On 7th November 2025, Frasers Logistics and Commercial Trust announced its 2HFY25 financial results. Frasers Logistics and Commercial Trust own a diversified portfolio of 113 income-producing properties valued at S$6.99 billion across Australia, Germany, the Netherlands, Singapore, and the UK. For continuous three financial years (FY22, FY23 and FY24), the distribution per unit has been lower.

Currently, Frasers Logistics and Commercial Trust make up 7.47% of my stock portfolio. Can Frasers Logistics and Commercial Trust turn around the decline in DPU in FY25? What is Frasers Logistics and Commercial Trust’s current share price and current dividend yield?

Let us look into the details of Frasers Logistics and Commercial Trust’s financial results to find out more.

Frasers Logistics and Commercial Trust 2HFY25 Financial Results

In the six months ended 30 September 2025, Frasers Logistics and Commercial Trust’s gross revenue climbed to S$239.2 million, supported by contributions from the newly acquired 2 Tuas South Link 1, the completed Maastricht logistics property in the Netherlands, and stronger income from UK business parks.

Adjusted net property income rose to S$164.9 million, reflecting a 2.2% increase despite headwinds from weaker AUD/SGD exchange rates and higher non-recoverable land taxes in Australia. However, finance costs surged 19.5% year-on-year, driven by refinancing at higher interest rates and additional borrowings for acquisitions and developments. As a result, distributable income fell to S$111.7 million, and DPU dropped to 2.95 cents, down from 3.32 cents in 2HFY24.

The decline was largely due to lower capital distributions, which fell to 0.26 cents from 0.75 cents previously, though core DPU before capital distribution improved slightly to 2.69 cents.

| 2HFY25 (S$’000) |

2HFY24 (S$’000) |

Change (%) | |

| Gross Revenue | 239,160 | 230,648 | 3.7 |

| Adjusted Net Property Income | 164,857 | 161,311 | 2.2 |

| Finance Cost |

43,553 | 36,437 | 19.5 |

| Amount Distributable to Unitholders | 111,650 | 124,853 | (10.6) |

| Distribution Per Unit (“DPU”) (cents) | 2.95 | 3.32 | (11.1) |

Frasers Logistics and Commercial Trust FY24 Full Year Financial Results

Frasers Logistics and Commercial Trust’s gross revenue increased to S$471.5 million, supported by contributions from newly acquired assets such as 2 Tuas South Link 1 and the completed Maastricht logistics property in the Netherlands, alongside stronger income from UK business parks.

Adjusted net property income rose to S$326.1 million, up from S$320 million in FY2024, though gains were partially offset by weaker AUD/SGD exchange rates and higher non-recoverable land taxes in Australia.

Finance costs surged 26.4% year-on-year, driven by refinancing at higher interest rates and additional borrowings for acquisitions.

As a result, DPU fell to 5.95 cents, down from 6.80 cents in FY2024, mainly due to reduced capital distributions and higher tax expenses.

| FY25 (S$’000) |

FY24 (S$’000) |

Change (%) | |

| Gross Revenue | 471,486 | 446,674 | 5.6 |

| Adjusted Net Property Income | 326,113 | 320,005 | 1.9 |

| Finance Cost |

83,000 | 65,658 | 26.4 |

| Amount Distributable to Unitholders | 224,654 | 255,515 | (12.1) |

| Distribution Per Unit (“DPU”) (cents) | 5.95 | 6.80 | (12.5) |

Debt

Frasers Logistics and Commercial Trust’s aggregate leverage stood at 35.7%, comfortably below the regulatory limit of 50%, providing S$507 million in debt headroom before reaching a 40% leverage threshold.

The interest coverage ratio was 4.3 times, reflecting prudent capital management. However, finance costs rose 26% year-on-year to S$83 million, driven by refinancing at higher interest rates and additional borrowings to fund acquisitions and developments.

The trust’s proactive hedging strategy, fixing 70.4% of its debt helped cushion the impact of rate volatility, though elevated funding costs continue to weigh on distribution per unit (DPU) growth in the near term.

Occupancy

Frasers Logistics and Commercial Trust’s overall portfolio occupancy improved to 95.1%, up from previous periods, driven primarily by robust demand in the logistics sector. The Logistics and Industrial segment, which includes assets in Singapore, Australia, and Europe, maintained near-full occupancy at 99.7%, underscoring the resilience and attractiveness of well-located industrial assets.

