Delfi Limited, the Singapore-listed chocolate confectionery group, has released its unaudited financial results for the first half of 2025, painting a picture of resilience amid mounting global pressures. While the company managed to hold revenue steady, profitability took a hit due to record-high cocoa prices, currency depreciation, and elevated promotional spending across its key markets.

Delfi Limited, the Singapore-listed chocolate confectionery group, has released its unaudited financial results for the first half of 2025, painting a picture of resilience amid mounting global pressures. While the company managed to hold revenue steady, profitability took a hit due to record-high cocoa prices, currency depreciation, and elevated promotional spending across its key markets.

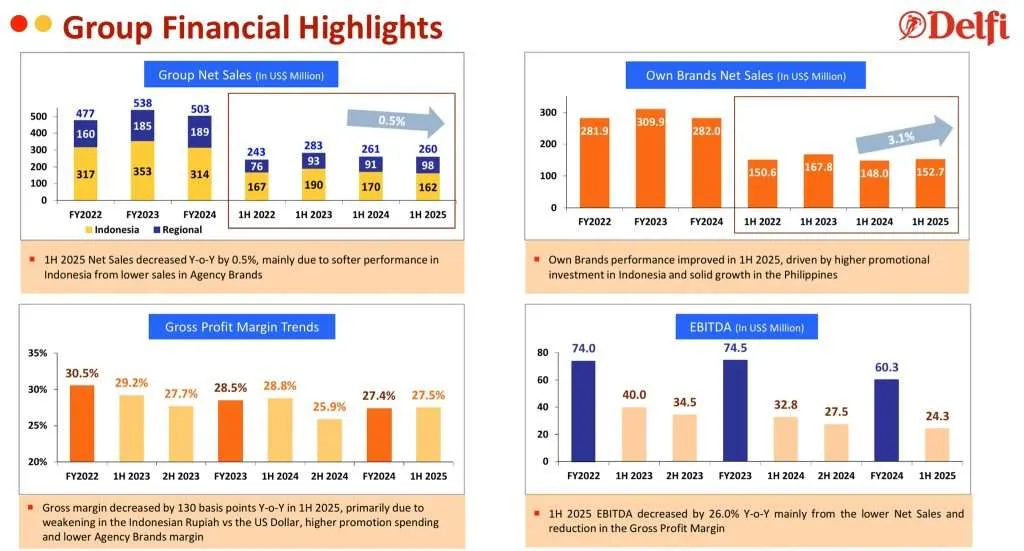

For the six months ended June 30, 2025, Delfi reported net sales of US$259.6 million, virtually unchanged from the same period in 2024. This flat performance masks underlying volatility, particularly in Indonesia, where revenue declined 4.6% year-on-year. When adjusted for currency effects, the drop was a more modest 1.3%, reflecting the impact of a 3.4% depreciation in the Indonesian rupiah against the US dollar. Indonesia remains Delfi’s largest market, and the currency movement had a pronounced effect on both reported sales and cost structure. In contrast, regional markets outside Indonesia posted a 7.2% increase in revenue, driven by strong growth in the Philippines and stable performance in Malaysia.

Despite stable topline figures, Delfi’s profitability metrics declined sharply. Net profit attributable to shareholders fell 37.7% to US$12.2 million, while earnings per share dropped to US$0.02 from US$0.032 in the prior-year period. The company’s profit margin narrowed to 4.7%, down from 7.5% a year earlier. This erosion was largely due to higher input costs, particularly for cocoa, which reached record highs during the period. The global cocoa market has been roiled by supply disruptions and speculative trading, pushing up prices and compressing margins for chocolate manufacturers worldwide. Delfi was no exception, and the impact was compounded by increased promotional spending aimed at defending market share and stimulating demand in a cautious consumer environment.

The company’s EBITDA fell 26% year-on-year to US$24.3 million, reflecting the dual pressure of rising costs and strategic investments in marketing. Delfi’s management emphasized that these promotional efforts were necessary to maintain brand visibility and consumer engagement, especially in Indonesia, where competition has intensified. While agency brands saw a 5.2% decline in sales, proprietary brands grew 3.1% year-on-year, or 5.9% in constant currency terms. This divergence underscores Delfi’s ongoing pivot toward its own labels, such as SilverQueen and Ceres, which offer stronger margins and brand equity.

Operationally, Delfi demonstrated discipline and agility. Net cash generated from operations rose to US$57.6 million, up US$20 million from the previous year, thanks to improved working capital management and better alignment of the sales cycle with festive demand. Inventory days dropped to 112 from 124 at the end of 2024, indicating more efficient inventory turnover. The company ended the period with US$81.6 million in cash and equivalents, even after paying US$7.2 million in dividends, investing US$5.4 million in capital expenditures, and repaying US$4.8 million in borrowings. The current ratio remained healthy at 1.91, slightly down from 1.95 at year-end 2024, but still indicative of strong liquidity.

Delfi’s board declared an interim dividend of 1.00 US cent per share (1.28 Singapore cents), payable on September 12, 2025. This represents a 50% payout of profit after tax and minority interest, signalling the company’s commitment to shareholder returns despite the earnings dip. The dividend decision reflects confidence in Delfi’s long-term strategy and its ability to weather near-term volatility.

Looking ahead, Delfi anticipates a challenging operating environment for the remainder of 2025 and into 2026. Geopolitical tensions, inflationary pressures, and continued currency volatility are expected to weigh on consumer sentiment and cost structures. The company also flagged the impact of high cocoa prices as a persistent headwind. Nevertheless, Delfi remains focused on its strategic priorities, including brand growth, product innovation, and operational efficiency. Delfi’s strong brand equity, disciplined financial management, and robust balance sheet position it well to navigate uncertainty and pursue sustainable growth.

Delfi Dividend Yield

Currently, Delfi Limited makes up 2.89% of my stock portfolio. Based on Delfi share price of S$0.75 and FY2024 full year distribution of 3.25 US cents (4.20 Singapore cents), this translates to a current dividend yield of 5.60%. However, I noted the interim dividend declared for 1H2025 was 1.00 US cents which is lesser than the interim dividend of 2.06 US cents per share declared in 1H2024.

If I estimated FY2025 full year distribution to be 2.19 US cents (2.8 Singapore cents), the current dividend yield would be 3.73% based on Delfi’s current share price of S$0.75. A more conservative entry point will be at Delfi share price of S$0.56 and below.

Summary of Delfi 1H2025 Financial Results

In summary, Delfi’s first-half results reflect a company balancing short-term pressures with long-term ambition. While profitability has softened, the underlying fundamentals remain sound, and the strategic pivot toward proprietary brands continues to gain traction. For investors and industry watchers, Delfi’s performance offers a nuanced view of resilience, adaptability, and forward-looking discipline in a turbulent global landscape.