On 30th July 2025, MPACT (Mapletree Pan Asia Commercial Trust) announced their 1QFY25/26 financial results. MPACT is formed after the merger of Mapletree Commercial Trust and Mapletree North Asia Commercial Trust. Because of the inherited overseas assets from North Asia Commercial Trust, MPACT has been facing headwinds due to its underperforming assets in China. In 4QFY24/25, MPACT also faced high finance costs due to higher interest rates on SGD, HKD and JPY borrowings. Has the financial performance of MPACT improved? What is MPACT dividend yield? Let us find out more below based on its latest financial results.

Mapletree Pan Asia Commercial Trust’s portfolio comprises of 17 commercial properties across five key gateway markets of Asia. There are four in Singapore, one in Hong Kong, two in China, nine in Japan and one in South Korea. The properties have a total lettable area of 10.5 million square feet valued at S$16.0 billion.

Now, let us dive into Mapletree Pan Asia Commercial Trust’s 1QFY25/26 financial results to see if the manager can turn the financial performance around.

MPACT 1QFY25/26 Financial Results

In 1QFY25/26, MPACT’s gross revenue fell 7.6% mainly attributed to the reduced contribution from Singapore properties after the divestment of Mapletree Anson. Overseas contributions were also lower, further dampened by a stronger SGD against HKD and RMB.

MPACT’s property operating expenses were lower due to divestment of Mapletree Anson and reduced utility expenses due to lower contracted utility rates in Singapore.

MPACT’s finance expenses improved 16.4% year-on-year as Mapletree Anson’s net divestment proceeds were deployed to reduce its debt.

Not withbearing the weakness, MPACT’s Distribution Per Unit (DPU) in 1QFY25/26 was 3.8% lower mainly because of the lower overseas contributions.

