On 31st July 2024, Frasers Logistics and Commercial Trust announced their 3QFY24 business updates. Business updates mainly touched on operational performance with minimal updates on financial performance. The key highlights showed that Frasers Logistics and Commercial Trust maintained its positive portfolio rental reversions +14.8% on an incoming rent versus outgoing rent basis (“incoming vs outgoing”) and +25.1% for the average rent of the new/renewal lease as compared to the average rent of the preceding lease (“average rent vs average rent”).

Why is positive rental reversion important? Positive rental reversions mean that there is an estimated increase in rent upon lease renewal, especially when the existing gross rent is below the estimated rental value. Positive rental reversions contribute to improved income and stability.

Frasers Logistics and Commercial Trust 3QFY24 Debt

As compared with 1HFY24, aggregate leverage rose slightly to 33.2%. Aggregate leverage, also known as gearing ratio, refers to the ratio of a real estate investment trust’s (REIT) debt to its total assets. In Singapore, Singapore REITs have a gearing limit of 50%. Thus, Frasers Logistics and Commercial Trust’s gearing of 33.2% is well below S-REIT’s gearing limit.

Frasers Logistics and Commercial Trust’s weighted average debt maturity stood at 2.0 years and interest coverage ratio is 5.9 times.

72.6% of its borrowings are hedged at fixed rates to mitigate against the risk of sudden interest rate hikes. REITs often use debt to fund acquisitions. If interest rates rise, the cost of servicing their debt increases, affecting profitability. Thus, it is important REITs hedged some of their borrowings at fixed rates to mitigate against the risk of sudden interest rate hikes.

Occupancy

Let us look at Frasers Logistics and Commercial Trust portfolio occupancy to see if its commercial segment had improved.

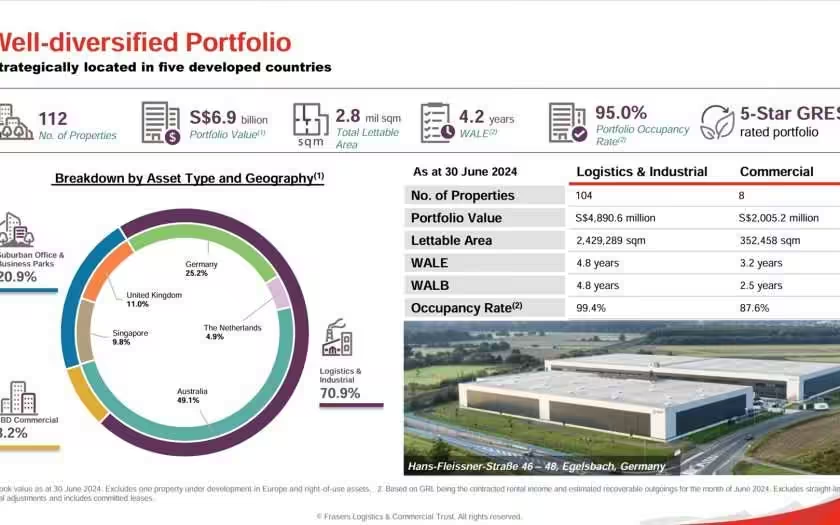

Overall portfolio occupancy stood healthy at 95.0%. The occupancy of its logistics and industrial segment has fallen from 100% to 99.4% while its commercial segment has improved from 85.0% in 1HFY24 to 87.6% in 3QFY24. The improved commercial portfolio occupancy was due to new leases secured at Alexandra Technopark and Farnborough Business Park.

Lease Expiry

Lease expiry remained well spread. The number of leases requiring renewal had reduced from 27 in 1HFY24 to 16 requiring renewal in 4QFY24. As you can see from the above slide, 83.6% of the portfolio leases were embedded with CPI-linked indexation or fixed escalations. Fixed escalations meant that when leases are due for renewal, the renewed rent will be increased.

Weighted Average Lease Expiry (WALE) stood at 4.8 years. WALE measures the average time to expiry of existing leases within a property portfolio. Properties with longer WALEs face less risk of vacancy. REIT investors generally prefer longer WALEs because they provide stable income.

Frasers Logistics and Commercial Trust’s Weighted Average Lease to Expiry (WALE) of 4.8 years is generally considered short term. However, as mentioned above, fixed escalations are embedded into the renewal which provided opportunity for the REIT manager to increase rent.

Frasers Logistics and Commercial Trust Share Price and Dividend Yield

Frasers Logistics and Commercial Trust share price closed at S$1.00 on 8th August 2024. As you can see from the above chart, Frasers Logistics and Commercial Trust share price has been on the downtrend but recovered slightly in July driven by positive news.

What is Frasers Logistics and Commercial Trust dividend yield? Is it a good time to buy Frasers Logistics and Commercial Trust? Based on the current closing price of S$1.00 and FY23 full year distribution of 7.04 cents, Frasers Logistics and Commercial Trust current dividend yield is 7.04%. In my opinion, the dividend yield remains attractive to make an entry into Frasers Logistics and Commercial Trust. The continued momentum in positive rental reversions is also an indicator of further uptrend. However, investors should also be aware of geographical political factors (E.g. War, political tensions etc) that could disrupt the uptrend.

Summary of Frasers Logistics and Commercial Trust 3QFY24 Business Update

Based on the business updates, let me summarize the pros and cons. The pros are:

- Positive portfolio rental reversions +14.8% on an incoming rent versus outgoing rent basis. +25.1% for the average rent of the new/renewal lease as compared to the average rent of the preceding lease.

- Embedded fixed rent escalations.

- Aggregate leverage of 33.2% is well below S-REIT’s gearing limit.

- 72.6% of its borrowings are hedged at fixed rates to mitigate against the risk of sudden interest rate hikes.

- Overall portfolio occupancy stood healthy at 95.0%.

- Occupancy for commercial segment has improved from 85.0% in 1HFY24 to 87.6% in 3QFY24.

- Lease expiry remained well spread with 16 leases expiring in 4QFY24.

- Attractive current dividend yield at 7.04%.

The cons are:

- Aggregate leverage rose slightly to 33.2%.

- Occupancy of its logistics and industrial segment has fallen from 100% in 1HFY24 to 99.4% in 3QFY24.

The outlook for Frasers Logistics and Commercial Trust appears positive, with analysts maintaining a Buy rating. The trust has demonstrated robust growth and strategic acquisitions, which fuel this optimistic perspective. High occupancy rates and positive rental reversions, particularly in its logistics properties in Australia, contribute to stable revenue streams. Additionally, the trust’s financial health is solid, with a low aggregate leverage and substantial debt headroom, allowing for further expansion opportunities.