DBS Group Holdings, Singapore’s largest bank, delivered a strong set of third-quarter results for 2025, showcasing its ability to navigate a challenging interest rate environment while maintaining profitability and shareholder returns. Despite macroeconomic pressures and declining benchmark rates, DBS reported record pre-tax profits and sustained momentum across its core business segments a testament to its diversified income streams and disciplined balance sheet management.

DBS Group Holdings, Singapore’s largest bank, delivered a strong set of third-quarter results for 2025, showcasing its ability to navigate a challenging interest rate environment while maintaining profitability and shareholder returns. Despite macroeconomic pressures and declining benchmark rates, DBS reported record pre-tax profits and sustained momentum across its core business segments a testament to its diversified income streams and disciplined balance sheet management.

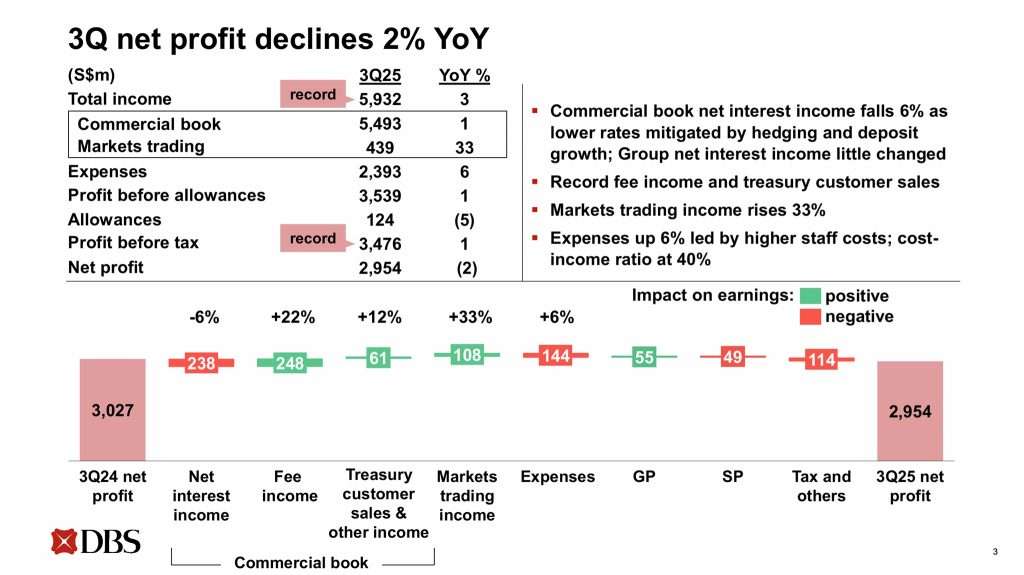

For the quarter ended 30 September 2025, DBS posted a net profit of S$2.95 billion, down just 2% year-on-year from S$3.03 billion. This modest dip was primarily attributed to the impact of the global minimum tax, rather than operational weakness. In fact, total income rose to a record S$5.93 billion, up 3% from the previous year, driven by robust fee income, treasury sales, and trading activity.

Interest Rate Pressures and Hedging Strategy

One of the key themes in this quarter’s results was the impact of falling interest rates on net interest margins (NIM). DBS’s group NIM declined 15 basis points to 1.96%, reflecting lower SORA and HIBOR benchmarks. However, the bank’s proactive hedging strategy and strong deposit growth helped cushion the blow. Group net interest income remained stable at S$3.58 billion, while commercial book net interest income fell 6% to S$3.56 billion, with NIM for the segment dropping 43 basis points to 2.4%.

DBS has approximately S$200 billion in fixed-rate assets and hedges, with S$78 billion set to roll off in 2026. This presents a headwind for future margins, but analysts believe the bank’s wealth franchise and deposit momentum will help mitigate the impact.

Fee Income and Treasury Sales Hit Record Highs

One of the standout highlights of Q3 was the surge in non-interest income, which rose 22% year-on-year to S$1.36 billion, a new record for the bank. This was led by a 31% increase in wealth management fees, which reached S$796 million, reflecting strong customer demand for investment products amid stabilizing markets.

Loan-related fees also saw a healthy 25% increase, while investment banking fees surged 65%, driven by a rebound in capital markets activity. In addition, treasury customer sales to wealth and corporate clients climbed 21%, contributing to a 12% rise in other non-interest income, which totalled S$578 million.

Markets trading income rose 33% to S$439 million, supported by improved performance in equity derivatives and lower funding costs. These gains underscore DBS’s ability to pivot toward fee-based and trading income to offset pressure on interest margins.

Asset Quality and Loan Growth

DBS maintained strong asset quality, with the non-performing loan (NPL) ratio unchanged at 1.0%. Specific allowances for loans were stable at 15 basis points, and allowance coverage stood at 139%, or 229% after collateral. These figures reflect prudent risk management and a disciplined approach to credit exposure.

Customer loans grew 4% in constant-currency terms to S$437 billion, led by broad-based expansion in non-trade corporate lending. Deposits rose 9% to S$596 billion, supported by both CASA and fixed deposit inflows. Surplus deposits were deployed into high-quality liquid assets, such as government securities, which helped support returns despite modestly reducing NIM.

