounts. Thus, I doubt I will transfer my money in OCBC 360 into other high interest savings account that I have.

The other high interest savings account I have is UOB Stash, CIMB Fast Saver and DBS Multiplier. I hope they can sustain their current interest rates!

Disclaimer: This is Not a sponsored post, and the opinions are solely based on My Sweet Retirement’s own research and opinion.