Mapletree Logistics Trust (MLT) is one of Asia’s largest logistics-focused REITs, with a diversified portfolio spanning Singapore, China, Japan, South Korea, Australia, and other key Asia‑Pacific markets. The trust focuses on modern logistics facilities that support supply chain resilience and e‑commerce growth, two long‑term structural trends that continue to shape the region.

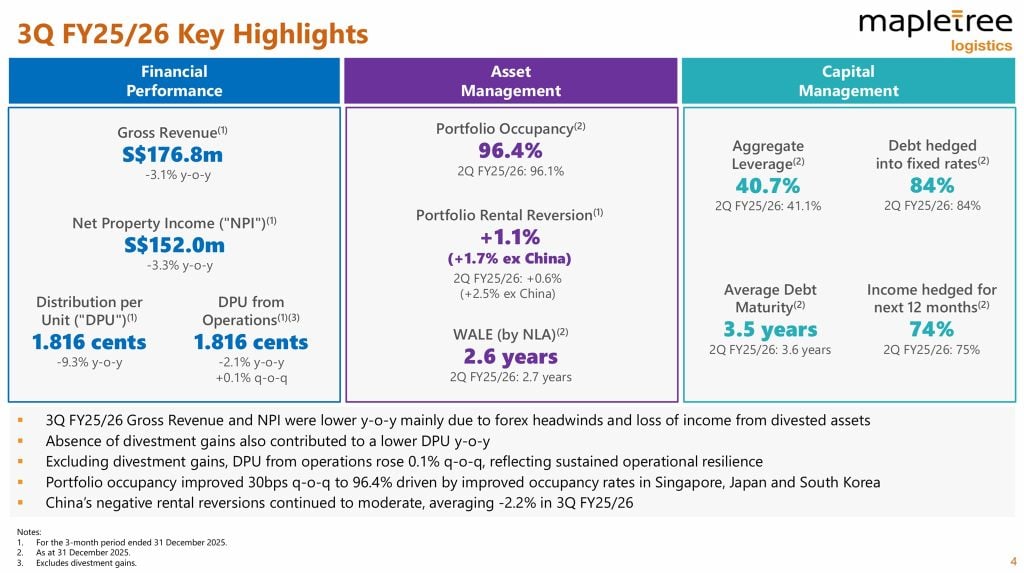

MLT released its Third Quarter FY25/26 financial results on 26 January 2026, providing investors with an updated view of its operational performance, capital management, and portfolio health. Despite a challenging macroeconomic backdrop, the REIT demonstrated stability across most metrics, supported by its scale and diversified tenant base.

Financial Performance

| 3QFY25/26 (S$’000) | 3QFY24/25 (S$’000) | % Change | |

|---|---|---|---|

| Gross Revenue | 176,829 | 182,413 | (3.1%) |

| Property Expenses | (24,836) | (25,212) | (1.5%) |

| Net Property Income | 151,993 | 157,201 | (3.3%) |

| Borrowing Costs | (38,191) | (39,925) | (4.3%) |

| Amount Distributable | 92,671 | 101,314 | (8.5%) |

| Distribution Per Unit (DPU) (cents) | 1.816 | 2.003 | (9.3%) |

MLT reported a slight decline in Gross Revenue, which came in at S$176.83 million, down 3.06% year‑on‑year. The dip was largely attributed to weaker performance in China and the absence of contributions from divested assets. Despite this, revenue remained supported by newly acquired properties and positive rental reversions in markets outside China.

Property Expenses rose modestly to S$24.84 million, reflecting higher maintenance and utilities costs across several markets. Even with this increase, the trust maintained a healthy cost structure, allowing it to preserve margins. As a result, Net Property Income (NPI) stood at S$151.99 million, demonstrating resilience despite top‑line pressure.

On the financing front, Borrowing Costs were recorded at S$38.19 million, slightly lower quarter‑on‑quarter due to proactive refinancing efforts. MLT continued to manage its debt profile carefully, taking advantage of lower interest rate opportunities where possible.

