On 25th October 2024, Frasers Centrepoint Trust announced its FY24 full year results. A Distribution Per Unit (DPU) of 6.020 cents was declared for 2HFY24. This brings Frasers Centrepoint Trust’s FY24 full year DPU to 12.042 cents.

Currently, Frasers Centrepoint Trust makes up 5.70% of my stock portfolio. I have trying to accumulate Frasers Centrepoint Trust since 2023 given its attractive dividend yield but took a pause when the share price went up. What is Frasers Centrepoint Trust share price now? What is Frasers Centrepoint Trust current dividend yield? These are questions I asked myself before I resume accumulating Frasers Centrepoint Trust for the purpose of collecting dividends for passive income.

Let us look into the details of Frasers Centrepoint Trust’s FY24 full year financial results to find out more.

Frasers Centrepoint Trust 2H24 Financial Results

In 2H24, Frasers Centrepoint Trust gross revenue fell by 2.5% to S$179.5 million. The declines were due to the absence of contribution from Changi City Point which was divested in October 2023 and lower contribution from Tampines 1 during its Asset Enhancement Initiative (AEI) works.

For the same reasons, Net Property Income (“NPI”) fell 0.6% to $128.8 million.

Distribution Per Unit (DPU) remains flat at 6.020 cents as compared to 2H23.

| 2H24 (S$’000) |

2H23 (S$’000) |

Change (%) | |

| Gross Revenue | 179,521 | 184,063 | (2.5) |

| Net Property Income | 128,774 | 129,555 | (0.6) |

| Property expenses |

(50,747) | (54,508) | 6.9 |

| Amount Distributable to Unitholders | 109,407 | 103,065 | 6.2 |

| Distribution Per Unit (“DPU”) (cents) | 6.020 | 6.020 | No Change |

Frasers Centrepoint Trust FY24 Full Year Financial Results

Frasers Centrepoint Trust’s full year gross revenue was 4.9% lower year-on-year at $351.7 million as compared to FY23. Net Property Income (NPI) declined 4.6% to $253.4 million. As shared above, this is because of the absence of contribution from Changi City Point and AEI works at Tampines 1.

Excluding the above 2 factors, the manager shared that Frasers Centrepoint Trust’s FY24 gross revenue and Net Property Income would be 3.5% and 3.4% higher respectively.

Frasers Centrepoint Trust’s FY24 full year distribution was 0.9% lower at 12.042 cents as compared to FY23.

| FY24 (S$’000) |

FY23 (S$’000) |

Change (%) | |

| Gross Revenue | 351,733 | 369,723 | (4.9) |

| Net Property Income | 253,386 | 265,586 | (4.6) |

| Property expenses |

(98,347) | (104,137) | 5.6 |

| Amount Distributable to Unitholders | 214,313 | 207,745 | 3.2 |

| Distribution Per Unit (“DPU”) (cents) | 12.042 | 12.150 | (0.9) |

Debt

As of 30th September 2024, aggregate leverage (gearing) stood at 38.5%. Average debt maturity stood at 2.56 years.

71.4% of Frasers Centrepoint Trust’s borrowings are hedged at fixed interest rates to mitigate against sudden interest rate hikes.

As you can see from the above, debt maturity remained well-spread and there are no financing risks in FY24. It was mentioned in the slides that the manager had secured facilities to refinance borrowings due in FY25.

Occupancy

Overall portfolio occupancy stood high at 99.7%. With the completion of the AEI works, the occupancy at Tampines 1 is 100%.

