On 22nd October 2025, MPACT (Mapletree Pan Asia Commercial Trust) announced their 2QFY25/26 financial results. Mapletree Pan Asia Commercial Trust (MPACT) is a leading real estate investment trust (REIT) listed on the Singapore Exchange, with a diversified portfolio of commercial properties across key gateway cities in Asia. Formed through the merger of Mapletree Commercial Trust and Mapletree North Asia Commercial Trust, MPACT holds a strategic mix of retail, office, and business park assets in Singapore, Hong Kong, China, Japan, and South Korea. Its flagship properties include VivoCity, Singapore’s largest retail mall and Mapletree Business City, both of which anchor its strong domestic performance.

MPACT has been facing headwinds due to the performance of its overseas properties. In this quarter, has the financial performance of MPACT improved? What is MPACT dividend yield? Let us find out more below based on its latest financial results.

MPACT 2QFY25/26 Financial Results

In 2Q FY25/26, MPACT reported gross revenue of S$218.5 million, reflecting a year-on-year (YoY) decline of 3.2% from S$225.6 million in 2Q FY24/25. This dip was primarily attributed to the strategic divestment of Mapletree Anson and two Japan office properties, as well as adverse foreign exchange movements due to a stronger Singapore dollar. Despite these headwinds, the Singapore portfolio anchored by VivoCity continued to demonstrate resilience, helping to cushion the overall revenue impact.

Net Property Income for the quarter came in at S$163.9 million, down 2.2% YoY from S$167.7 million. While the decline mirrors the revenue contraction, it was partially offset by strong performance from VivoCity, which posted a 7.7% NPI growth despite ongoing asset enhancement initiatives. The Singapore segment’s robust rental reversions and high occupancy rates played a pivotal role in stabilizing NPI, even as overseas assets faced market softness and divestment effects.

MPACT achieved a notable reduction in property operating expenses during the quarter, driven by lower utility rates and the impact of asset divestments. These cost efficiencies were especially evident in the Singapore portfolio, where proactive energy management and streamlined operations contributed to improved margins. The decline in finance expenses from S$56.6 million in 2Q FY24/25 to S$47.4 million in 2Q FY25/26 further underscored the REIT’s disciplined cost control and strategic debt reduction efforts.

MPACT declared a DPU of 2.01 Singapore cents for 2Q FY25/26, marking a 1.5% increase from the 1.98 cents distributed in the same quarter last year.