The Amount Distributable to unitholders was S$92.67 million, reflecting the trust’s steady cash‑flow generation. However, Distribution Per Unit (DPU) declined 9.3% year‑on‑year to 1.816 cents, mainly due to the absence of divestment gains that had boosted prior‑year distributions. Still, DPU improved slightly compared to the previous quarter, signalling stabilisation.

Debt

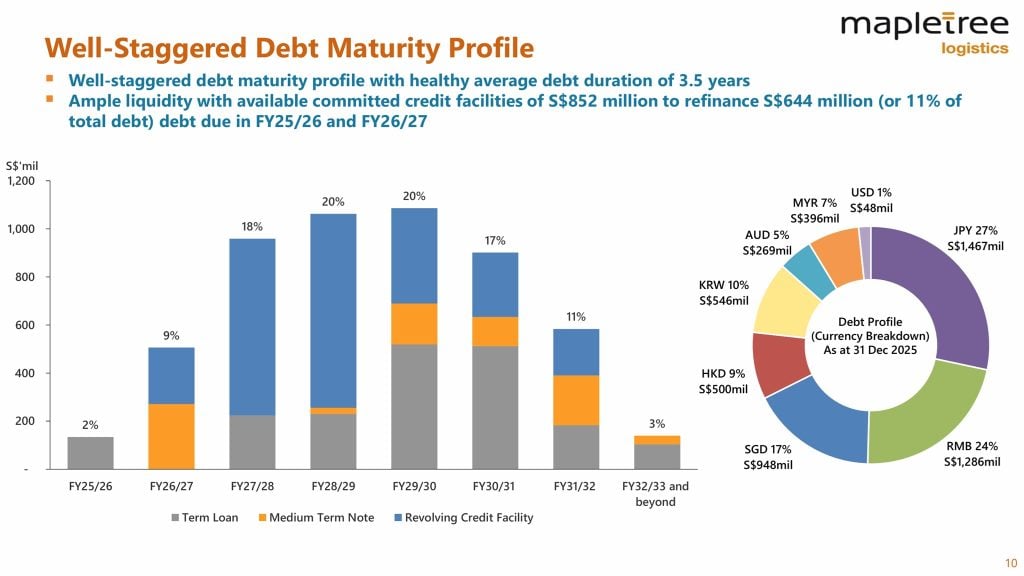

MLT maintained a disciplined approach to capital management during the quarter. Mapletree Logistics Trust’s aggregate leverage ratio decreased slightly to 40.7% as of 31st December 2025. The decrease was mainly due to divestment of a property in Australia and foreign currency effects from the weaker JPY.

The trust’s aggregate leverage (gearing ratio) remained within a comfortable range, consistent with its long‑standing strategy of keeping leverage at prudent levels. This conservative stance provides financial flexibility for future acquisitions and shields the trust from interest rate volatility.

A well‑managed gearing ratio also ensures that MLT retains access to competitive funding options across multiple markets. With a diversified debt maturity profile and a mix of fixed and floating‑rate borrowings, the trust continues to mitigate refinancing risks. This approach has been a key pillar of MLT’s long‑term stability and remains a positive factor for investors.

