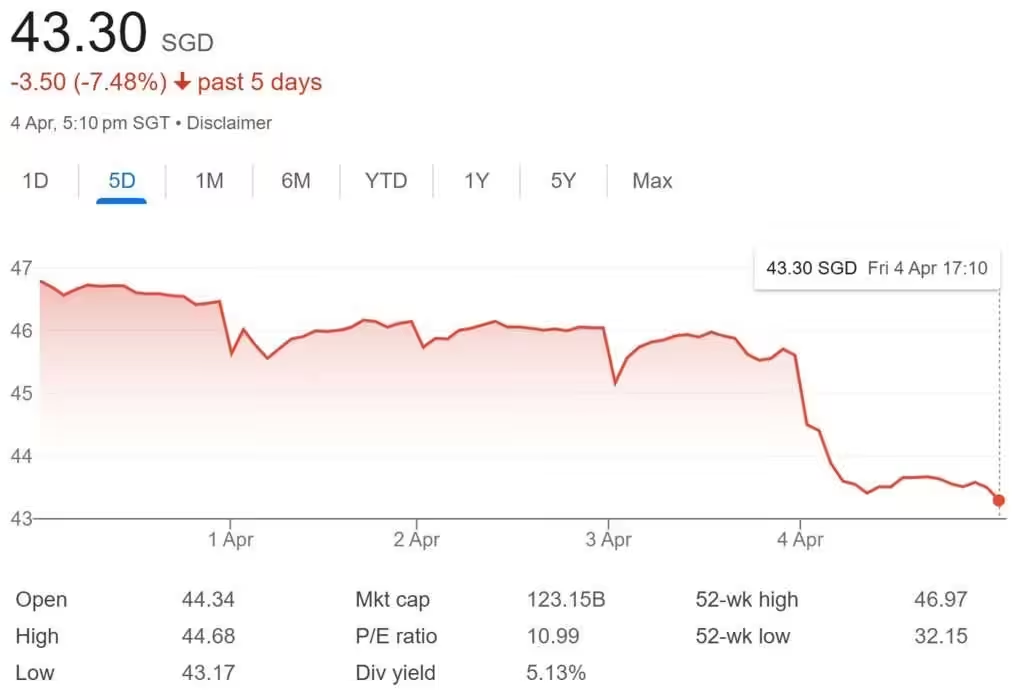

On Friday, I bought DBS. With this addition, I held the shares of all 3 Singapore banks in my stock portfolio. Are you wondering what is DBS (SGX:D05) Bank Singapore stock price right now? On Friday, DBS share price closed at S$43.30. As you can see from the above chart, DBS share price was on the decline this week.

There was a major selloff mid of this week as Trump announced the tariffs that he will impose on various countries. The tariffs imposed for Singapore was 10% which was the lowest tier as compared to other countries. Trump’s tariffs sent the global markets into turmoil as I observed major selloff in both the US stock market and Singapore stock market.

While some investors see this as a crisis, I see this as an opportunity to nibble on some stocks that I have been eyeing for a long time. The share price of the stocks I am eyeing have yet to reach extremely attractive levels. Thus, I will only deploy my first tranche and wait for further crash before deploying my subsequent tranches of cash.

Why buy stocks in tranches? This is the usual strategy I adopt when it comes to investing. This is because we will never know how far the share price of stocks will decline. By deploying your cash in tranches, we can also average down when the share price dips further.

As a dividend investor, are you wondering how much dividend is DBS Bank paying over the past years? DBS Bank historical dividends payout could easily be found at their investor’s relation page. As you can see from below, DBS Bank was able to constantly payout dividends year-on-year. For the last 5 years, DBS Bank increased its dividend payout every year.

Financial Year: 2024

Dividend Payout: 2.22 SGD per share

Financial Year: 2023

Dividend Payout: 1.75 SGD per share

Financial Year: 2022

Dividend Payout: 1.82 SGD per share (include special dividend of 45 cents)

Financial Year: 2021

Dividend Payout: 1.09 SGD per share

Financial Year: 2020

Dividend Payout: 0.78 SGD per share

DBS Current Dividend Yield

What is DBS Bank’s current dividend yield? Based on the current share price and 2024 full year dividend payout of 2.22 SGD per share, this translates to a current dividend yield of 5.13%.

DBS Group Holding’s upcoming ex-dividend date is on 7th April 2025. DBS Group Holdings shareholders who own DBS (SGX:D05) stock before this date will receive DBS Group Holding’s next dividend payment of S$0.60 per share on 16th April 2025.

My Thoughts

“To be fearful when others are greedy and to be greedy only when others are fearful.”

I know some may not agree with me for making an entry into DBS right now. The global stock market may crash further. However, should the share price of DBS decline further, I see this as an opportunity to accumulate more of DBS Bank!