| 2QFY25/26 (S$’000) |

2QFY24/25 (S$’000) |

% Change | |

| Gross Revenue | 218,486 | 225,619 | (3.2) |

| Net Property Income | 163,904 | 167,674 | (2.2) |

| Property expenses |

(54,582) | (57,945) | (5.8) |

| Net Finance Costs |

(47,350) | (56,620) | (16.4) |

| Amount Distributable to Unitholders | 106,205 | 103,996 | 2.1 |

| Distribution Per Unit (“DPU”) (cents) | 2.01 | 1.98 | 1.5 |

Debt

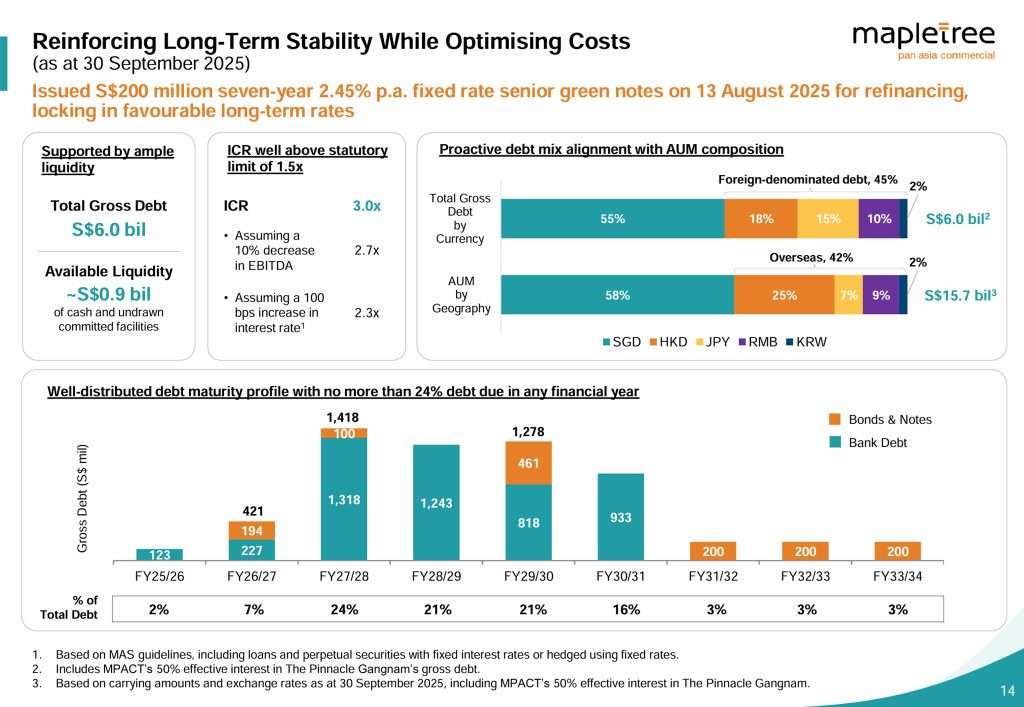

As of 30 September 2025, Mapletree Pan Asia Commercial Trust reported an aggregate leverage of 37.6%, comfortably below the regulatory ceiling and down from previous quarters.

MPACT’s debt maturity profile remains well-distributed, with no more than 24% of total debt due in any single financial year. The weighted average term to debt maturity stood at 3.5 years, and approximately 78% of total debt is fixed-rate, shielding the REIT from short-term rate volatility.

Occupancy

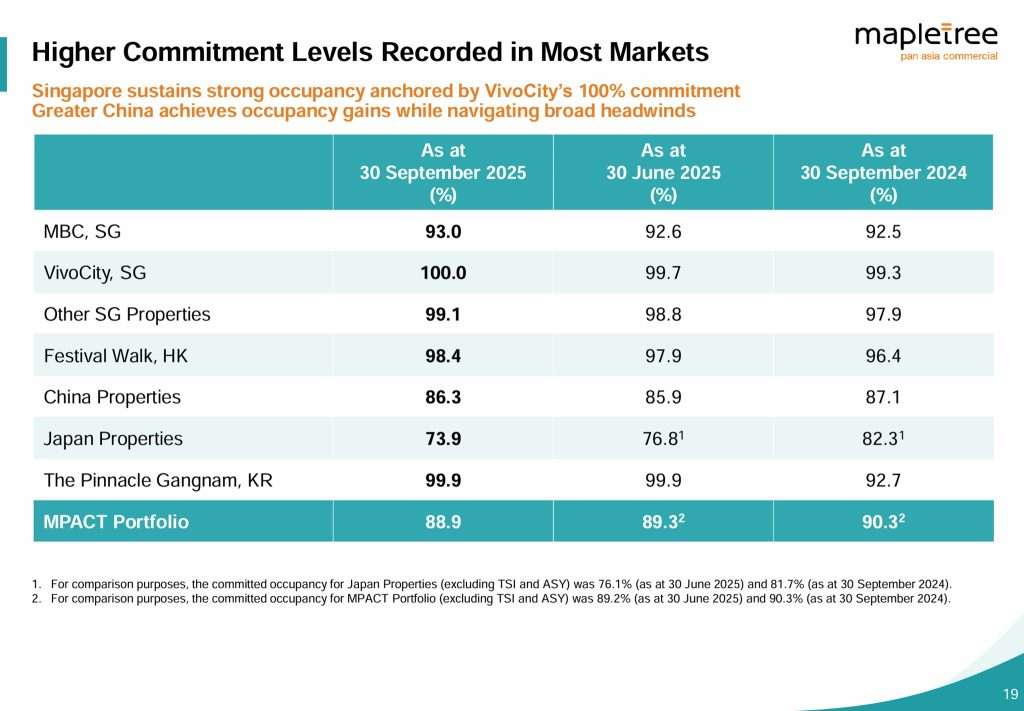

As of 30th September 2025, Mapletree Pan Asia Commercial Trust (MPACT) reported a committed portfolio occupancy of 88.9%, down from 90.3% a year earlier. With the exception of MPACT’s Japan Properties, occupancy improved across all its properties.

