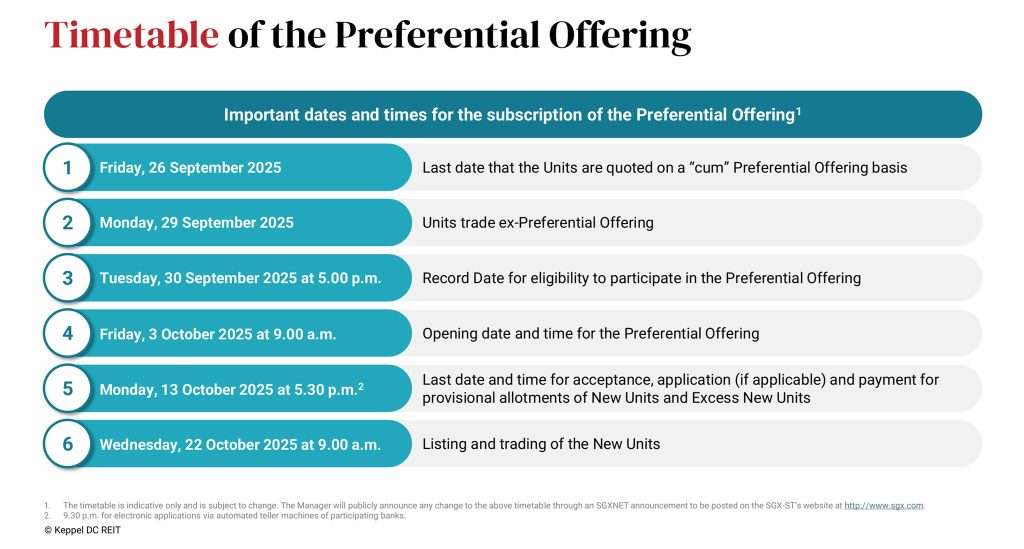

On Friday, 3rd October 2025, Keppel DC REIT launched its preferential offering which means you should already see the allocation in your CDP (SGX Central Depository Pte Account). Eligible Unitholders should remember to accept and make payment before the closing date on 13th October 2025. Previously, Keppel DC REIT had announced a non-renounceable preferential offering to raise approximately S$404.5 million, marking a pivotal moment in its growth strategy. This capital raise is designed to support its acquisition of Tokyo Data Centre 3, a hyperscale facility located in Inzai City, Japan. The data centre is fully leased to a global hyperscaler under a 15-year agreement with annual rent escalations, positioning the REIT to benefit from stable, long-term income and enhanced portfolio resilience.

A preferential offering is a method of equity fundraising that gives existing shareholders the opportunity to subscribe to new units at a discounted price. Unlike a public offering, this approach prioritizes current investors, allowing them to maintain their proportional ownership. In Keppel DC REIT’s case, the offering is non-renounceable, meaning unitholders cannot sell their rights to others. They must either subscribe to the new units or accept dilution of their stake.

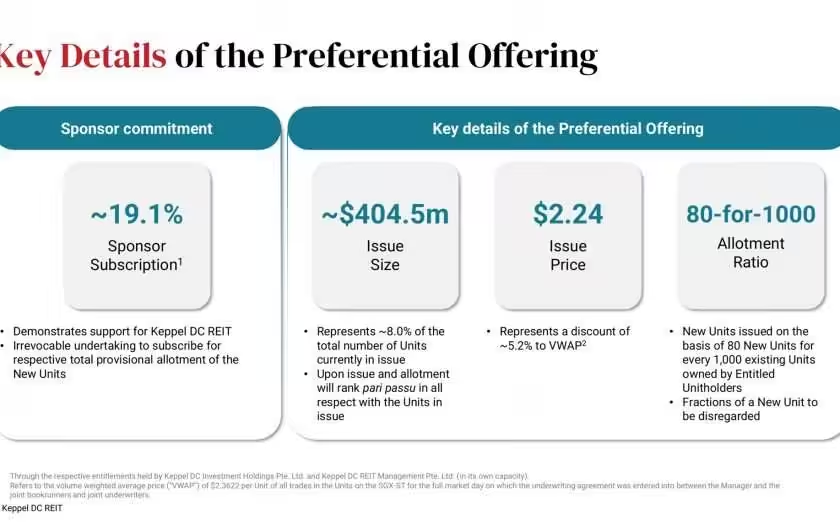

The offering price is set at S$2.24 per unit, representing a 5.2% discount to the volume-weighted average price prior to the announcement. Eligible unitholders will be allotted 80 new units for every 1,000 units they already hold. Applications for excess units are allowed, though allocation will be at the discretion of the manager. Entitled unitholders who wish to accept their provisional allotment of New Units and (if applicable) apply for the Excess New Units, will need to do so in the manner set out in the Instruction Booklet by 13 October 2025.

