Frasers Centrepoint Trust (FCT) is one of Singapore’s largest and most established suburban retail REITs, with a resilient portfolio of nine malls strategically located near MRT stations and residential heartlands. On 23rd January 2026, FCT released its 1Q FY26 Business Updates, highlighting stable operational performance, strong occupancy, and continued progress on asset enhancement initiatives (AEIs).

The trust continues to demonstrate its defensive qualities, supported by necessity‑driven retail tenants and consistent shopper traffic. This quarter’s update reinforces FCT’s position as a key beneficiary of Singapore’s suburban retail strength.

Debt

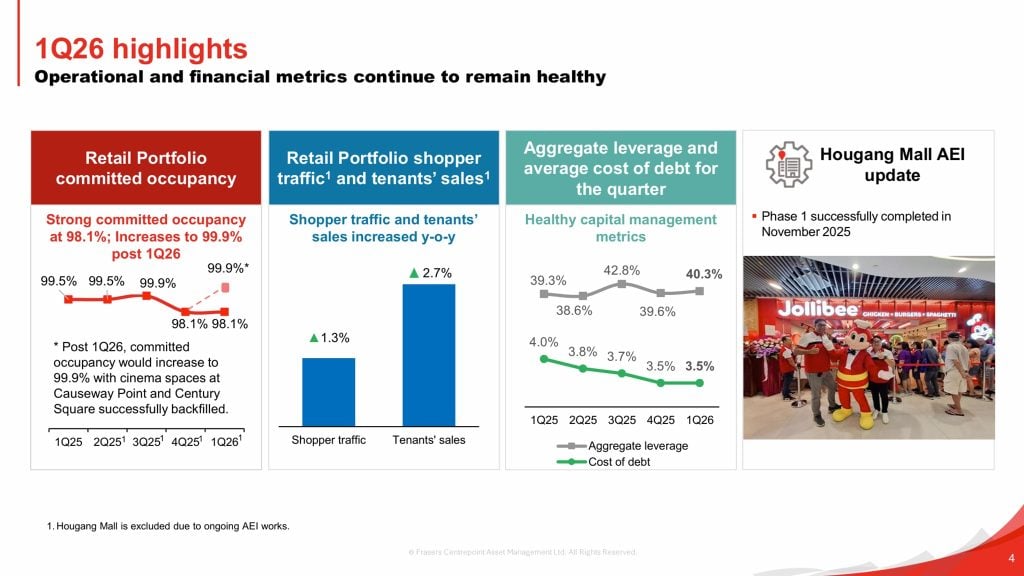

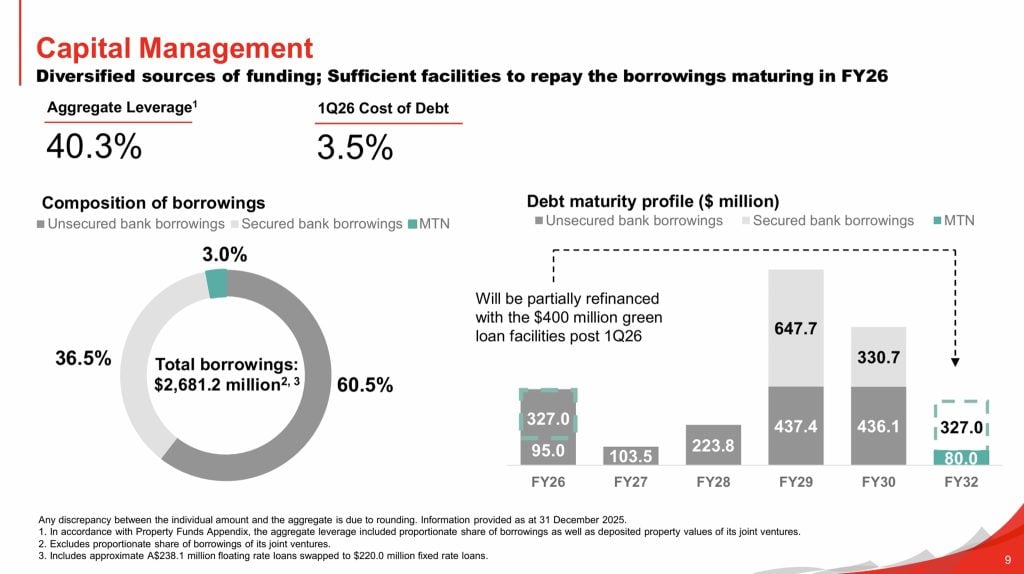

FCT maintained a healthy capital structure in 1Q FY26, with aggregate leverage at 40.3%, slightly higher than the 39.6% recorded in the previous quarter. This gearing level remains comfortably within regulatory limits and provides the trust with sufficient debt headroom for future acquisitions or AEI investments.

The trust’s average cost of debt held steady at 3.5%, reflecting prudent interest rate management. Notably, 81.2% of total borrowings are hedged to fixed rates, offering stability amid fluctuating interest rate environments. FCT also retains S$839.5 million in undrawn facilities, strengthening its liquidity position.