| 1QFY25/26 (S$’000) |

1QFY24/25 (S$’000) |

% Change | |

| Gross Revenue | 218,616 | 236,654 | (7.6) |

| Net Property Income | 165,990 | 179,402 | (7.5) |

| Property expenses |

(52,626) | (57,252) | (8.1) |

| Net Finance Costs |

(50,098) | (59,907) | (16.4) |

| Amount Distributable to Unitholders | 106,769 | 110,750 | (3.6) |

| Distribution Per Unit (“DPU”) (cents) | 2.01 | 2.09 | (3.8) |

Debt

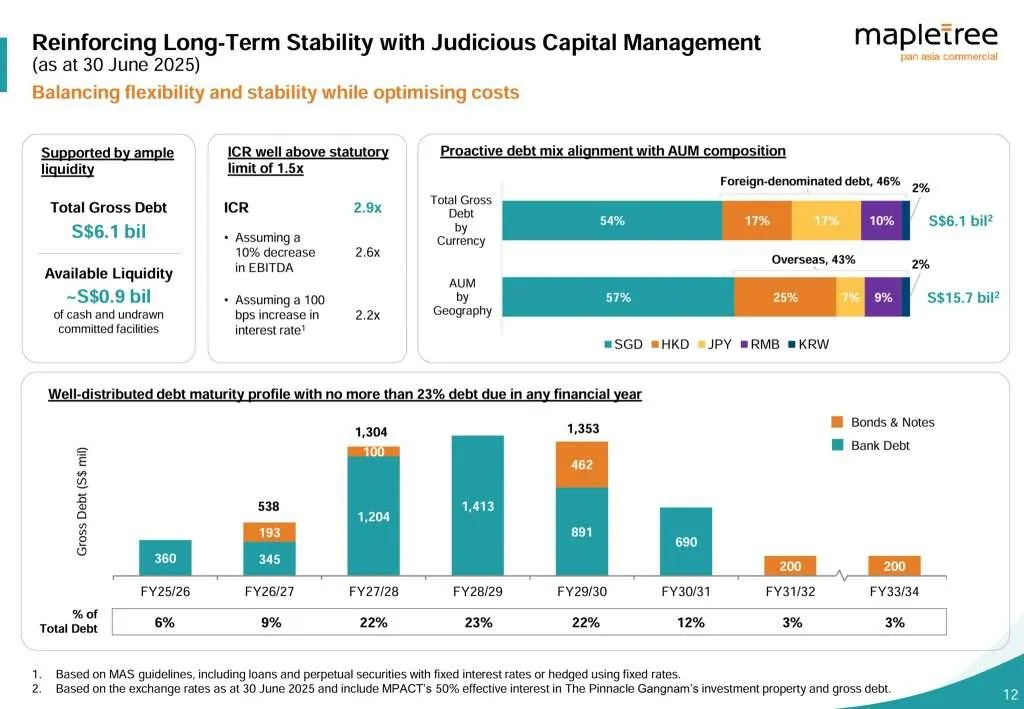

Aggregate Leverage also known as the gearing ratio is a financial metric that shows how much debt a company or investment trust (like a REIT) is using relative to its total assets. As of 30th June 2025, MPACT’s aggregate leverage stood healthy at 37.9%. MPACT’s average term to maturity of debt stood at 3.4 years.

Moody’s downgraded MPACTs’ credit rating from Baa1 (negative) to Baa2 (negative). This is because MPACT is expected to face continued rental pressures and weak occupancies across its overseas assets over the next 1 to 1.5 years due to soft leasing demand, weak business sentiment, and increased market competition. We are already seeing this from the lower revenue contributions from MPACT’s overseas assets.

Despite a negative credit rating, MPACT has a well-distributed debt maturity profile with no more than 23% debt due in any financial year.

What are the benefits of having a well-staggered debt maturity profile? Having a well-staggered debt maturity profile is crucial for REITs to manage their debt obligations effectively. By spreading out debt repayments over different time periods, REITs can avoid liquidity crunches and reduce the risk of default.

Furthermore, a well-staggered debt maturity profile allows REITs to take advantage of changes in interest rates. For example, if interest rates drop, REITs with debt maturing in the future can refinance at lower rates, reducing their interest expenses.

