NVIDIA has once again delivered a record-breaking quarter, with its Q3 fiscal 2026 earnings showcasing the company’s dominance in the artificial intelligence (AI) and data centre markets. The tech giant reported $57.0 billion in revenue, up 62% year-over-year and 22% quarter-over-quarter, fuelled by unprecedented demand for its Blackwell GPUs and AI infrastructure solutions.

This earnings report confirms NVIDIA’s position as the leading provider of AI compute and networking hardware, with its data centre segment contributing $51.2 billion, nearly 90% of total revenue. The company’s continued innovation in GPU architecture, particularly with the Blackwell GB300 chips, has made it the go-to supplier for hyperscalers, sovereign AI programs, and enterprise customers building large-scale AI factories.

NVIDIA Blackwell GPUs Power Explosive Growth

The highlight of NVIDIA’s Q3 FY2026 performance was the explosive adoption of its Blackwell GPU platform. CEO Jensen Huang revealed that NVIDIA is now shipping over 1,000 racks of Blackwell systems per week, a pace that reflects the global acceleration of AI deployment. These GPUs are optimized for both training and inference workloads, making them essential for companies building generative AI models and large language models (LLMs).

With Blackwell, NVIDIA has not only solved previous supply chain constraints but also unlocked a new wave of AI infrastructure investment. The company’s full-stack approach combining GPUs, networking, and CUDA software has created a powerful ecosystem that competitors struggle to match.

Data Centre and Networking Revenue Hit New Highs

NVIDIA’s data centre revenue surged to $51.2 billion, driven by $43 billion in compute (GPU) sales and $8.2 billion in networking. The networking segment, which includes NVLink, Spectrum-X, and InfiniBand, saw triple-digit growth as customers scaled up their AI clusters.

As AI workloads become more data-intensive, high-speed networking has become a critical differentiator. NVIDIA’s ability to deliver end-to-end solutions for AI infrastructure from silicon to systems to software gives it a strategic advantage in a rapidly evolving market.

NVIDIA Q3 2026 Financial Highlights

The company’s financial performance in Q3 FY2026 was exceptional across the board. Gross margins reached 73.4% GAAP and 73.6% non-GAAP, reflecting strong pricing power and operational efficiency. Operating income came in at $36.0 billion GAAP, while net income hit $31.9 billion. Earnings per share (EPS) were $1.30, beating analyst expectations.

NVIDIA also returned $37.0 billion to shareholders through stock buybacks and dividends in the first nine months of the fiscal year. With $62.2 billion still authorized for repurchases, the company remains committed to delivering long-term value while prioritizing growth investments in AI software and global logistics.

Global Expansion and Regulatory Navigation

While NVIDIA faced export restrictions in China, it secured U.S. government approval to sell up to 35,000 Blackwell GPUs to customers in the Middle East. This $1 billion opportunity highlights the company’s expanding global footprint and ability to navigate complex geopolitical dynamics.

CFO Colette Kress confirmed that the first Blackwell wafers have been fabricated in the United States, signalling a shift toward domestic production and supply chain resilience. This move aligns with broader trends in semiconductor reshoring and national AI strategies.

NVIDIA Q4 FY2026 Guidance: More Growth Ahead

Looking ahead, NVIDIA issued bullish guidance for Q4 FY2026, projecting $65 billion in revenue, well above the $61.66 billion consensus. Gross margins are expected to rise to 74.8% GAAP and 75.0% non-GAAP, indicating continued operating leverage.

This strong outlook reinforces investor confidence in NVIDIA’s long-term growth trajectory and its central role in powering the global AI economy.

Is NVIDIA in an AI Bubble? CEO Jensen Huang Responds

With NVIDIA’s stock up over 1,000% since the end of 2022, some analysts have raised concerns about a potential AI bubble. However, CEO Jensen Huang dismissed these fears, pointing to real-world deployments by companies like Meta, Microsoft, Google, Oracle, and xAI.

According to Huang, NVIDIA has visibility into $500 billion in Blackwell and Rubin orders through 2026. This pipeline suggests that demand for AI infrastructure is structural, not speculative, and that the company is well-positioned to capitalize on the next wave of technological transformation.

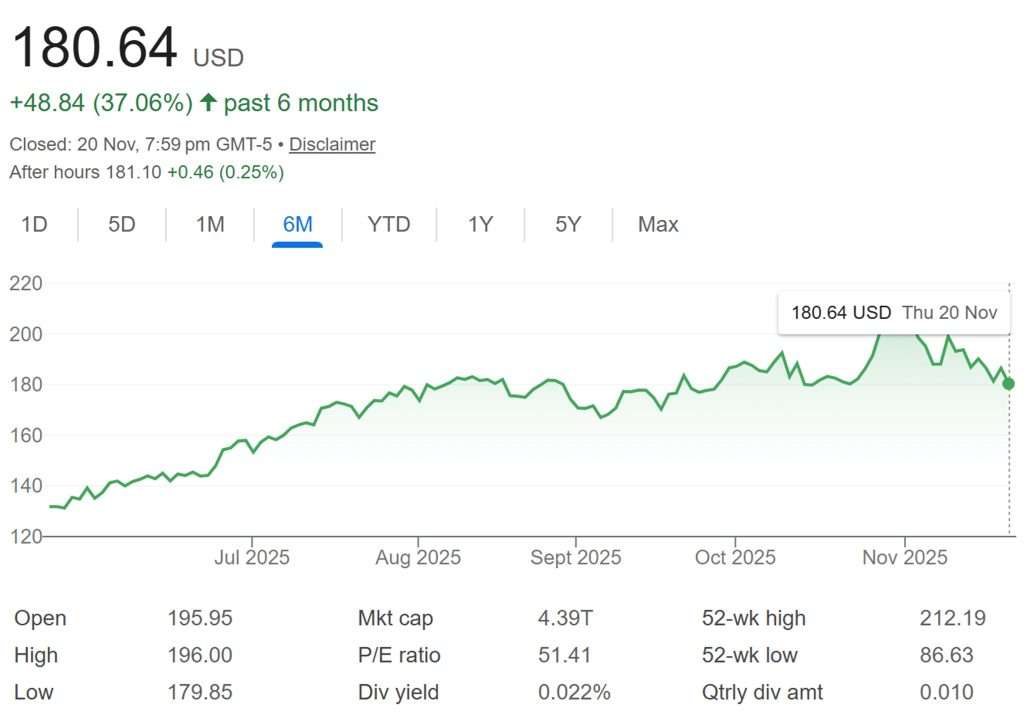

NVIDIA Stock Performance and Market Impact

Following the Q3 earnings announcement, NVIDIA’s stock surged 5% in after-hours trading, adding $220 billion in market capitalization. The positive momentum extended to global markets, with major Asian indices like Japan’s Nikkei, Taiwan’s TAIEX, and Korea’s KOSPI all rising more than 2.9%.

This market reaction reflects not only investor enthusiasm for NVIDIA’s results but also broader optimism about the future of AI and semiconductor innovation.

Conclusion: NVIDIA Leads the AI Infrastructure Revolution

NVIDIA’s Q3 FY2026 earnings report is a clear signal that the company is leading the AI boom. With record revenue, expanding margins, and a robust product roadmap, NVIDIA is redefining what it means to be a technology leader in the AI era.

For investors, technologists, and industry observers, NVIDIA remains the most important company in the AI value chain. As demand for AI compute and networking continues to grow, NVIDIA’s integrated platform and relentless innovation make it a cornerstone of the digital future.