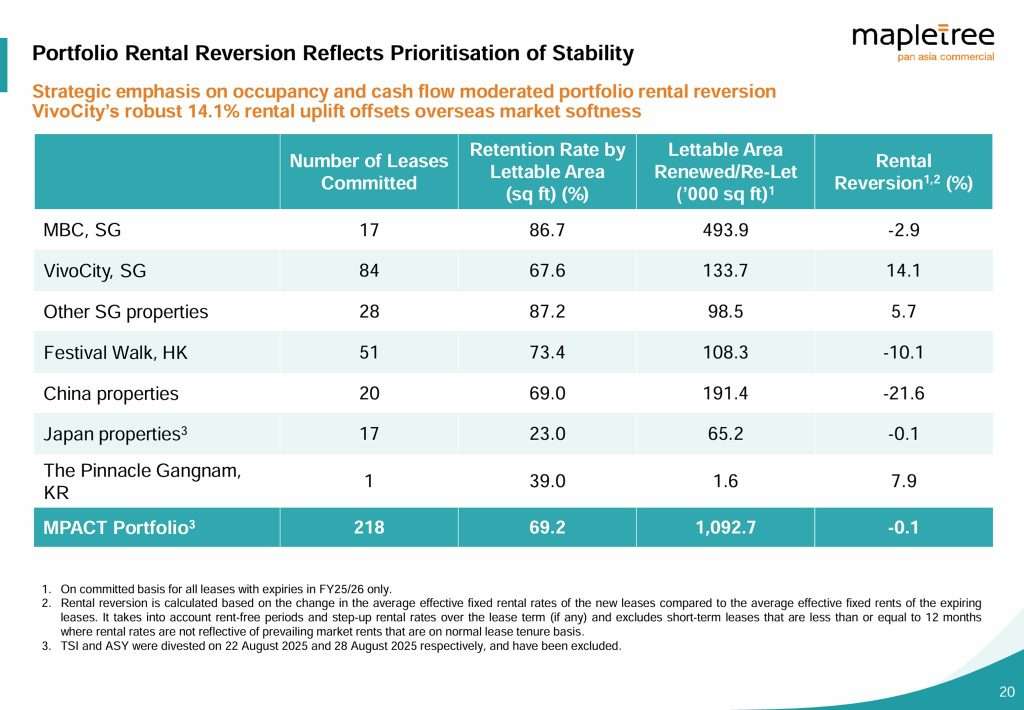

In Singapore, VivoCity continued to demonstrate exceptional all-round strength, achieving 100%

commitment and 14.1% rental reversion. Overall portfolio’s rental reversion was negative 0.1. This is because of the manager’s strategic emphasis on tenant retention and cash flow stability on Hong Kong and China properties. Portfolio rental reversion moderated as a result of this prioritisation.

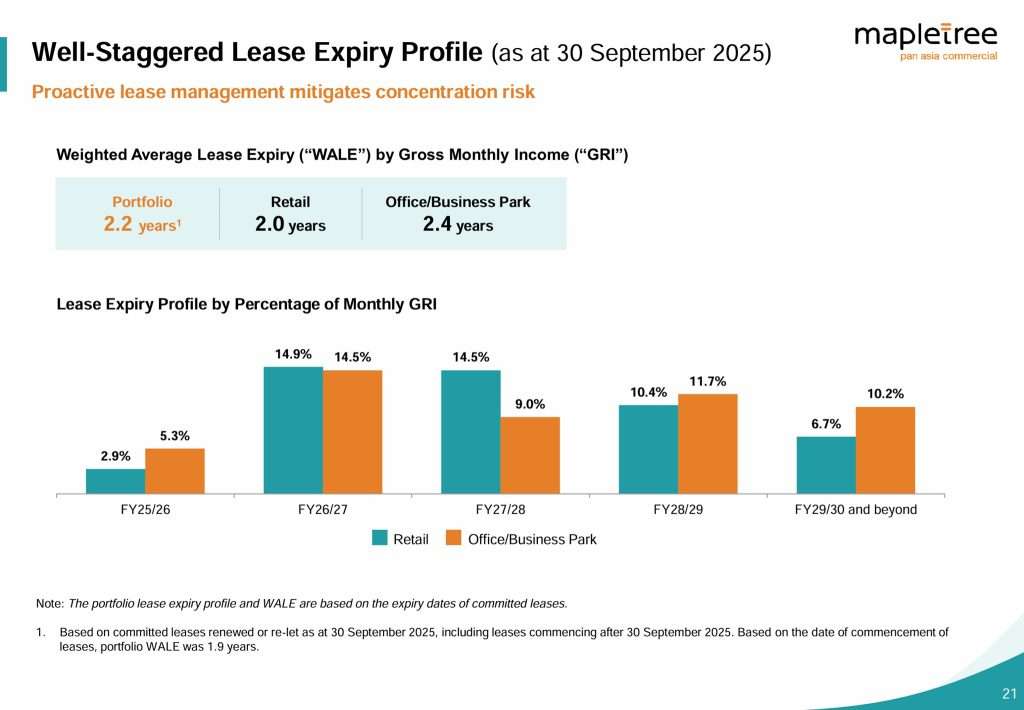

Lease Expiry

As of 30th September 2025, MPACT’s portfolio weighted average lease expiry (WALE) stood at 2.2 years, comprising 2.0 years for the retail segment and 2.4 years for the office and business park segment. Lease expiry remained well-staggered.