The proceeds from this offering will be used not only to fund the Tokyo acquisition but also to support asset enhancement initiatives at Keppel DC Singapore 8, extend the land lease for Keppel DC Singapore 1 by 30 years, and repay existing debt. These moves are expected to be earnings accretive, with the Tokyo acquisition alone projected to boost FY2024 distribution per unit by 2.8%.

Strategically, this expansion into Japan strengthens Keppel DC REIT’s presence in one of Asia’s most advanced data centre markets. Inzai City is a key hub for hyperscale infrastructure, offering robust connectivity and limited supply, factors that enhance the long-term value of the asset. With this acquisition, the REIT’s assets under management will rise to S$5.7 billion, spanning 25 data centres across 10 countries.

For investors, the preferential offering presents a compelling opportunity to participate in the REIT’s growth at a discount. However, as the rights are non-renounceable, those who choose not to subscribe will see their ownership diluted. The offering also introduces foreign exchange exposure due to the Japanese yen-denominated asset, and execution risks tied to the enhancement and lease extension projects.

Ultimately, Keppel DC REIT’s preferential offering reflects a confident push into high-growth territory, backed by a strong tenant profile and long-term lease structure. It is a calculated move that aligns with the REIT’s strategy of deepening its footprint in hyperscale markets while reinforcing income stability and portfolio diversification.

Will I Accept Keppel DC REIT Preferential Offering?

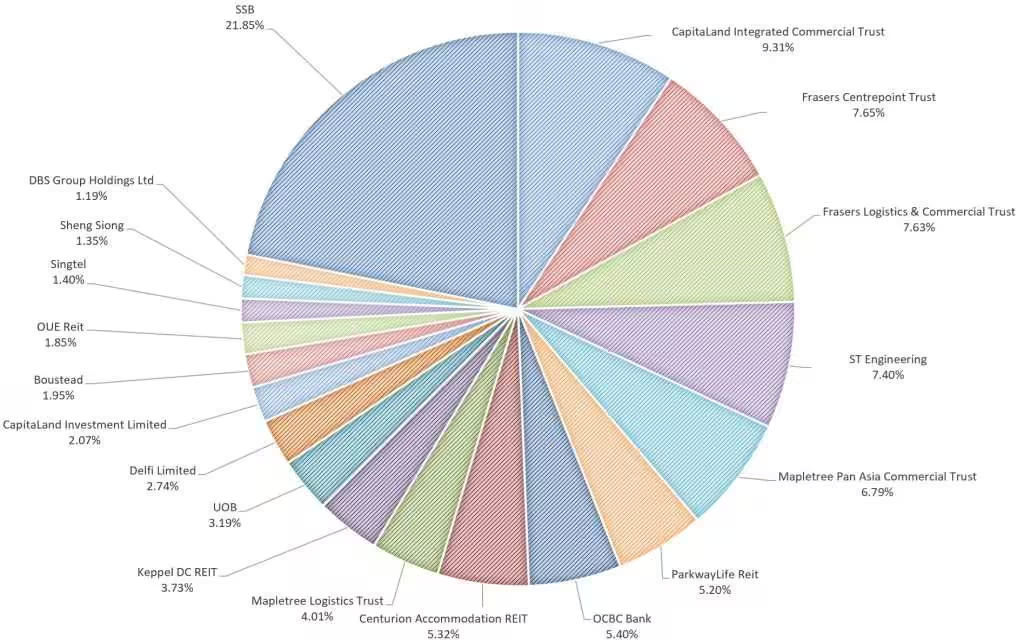

As you can see from the above, Keppel DC REIT only makes up 3.73% of my stock portfolio. Based on Keppel DC REIT share price of S$2.40 on 3-Oct-25 and FY2024 full year distribution of 9.451 cents, this translates to a low current dividend yield of 3.93%.

But of course, the manager promised the acquisition is DPU accretive and pro forma DPU post-acquisition would be 9.712. Based on the offering price of S$2.24 per unit, the dividend yield is 4.34%. The dividend yield is actually not that bad despite being below my expectation of 5%. Given the current low-interest rate environment, a dividend yield of 4 to 5% range is pretty acceptable to me.

In conclusion, I shall be accepting the allocated units but will skip applying for excess as I can find higher yield with other Singapore REITs.