Occupancy

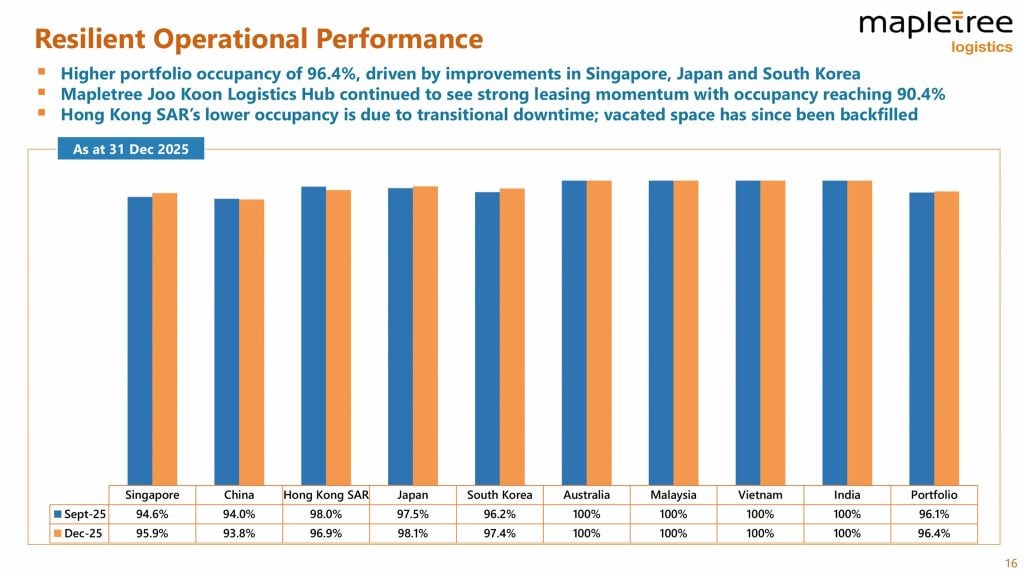

Portfolio occupancy remained strong at 96.4%, underscoring the continued demand for logistics space across MLT’s markets. This level of occupancy is particularly notable given the economic slowdown in certain regions, especially China. The trust’s diversified tenant base — spanning e‑commerce, logistics, manufacturing, and consumer goods — helps cushion against sector‑specific downturns.

High occupancy also reflects the quality and strategic locations of MLT’s assets. Many of its properties are situated near key transportation hubs, ports, and urban centres, making them attractive to tenants seeking efficient distribution networks. This positioning continues to support stable rental income and long‑term tenant retention.

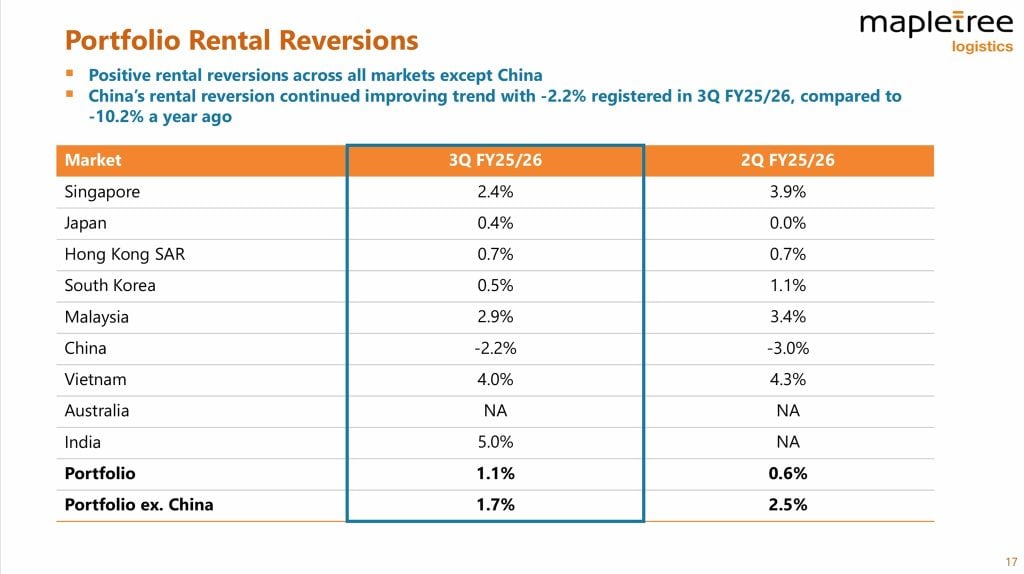

Rental Reversions

MLT achieved positive rental reversions of 1.7% outside China, demonstrating its ability to command higher rents upon lease renewals in most markets. This is a healthy sign of underlying demand, especially in markets such as Singapore, Japan, and Australia, where logistics space remains tight.

