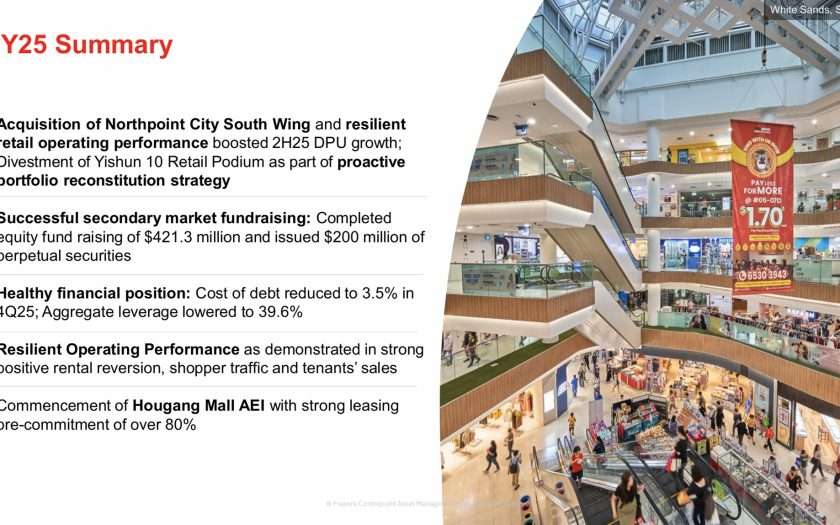

On 23rd October 2025, Frasers Centrepoint Trust (FCT) announced its 2H2025 financial results. This also makes up FCT’s FY25 full year financial results. In FY25, Frasers Centrepoint Trust (FCT) declared a total Distribution Per Unit (DPU) of 12.113 cents. This marks an increase in DPU of 0.6% year-on-year. Frasers Centrepoint Trust (FCT) reported strong second-half financial results for FY2025, underscoring its position as a leading suburban retail REIT in Singapore.

Frasers Centrepoint Trust (FCT) is one of Singapore’s leading retail real estate investment trusts (REITs), with a strategic focus on suburban malls that cater to everyday consumer needs. Listed on the Singapore Exchange, FCT owns and manages a portfolio of well-located retail properties including Causeway Point, Northpoint City, and Tampines 1, serving densely populated residential catchments. The trust is known for its stable income generation, high occupancy rates, and proactive asset enhancement initiatives. Backed by its sponsor, Frasers Property Limited, FCT continues to pursue disciplined growth through acquisitions and portfolio optimization, delivering consistent returns to its unitholders.

Now, let us take a deeper look into Frasers Centrepoint Trust 2H25 financial results.

Frasers Centrepoint Trust 2H25 Financial Results

The trust’s gross revenue surged 14.3% year-on-year to S$205.2 million, while net property income (NPI) climbed 12% to S$144.3 million. These gains were primarily attributed to the acquisition of Northpoint City South Wing in May 2025 and the completion of asset enhancement initiatives (AEI) at Tampines 1.

Despite higher operating expenses, up 20.1% to S$60.9 million, the trust’s distributable income to unitholders rose 12.5% to S$123.1 million, reflecting effective cost management and accretive asset strategies. Frasers Centrepoint Trust (FCT) declared a Distribution Per Unit (DPU) of 6.059 cents, up 0.6% year-on-year.

| 2H25 (S$’000) |

2H24 (S$’000) |

Change (%) | |

| Gross Revenue | 205,212 | 179,521 | 14.3 |

| Net Property Income | 144,290 | 128,774 | 12.0 |

| Property expenses |

(60,922) | (50,747) | (20.1) |

| Amount Distributable to Unitholders | 123,089 | 109,407 | 12.5 |

| Distribution Per Unit (“DPU”) (cents) | 6.059 | 6.020 | 0.6 |

Frasers Centrepoint Trust FY25 Full Year Financial Results

Below are Frasers Centrepoint Trust FY25 full year financial results.