Occupancy

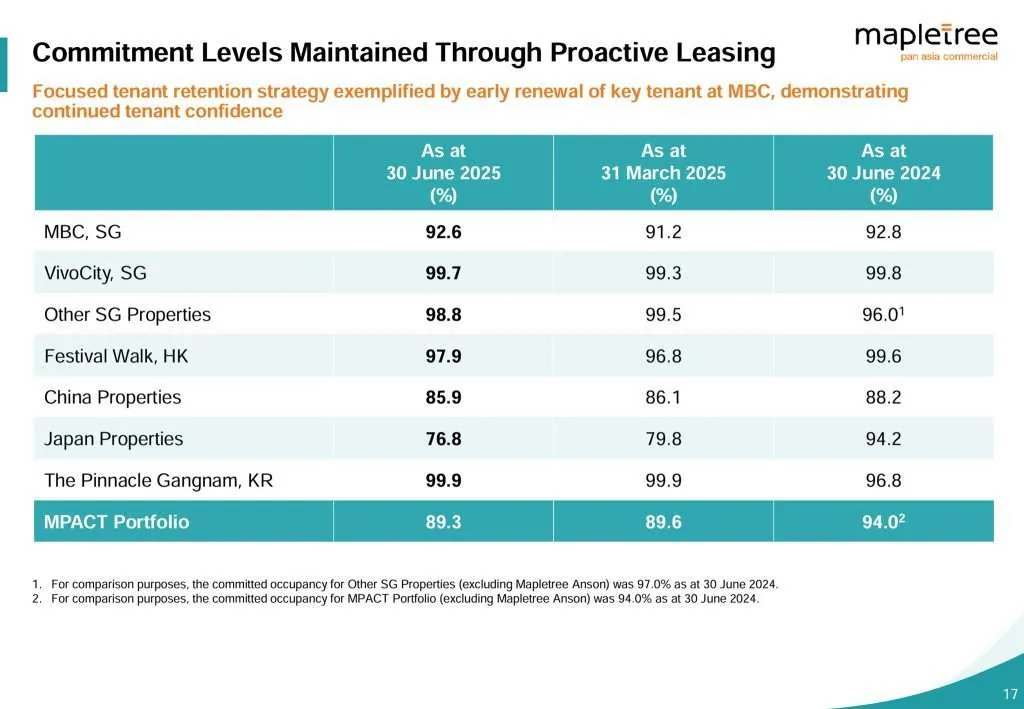

MPACT’s overall portfolio occupancy stood at 89.3%. As you can see from the above, occupancy at its Japan Properties fell 3% as compared to the last quarter. Occupancy at MPACT’s China Properties fell slightly by 0.2%.

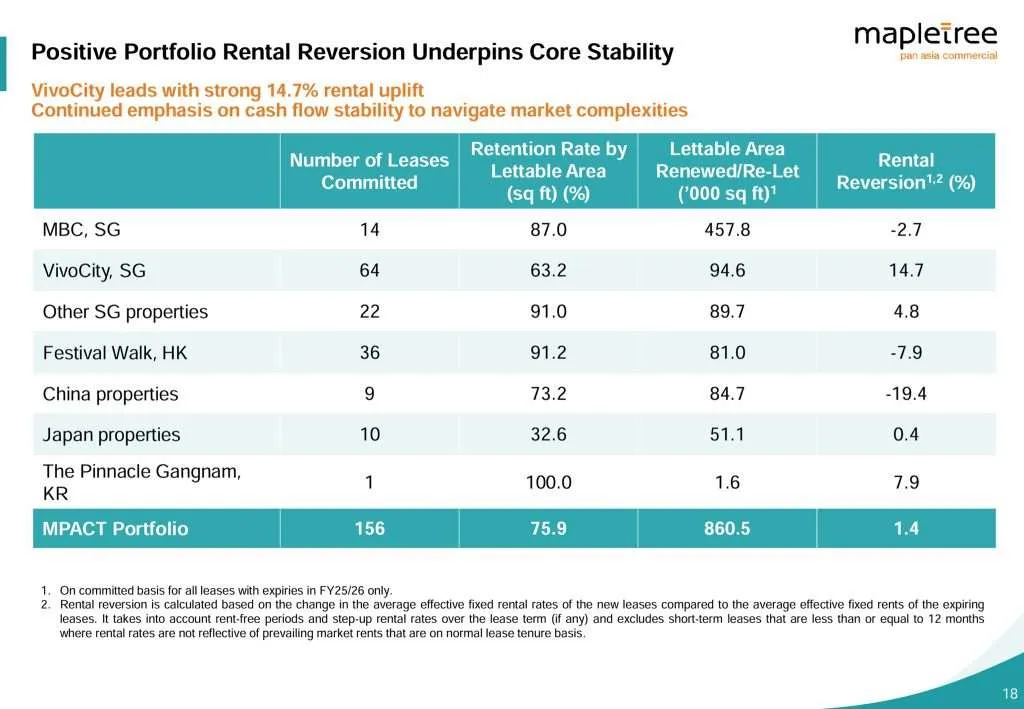

Next, let us take a look at the rental reversion. Do you know what is rental reversion? Rental reversion refers to the change in rental rates when leases are renewed. A positive rental reversion means the new rental rate is higher than the previous rate. A negative rental reversion happens when the new rental rate is lower than the previous rate. Whether the rental reversion is positive or negative depends on the market demand and supply.

MBC in Singapore, Festival Walk in Hong Kong and MPACT’s China properties faced negative rental reversion. Despite that, MPACT managed to achieve an overall portfolio positive rental reversion of 1.4%.