Meanwhile, the weighted average lease expiry (WALE) across the portfolio stood at 4.8 years, providing income visibility and stability.

Frasers Logistics and Commercial Trust also achieved average rental reversions of +29.5% in FY25, with the Logistics and Industrial segment delivering a stellar +39.6%, reflecting strong tenant retention and upward rental momentum amid tight supply in key logistics markets.

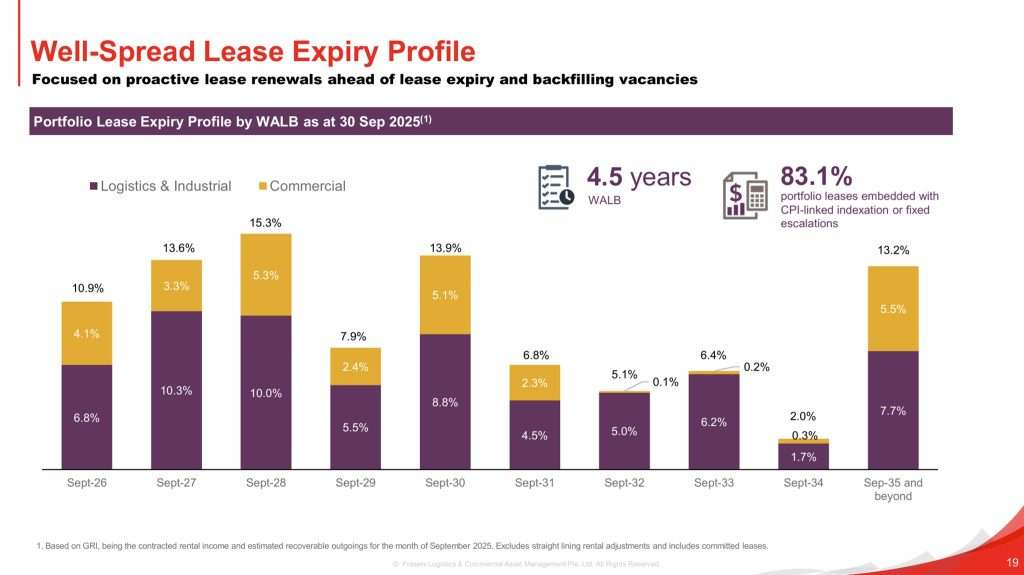

Lease Expiry Profile

Frasers Logistics and Commercial Trust maintained a well-spread lease expiry profile as of 30th September 2025, with no more than 19.2% of gross rental income expiring in any single financial year over the next five years, supporting income stability and risk diversification.

The trust’s weighted average lease expiry (WALE) stood at 4.8 years, underpinned by long-duration leases in its Logistics & Industrial (L&I) segment. The expiry profile is front-loaded with manageable rollover: 13.6% of leases by gross rental income are due in FY2026, followed by 19.2% in FY2027, and tapering off in subsequent years.

This distribution provides Frasers Logistics and Commercial Trust with flexibility to capture rental upside in strong markets while maintaining predictable cash flows. The trust’s ability to secure positive rental reversions of +29.5% in FY2025 further enhances the resilience of its lease portfolio amid evolving market conditions.

What is Frasers Logistics and Commercial Trust’s Current Share Price and Dividend Yield?

What is Frasers Logistics and Commercial Trust’s share price? Frasers Logistics and Commercial Trust’s share price closed at S$0.96 on Wednesday, 12th November 2025. Based on FY25 full year distribution of 5.95 cents and Frasers Logistics and Commercial Trust share price of S$0.96, this translates to a current dividend yield of 6.20%.

Summary of Frasers Logistics and Commercial Trust FY25 Full Year Results

Let me summarize the pros and cons based on Frasers Logistics and Commercial Trust FY25 full year financial results.

The pros are:

- FY25 revenue was 5.6% higher as compared to FY24.

- Aggregate leverage stood healthy at 35.7%.

- Healthy occupancy at 95.1%.

- Lease expiry remains well-spread.

- Positive rental reversion (+29.5% on an incoming rent vs. outgoing rent basis).

- Current dividend yield at 6.20% (Based on S$0.96 per unit)

The cons are:

- FY25 full year DPU was 12.5% lower at 5.95 cents.

- Full year finance cost was 26.4% higher.