| FY25 (S$’000) |

FY24 (S$’000) |

Change (%) | |

| Gross Revenue | 389,603 | 351,733 | 10.8 |

| Net Property Income | 277,980 | 253,386 | 9.7 |

| Property expenses |

(111,623) | (98,347) | (13.5) |

| Amount Distributable to Unitholders | 233,166 | 214,313 | 8.8 |

| Distribution Per Unit (“DPU”) (cents) | 12.113 | 12.042 | 0.6 |

Debt

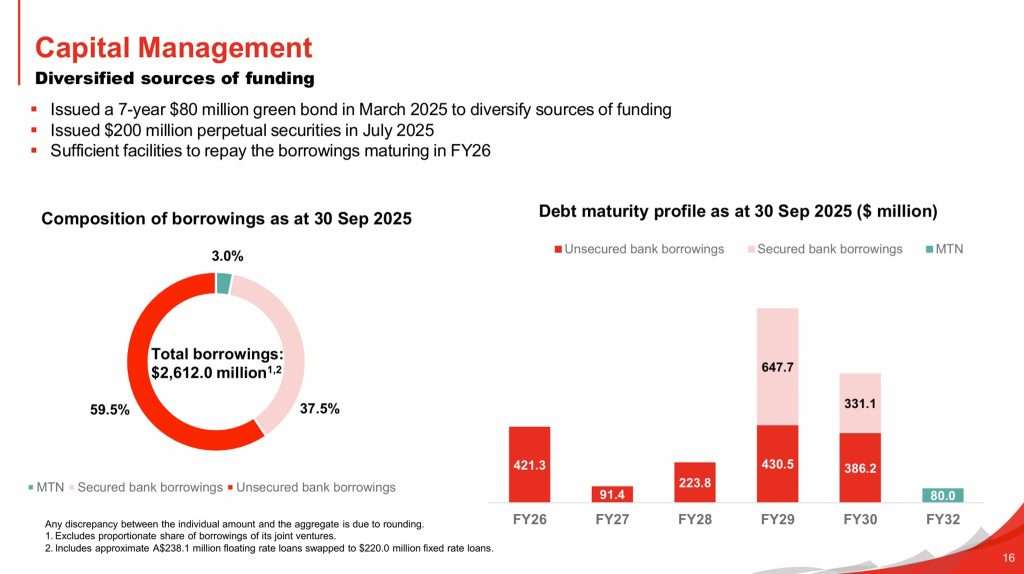

Frasers Centrepoint Trust (FCT)’s balance sheet strengthened with aggregate leverage easing to 39.6% from 42.8% in June, aided by perpetual securities issuance for the Northpoint acquisition.

The average cost of borrowing declined to 3.5% in Q4, down from 4% in Q1, while interest coverage improved to 3.46 times. CEO Richard Ng emphasized the trust’s resilience and strategic execution, noting future opportunities in asset enhancement and portfolio optimization.