Occupancy

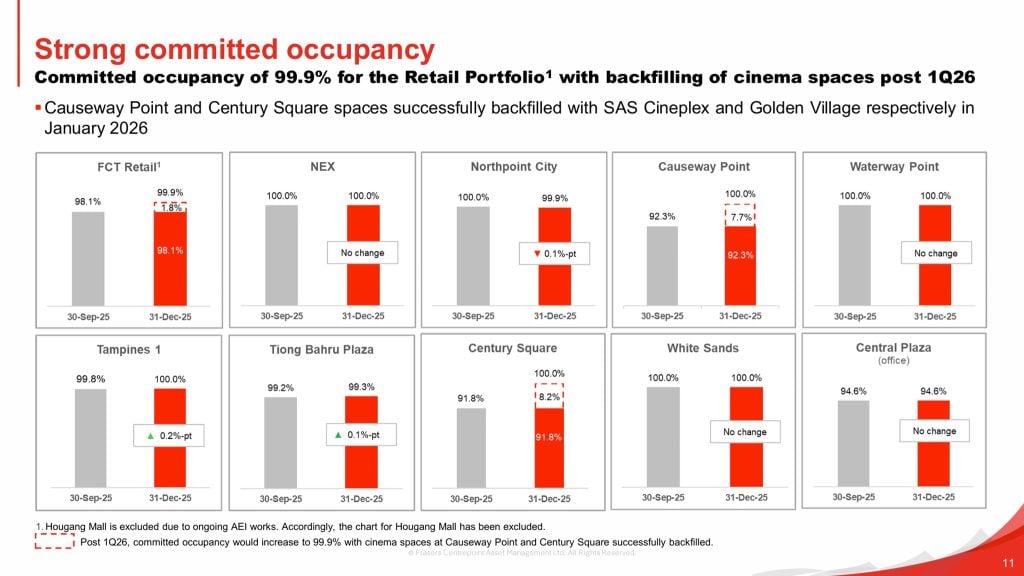

Occupancy remains one of FCT’s strongest pillars. As of 31 December 2025, the retail portfolio recorded a committed occupancy of 98.1%, excluding Hougang Mall due to ongoing AEI works. The trust also highlighted that post‑1Q26, occupancy would rise to 99.9% following the successful backfilling of cinema spaces at Causeway Point and Century Square.

Individual malls such as Northpoint City, Tampines 1, and Tiong Bahru Plaza continue to maintain near‑full occupancy, demonstrating strong tenant demand for suburban retail space. Shopper traffic and tenant sales also grew 2.7% and 1.3% year‑on‑year respectively, reinforcing the resilience of FCT’s retail ecosystem.

Lease Expiry

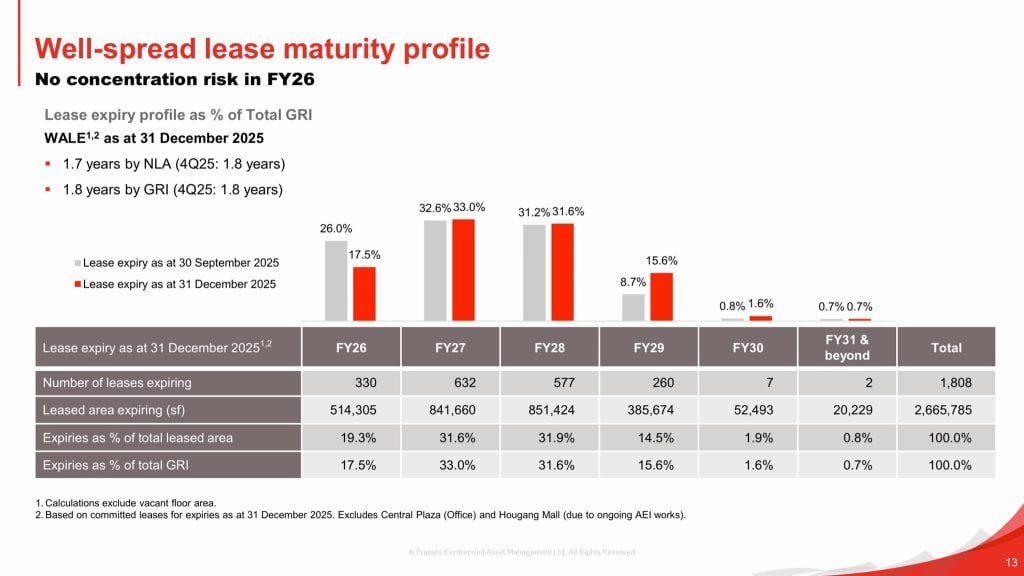

FCT’s lease expiry profile remains well‑spread, reducing concentration risk. As of 31st December 2025, the weighted average lease expiry (WALE) stood at 1.7 years by NLA and 1.8 years by GRI, consistent with the previous quarter.

For FY26, 17.5% of total GRI and 19.3% of total leased area are due for renewal. This is manageable given FCT’s strong leasing momentum and the trust’s ability to refresh tenant mix effectively. A total of 330 leases is expiring in FY26, with the largest expiries coming from NEX, Northpoint City, and Waterway Point.

Frasers Centrepoint Trust Share Price and Dividend Yield

As of the latest available market data, Frasers Centrepoint Trust (SGX: J69U) last closed at S$2.27. Based on its FY25 full year distribution of 12.113 cents per unit, the current dividend yield stands at approximately 5.34%.

This positions FCT as one of the higher‑yielding Singapore REITs, supported by stable cash flows from its suburban retail assets.

Summary of Frasers Centrepoint Trust 1Q FY26 Business Updates

Based on Frasers Centrepoint Trust 1Q FY26 business updates, the pros are:

- High committed occupancy of 98.1%, rising to 99.9% post‑1Q26.

- Stable cost of debt at 3.5% with strong hedging at 81.2%.

- Healthy shopper traffic and tenant sales growth, indicating resilient retail demand.

- Well‑distributed lease expiry profile, reducing concentration risk.

- Strong liquidity with S$839.5 million in undrawn facilities.

- AEI progress at Hougang Mall and upcoming NEX AEI to unlock further value.

The cons are:

- Gearing increased slightly to 40.3%, though still manageable.

- Short WALE of 1.7–1.8 years may require continuous leasing efforts.

- Century Square and Waterway Point showed lower occupancy before backfilling.

- Retail sector sensitivity to macroeconomic conditions and consumer sentiment remains a structural risk.