However, China continued to weigh on overall rental performance due to oversupply and weaker economic conditions. While the trust’s China portfolio remains a drag, management has been actively repositioning assets and engaging tenants to stabilise occupancy and rental rates. Over time, improvements in China’s logistics sector could help lift overall rental reversion figures.

Lease Expiry

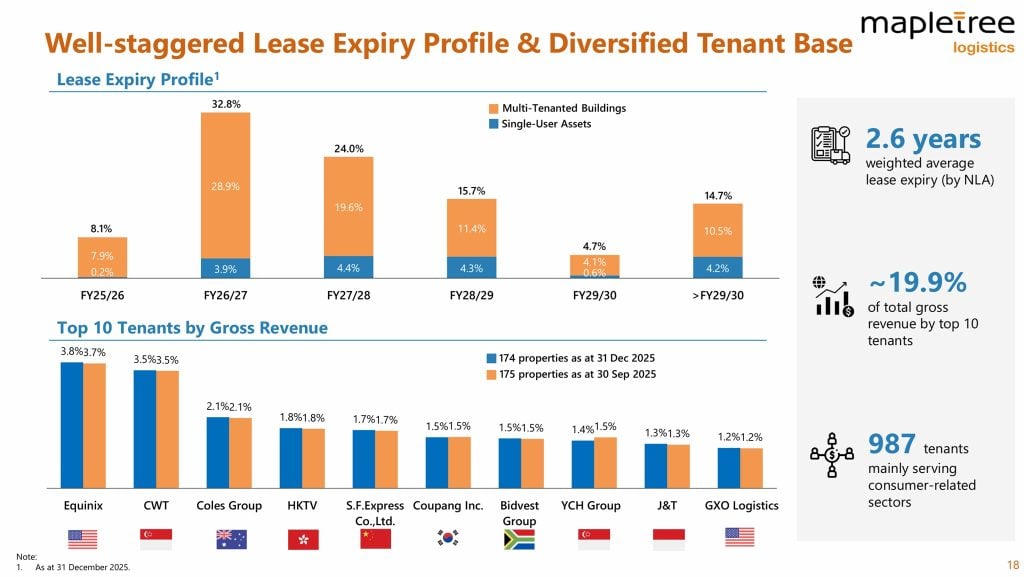

MLT’s lease expiry profile remains well‑staggered, reducing concentration risk and ensuring income stability. The trust typically spreads out expiries across multiple years and markets, preventing any single period from experiencing a significant drop in occupancy or rental income.

This disciplined approach to lease management also gives MLT flexibility to capture rental upside in stronger markets. As leases come up for renewal, the trust can negotiate higher rents in markets with tight supply, while maintaining stability in markets experiencing softer conditions. This balanced strategy supports long‑term income visibility for unitholders.

Mapletree Logistics Trust Share Price and Current Dividend Yield

As of the latest available market data, Mapletree Logistics Trust’s closing share price is S$1.31. This price reflects investor sentiment around the trust’s stable fundamentals, cautious outlook, and the broader interest rate environment affecting REIT valuations.

Based on the annualised FY24/25 full year distribution of 8.053 cents, MLT’s current dividend yield stands at around 6.15%. This yield remains attractive relative to other logistics REITs and fixed‑income alternatives, especially given MLT’s scale, diversification, and long‑term growth potential.

Summary of Mapletree Logistics Trust Third Quarter FY25/26 Financial Results

In my opinion, Mapletree Logistics Trust’s current quarter result remained negative. Let me summarize the pro and cons.

- Strong 96.4% occupancy, reflecting resilient demand for logistics space.

- Positive rental reversions outside China, showing pricing power in key markets.

- Proactive capital management helped lower borrowing costs.

- Quarter‑on‑quarter DPU improvement, signalling stabilisation.

- Diversified portfolio across multiple Asia‑Pacific markets reduces concentration risk.

The cons are:

- Gross revenue declined 3.06% year‑on‑year due to China weakness and divestments.

- DPU fell 9.3% year‑on‑year, mainly due to absence of divestment gains.

- China portfolio continues to face oversupply and rental pressure.

- Higher property expenses slightly compressed margins.