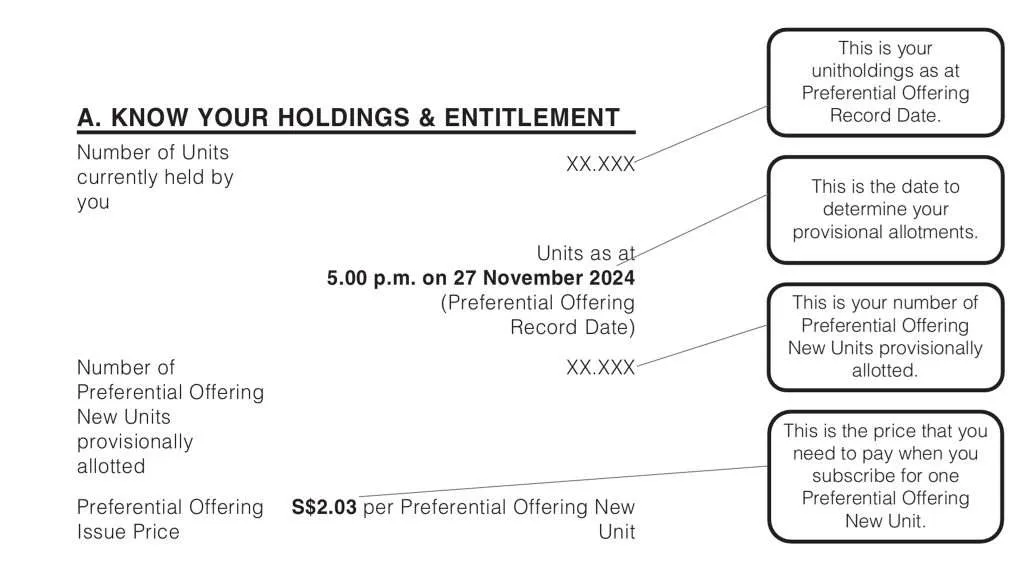

Keppel DC REIT is offering shareholders the rights (rights issue) to buy 86 new preferential offering units for every 1000 units, at S$2.03 each. The subscription to the rights and payment was already open on 2nd December and will close on 10th December 2024.

Why do REITs issue rights and launch preferential offerings? Rights and Preferential offerings are expected whenever REITs wanted to raise funds for certain purposes. If you are not familiar with rights and preferential offerings, read more below to find out exactly what these terms mean.

What is Rights Issue?

Rights issue is a way for a company to raise additional capital by offering existing shareholders the opportunity to purchase new shares at a discounted price. This allows current shareholders to maintain their ownership percentage in the company by purchasing more shares, while also providing the company with much-needed funds for growth, debt reduction, or other purposes.

Rights issues are typically offered on a pro-rata basis, meaning that shareholders can buy a certain number of new shares based on their existing holdings. It is a common method used by companies to raise capital without taking on additional debt or diluting the ownership of existing shareholders.

What is Preferential Offering?

Preferential offering is a type of offering made to existing shareholders of a company before it is offered to the general public. This allows current shareholders to purchase additional shares at a discounted price, giving them the opportunity to maintain or increase their ownership stake in the company.

Preferential offerings are often used by companies to raise additional capital while giving priority to their loyal shareholders. Shareholders who choose not to participate in the preferential offering may see their ownership stake diluted as new shares are issued to other investors.

Excess Rights Issue

An excess rights issue allows existing shareholders to purchase additional shares beyond their original allocation. This provides shareholders with the opportunity to increase their stake in the company at a discounted price.

By applying excess rights, shareholders can take advantage of the offering and potentially increase their ownership in the company. It is important for shareholders to carefully consider their financial situation and investment goals before deciding to apply for excess rights in order to make an informed decision that aligns with their long-term investment strategy.

How will Keppel DC REIT use the proceeds?

As part of equity fund raising, there will usually be explanation in the announcement on how the manager will use the proceeds from the fund raising. In Keppel DC REIT’s equity fund raising, the primary objective is to strengthen its balance sheet and capital structure and enhance its financial flexibility.

What does Keppel DC REIT mean by strengthening its balance sheet? Well, if you have followed Keppel DC REIT’s 3Q2024 Operational Updates, its aggregate leverage stood high at 39.7%. The proceeds will be used partially to repay Keppel DC REIT’s debts and possibly fund future acquisitions, taking into account the prevailing market conditions, while maintaining an optimum level of gearing.

Keppel DC REIT’s aggregate leverage is expected to decrease from approximately 39.7% to approximately 33.3%, assuming that the Proposed Shares and Notes Transactions will be funded immediately after the Equity Fund Raising.

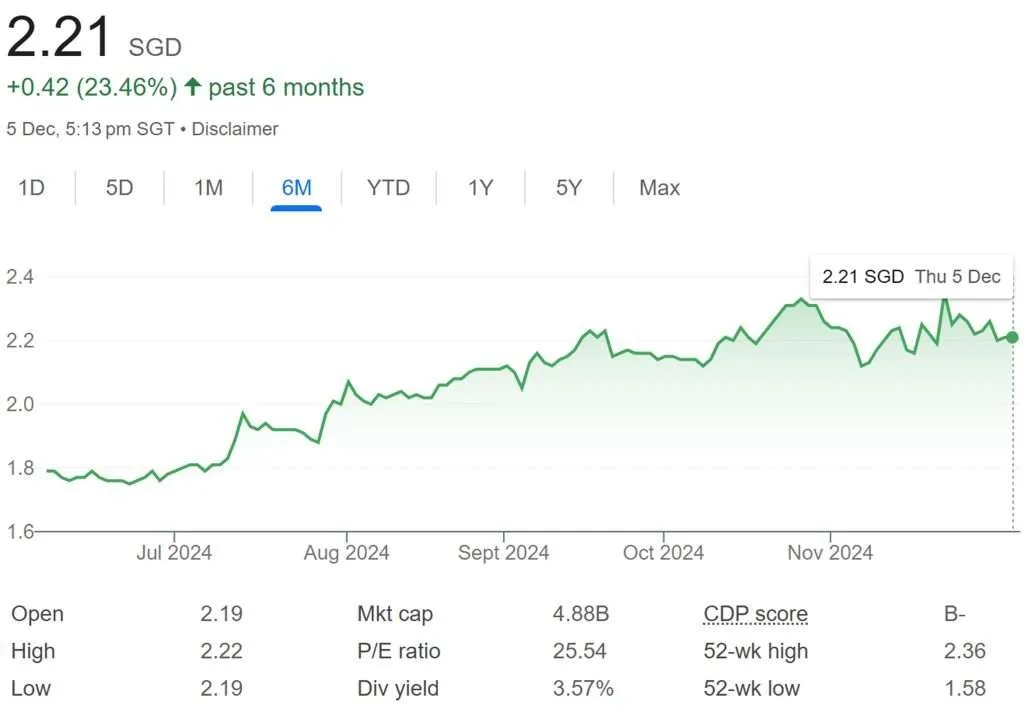

Keppel DC REIT Share Price

Keppel DC REIT share price closed at S$2.21 on 5th December 2024. Based on the preferential offering issue price of S$2.03, this represents a discount of S$0.18 per unit from the closing price.