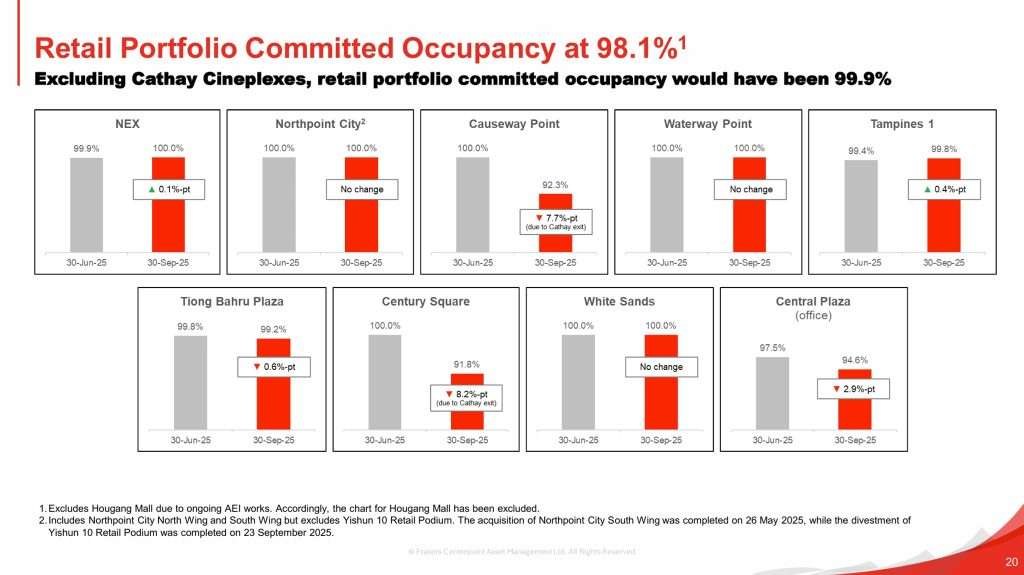

Occupancy

Frasers Centrepoint Trust (FCT) maintained a resilient portfolio occupancy in 2H FY2025, with committed occupancy across its retail assets standing at 98.1%. This slight dip from previous periods was primarily due to the exit of Cathay Cineplexes from Causeway Point and Century Square. However, when excluding these transitional vacancies, the portfolio’s effective occupancy remained robust at 99.9%, underscoring the strength and stability of FCT’s suburban mall network. The trust’s proactive leasing efforts and strong tenant relationships helped sustain high occupancy levels despite sectoral headwinds, reflecting continued demand for well-located retail space in Singapore’s heartland.

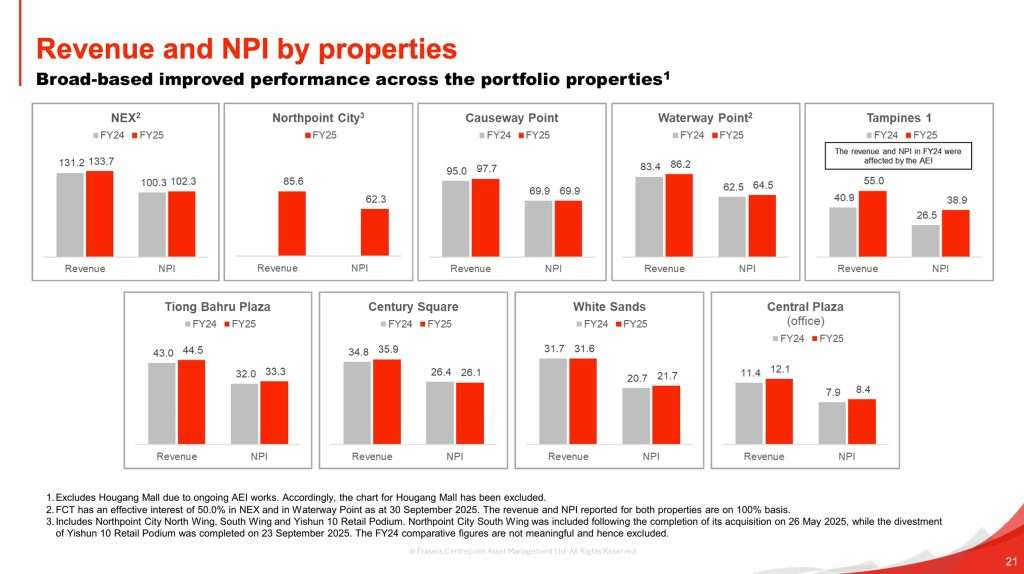

As you can see from the above, the top 3 malls in terms of revenue contributed are NEX, Causeway Point and Waterway Point.

