What is Israel Iran war impact on the share price of DBS Bank? Is this a crisis or an opportunity? Over the weekends, the United States bombed three of Iran’s nuclear sites. In retaliation, Iran fired missiles into Israel. Just early morning, I read from the news that Iran fired missiles at a United States airbase in Qatar. Moments later, Israel and Iran agree on ceasefire to end the 12-day war.

Last week, stock prices already tumbled with the news of Israel and Iran war. The share price of Singapore local banks was not spared. While some investors see this as a crisis, I see this as an opportunity to nibble on some stocks that I have been eyeing for a long time.

On 23rd June 2025, the share price of DBS dipped from the previous day of S$44.01 to close at S$43.39. As you can see from the chart of share price of DBS above, the share price recovered. At this point of writing, the share prices of Singapore stocks including DBS Bank reacted positively to the 12-day ceasefire.

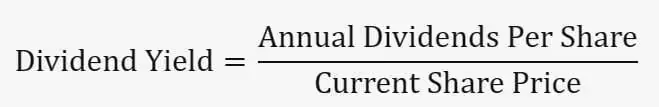

In April, I made my maiden entry and bought DBS. As the share price of DBS Singapore has been hovering above S$40, I refrained from increasing my position. When the share price of DBS Singapore increases, the current dividend yield decreases and vice versa.

Singapore local banks such as DBS have been consistently paying out dividends and their dividend yield are able to match the returns of some Singapore REITs. As such, bank stocks such as DBS can be considered as a good dividend stock if you invest at the right price.

As you can see from below, DBS Bank was able to constantly payout dividends year-on-year. For the last 5 years, DBS Bank increased its dividend payout every year. Below, let us take revisit at DBS historical dividend payouts and check what is DBS current dividend yield.

DBS Share Price and Dividend

Below is DBS historical dividend payouts.

Financial Year: 2024

Dividend Payout: 2.22 SGD per share (Interim: 162 cents, Final: 60 cents)

Financial Year: 2023

Dividend Payout: 1.75 SGD per share (Interim: 126 cents, Final: 49 cents)

Financial Year: 2022

Dividend Payout: 1.82 SGD per share (Interim: 99 cents, Final: 38 cents, Special: 45 cents)

Financial Year: 2021

Dividend Payout: 1.09 SGD per share (Interim: 76 cents, Final: 33 cents)

Financial Year: 2020

Dividend Payout: 0.78 SGD per share (Interim: 62 cents, Final: 16 cents)

In FY2024, DBS had paid out a total of 2.22 SGD per share. Based on DBS share price of S$44.00 and FY2024 dividend payout of 2.22 SGD per share, this translates to a current dividend yield of 5.04%.

In my opinion, the current dividend yield of 5.04% is acceptable. However, I will wait for opportunity if DBS share price crashed so that I can get a higher current dividend yield. For the time being, I shall just put DBS in my watch list.

I shall also be looking at other Singapore bank stocks such as OCBC and UOB to check on their current share price and current dividend yield. What about you? What stocks are you watching to add to your stock portfolio?

References:

Trump says Iran’s key nuclear sites ‘obliterated’ by US airstrikes – CNA

Airlines face fresh upheaval as Iran attacks US airbase in Qatar – CNA

Israel and Iran agree on ceasefire to end 12-day war, Trump says – CNA