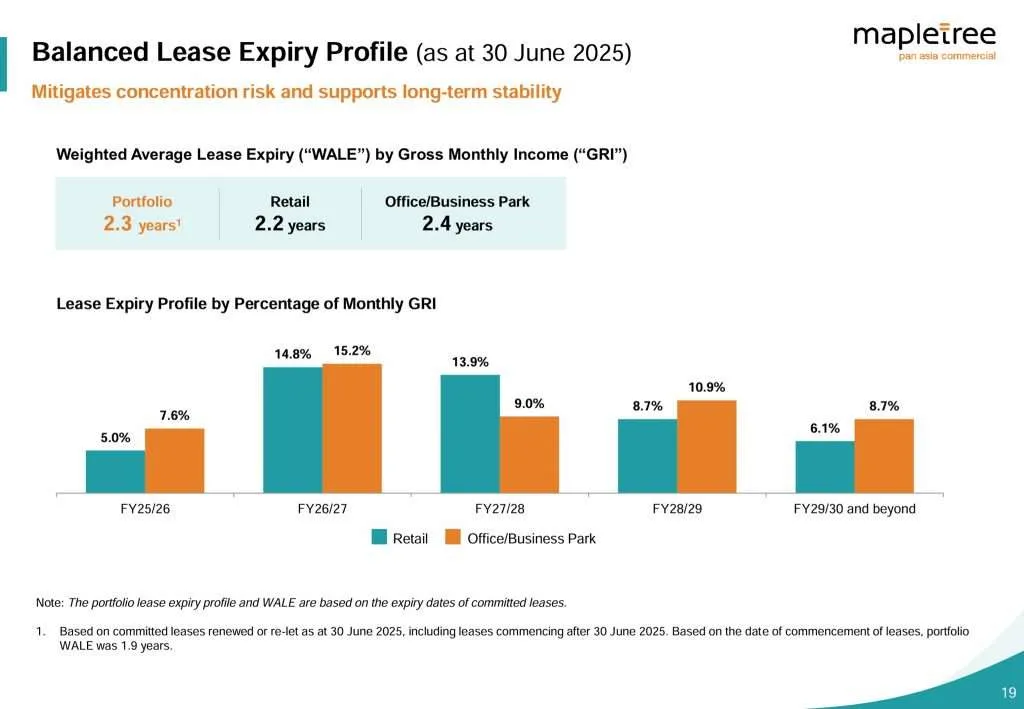

Lease Expiry

Lease expiry remained well-staggered. The weighted average lease expiry (WALE) was 2.2 years for the retail segment and 2.4 years for the office/business park segment, resulting in an overall portfolio WALE of 2.3 years.

Mapletree Pan Asia Commercial Trust Share Price and Dividend Yield

Based on the above 6-months share price chart, Mapletree Pan Asia Commercial Trust’s share price is on an uptrend. Based on MPACT’s FY24/25 full year distribution of 8.02 cents and current share price of S$1.28, this translates to a high current dividend yield of 6.27%.

Summary of MPACT 1QFY25/26 Financial Results

As usual, let me summarize the pros and cons of MPACT.

The pros are:

- MPACT’s property operating expenses were lower due to divestment of Mapletree Anson. Proceed were also used to par down its debt resulting lower financial expenses.

- Well-distributed debt maturity profile.

- Overall portfolio positive rental reversion of 1.4%.

- Lease expiry remained well-staggered.

- Attractive current dividend yield of 6.27%.

The cons are:

- MPACT’s gross revenue fell 7.6%.

- Overall portfolio occupancy stood at lower at 89.3%.

- Distribution Per Unit (DPU) was 3.8% lower mainly because of the lower overseas contributions.

- Moody’s downgraded MPACTs’ credit rating from Baa1 (negative) to Baa2 (negative).

Based on the above financial results, MPACT’s headwinds will last 12 to 18 months because of continued rental pressures and weak occupancies across its overseas assets.