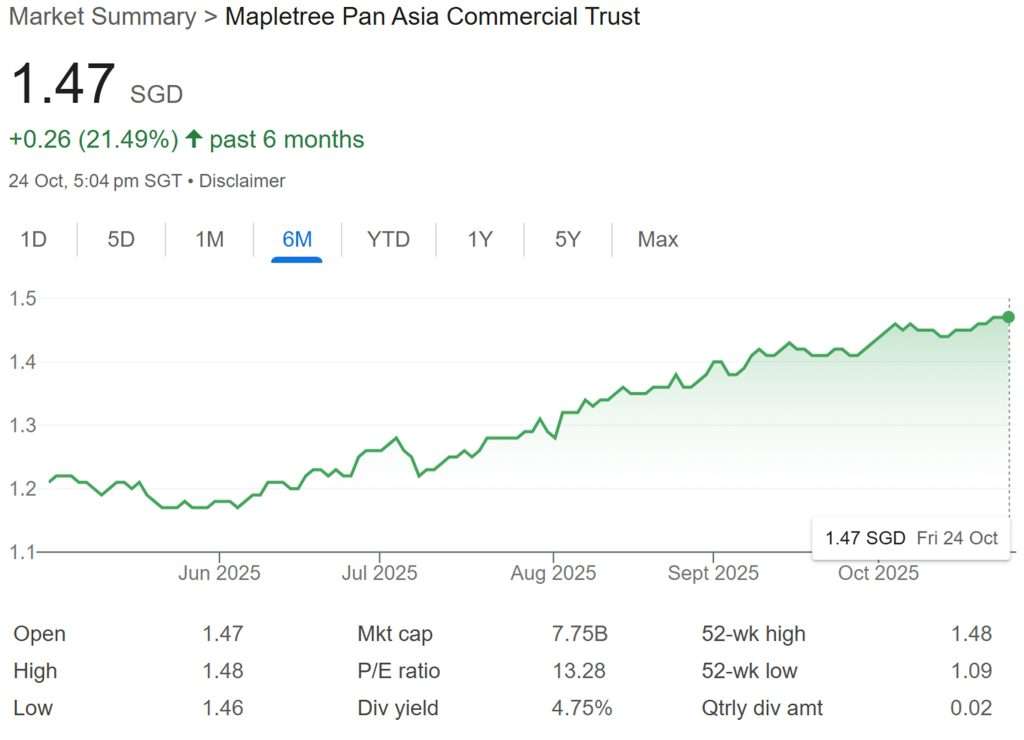

Mapletree Pan Asia Commercial Trust Share Price and Dividend Yield

As you can see from the above, MPACT share price is on an uptrend. Based on MPACT’s FY24/25 full year distribution of 8.02 cents and current share price of S$1.47, this translates to a high current dividend yield of 5.46%.

Summary of MPACT 2QFY25/26 Financial Results

As usual, let me summarize the pros and cons of MPACT.

The pros are:

- MPACT’s property operating expenses and finance expenses were lower.

- Distribution Per Unit (DPU) was 1.5% higher at 2.01 cents.

- Well-distributed debt maturity profile.

- Lease expiry remained well-staggered.

- Attractive current dividend yield of 5.46%.

The cons are:

- MPACT’s gross revenue fell 3.2%.

- Overall portfolio occupancy was 88.9%, down from 90.3% a year earlier.

- Overall portfolio negative rental reversion of 0.1%.

- Distribution Per Unit (DPU) was 3.8% lower mainly because of the lower overseas contributions.

While MPACT share price is on an uptrend, I am not so positive on MPACT’s performance. The only good thing to note is that VivoCity continued to demonstrate resilience, helping to cushion the overall revenue impact.

In my opinion, MPACT is still facing headwinds because of continued rental pressures and weak occupancies at its overseas assets. It is still too early to conclude that MPACT has recovered.