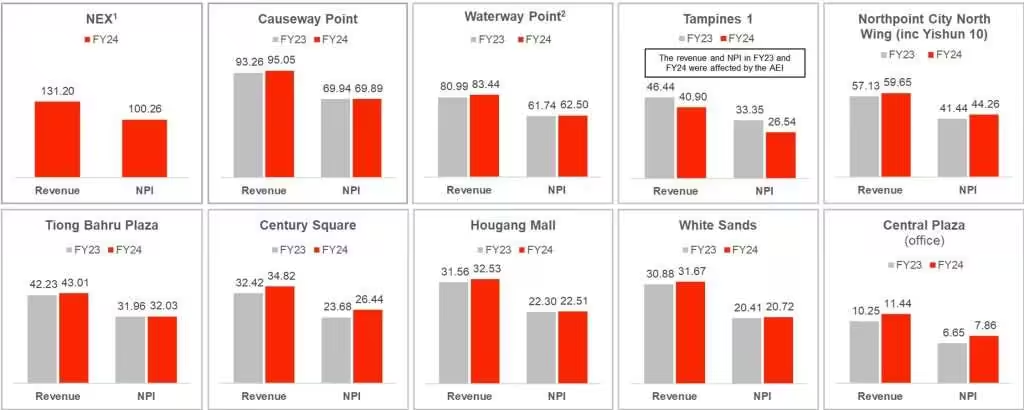

The above is my favourite slide as it shows which malls under Frasers Centrepoint Trust is contributing the most revenue and naturally is the top performing mall. In my opinion, the top 3 malls in terms of revenue contributed are NEX, Causeway Point and Waterway Point.

Another piece of good news is that Frasers Centrepoint Trust achieved portfolio rental reversion of +7.7% for FY24 (on an average-to-average basis) which is higher as compared with +4.7% for FY23. This is attributed to the higher contributions from atrium leasing as well as tenants’ sales growth that provided higher turnover rents.

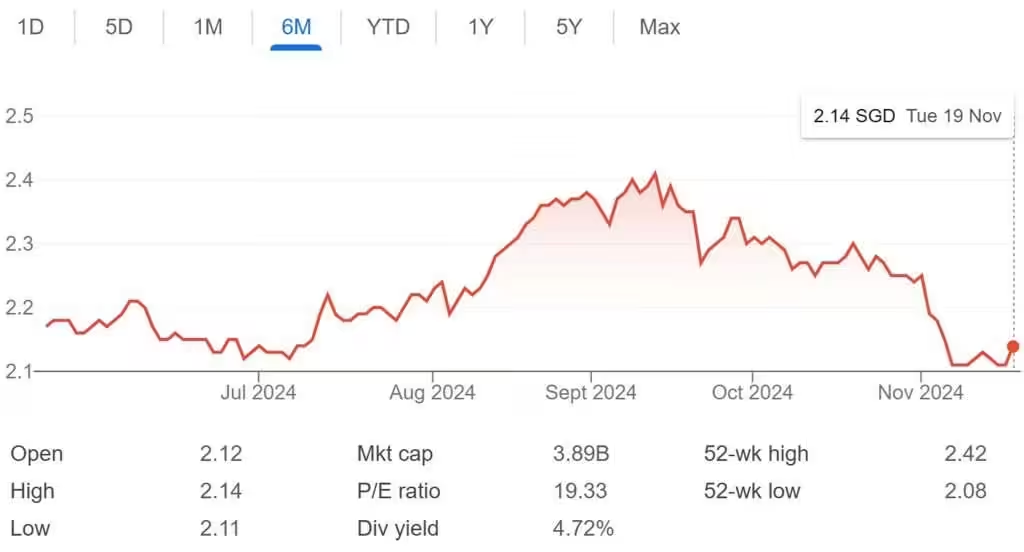

Frasers Centrepoint Trust Current Share Price and Dividend Yield

Frasers Centrepoint Trust share price hovers around S$2.14 on 19th November 2024. Based on Frasers Centrepoint Trust share price and FY24 DPU of 12.042 cents, this translates to a current dividend yield of 5.63%.

Summary of Frasers Centrepoint Trust FY24 Full Year Results

Based on Frasers Centrepoint Trust full year results, let me summarize the pros and cons.

The pros are

- Excluding the divestment of Changi City Point and AEI works at Tampines 1, FY24 gross revenue and Net Property Income would be 3.5% and 3.4% higher respectively.

- Aggregate leverage stood healthy at 38.5%.

- Debt maturity remained well-spread.

- Overall portfolio occupancy stood high at 99.7%.

- Positive rental reversion of +7.7% for FY24.

- Attractive current dividend yield of 5.63%.

The cons are

- Full year gross revenue and net property income fell 4.9% and 4.6% respectively.

- FY24 full year distribution was 0.9% lower at 12.042 cents.