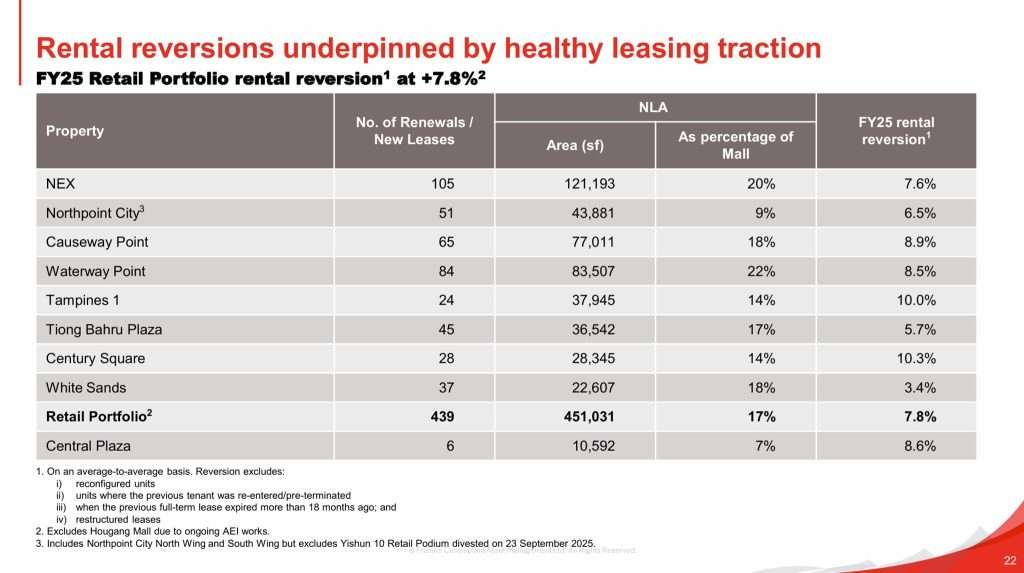

Rental Reversion

Frasers Centrepoint Trust (FCT) achieved a healthy portfolio rental reversion of 7.8% for FY2025, reflecting strong leasing momentum and sustained demand across its suburban retail assets. This positive reversion was supported by a 3.7% increase in tenant sales and a 1.6% rise in shopper traffic, indicating robust consumer engagement and spending patterns. The trust’s proactive asset management and strategic tenant mix helped drive rental uplifts, particularly in malls that underwent recent enhancements. With an average occupancy cost of 16.1%, FCT retains headroom for further rental growth, reinforcing its ability to deliver stable and accretive returns to unitholders.

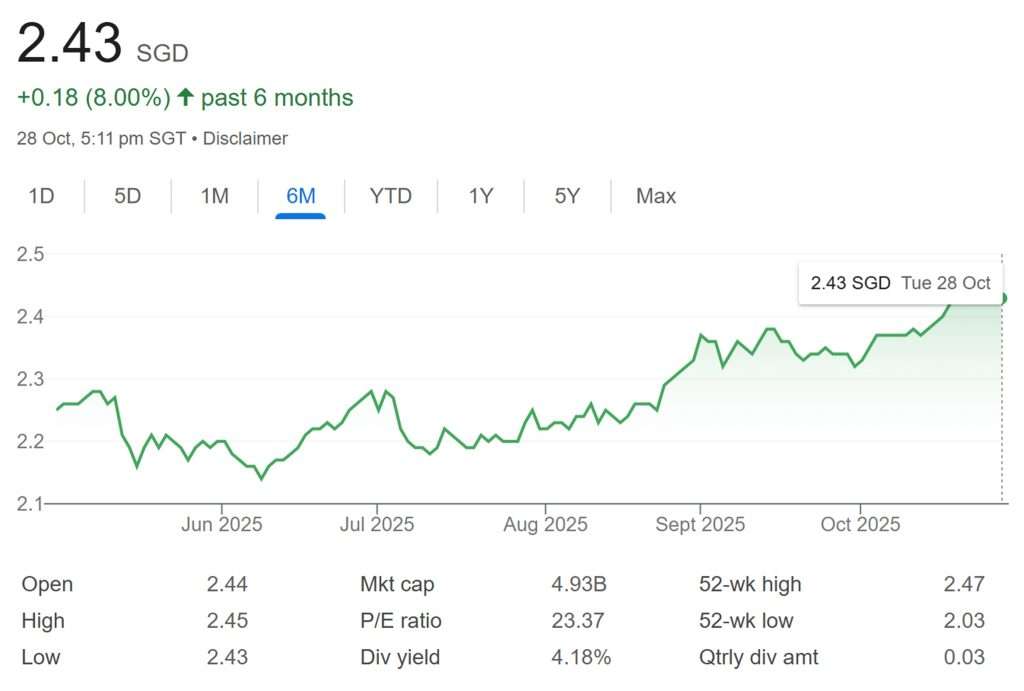

Frasers Centrepoint Trust Current Share Price and Dividend Yield

Frasers Centrepoint Trust share price closed at S$2.43 on 28th October 2025. Based on Frasers Centrepoint Trust (FCT) FY25 full year distribution of 12.113 cents and current share price of S$2.43, the current dividend yield is 4.98%.

Summary of Frasers Centrepoint Trust FY25 Full Year Results

Based on Frasers Centrepoint Trust full year results, let me summarize the pros and cons.

The pros are:

- DPU grew 0.6% year-on-year to 12.113 cents.

- Aggregate leverage stood healthy at 39.6%.

- Debt maturity remained well-spread.

- Overall portfolio occupancy stood high at 98.1%.

- Positive rental reversion of +7.8% for FY25.

The cons are:

- As Frasers Centrepoint Trust’s share price has gone up, the current dividend yield is lower at 4.98%.