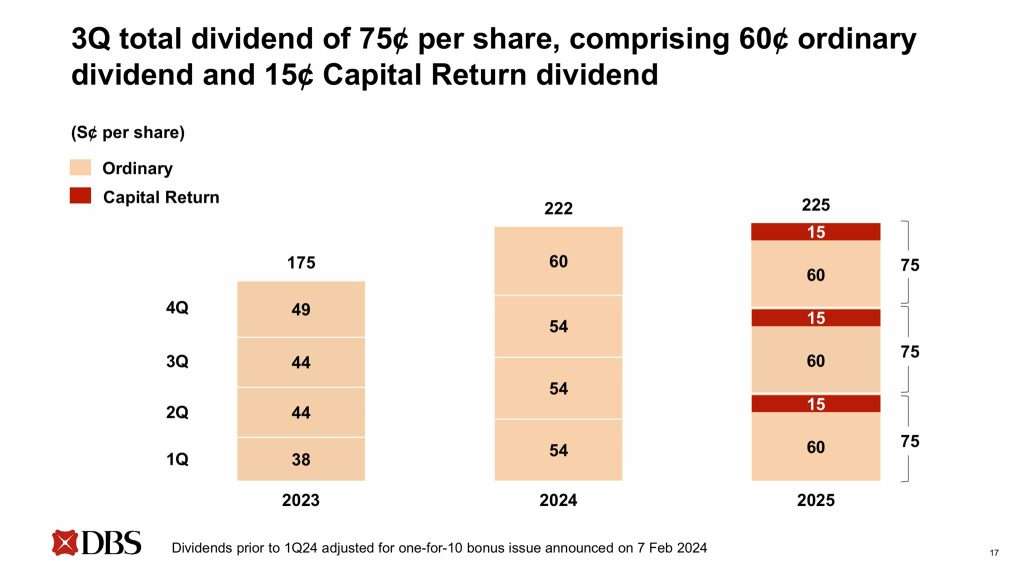

Dividend and Shareholder Returns

DBS declared a total dividend of S$0.75 per share for the quarter, comprising an ordinary dividend of S$0.60 and a capital return dividend of S$0.15. This represents a significant increase from the S$0.54 payout in the same period last year and reflects the bank’s continued commitment to rewarding shareholders even in a softer rate environment.

The dividend payable for the quarter is expected to be S$2.13 billion, underscoring DBS’s capital strength and confidence in its earnings trajectory.

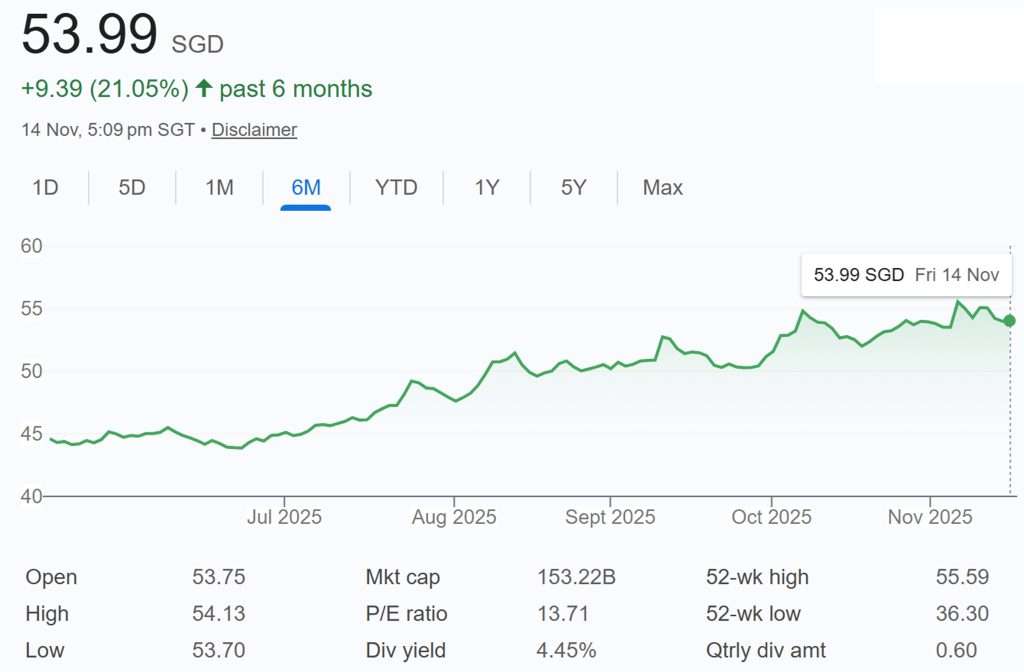

Share Price of DBS

Share price of DBS closed at S$53.99 on 14th November 2025. Based on the DBS share price of S$53.99 and FY2024 full year dividend of 222 cents, DBS current dividend yield is 4.07%.

Based on DBS FY2025 commitment to pay a full year dividend of 300 cents, DBS current dividend would be 5.56%.

Strategic Outlook and Regional Expansion

CEO Tan Su Shan highlighted several growth opportunities in the bank’s pipeline, particularly in Hong Kong, China, and ASEAN. DBS is actively supporting clients looking to diversify supply chains and expand into new markets, capitalizing on shifting trade and investment flows across the region.

The bank also continues to benefit from its acquisition of Citi’s Taiwan consumer banking business, which has bolstered its regional footprint and added scale to its wealth management operations.

Looking ahead, DBS expects total income in 2026 to remain around 2025 levels, though net profit may dip slightly due to lower net interest income. Nonetheless, analysts remain optimistic about the bank’s ability to sustain earnings through fee growth, disciplined cost management, and resilient asset quality.

Summary of DBS 3Q 2025 Financial Results

DBS’s Q3 2025 results reflect a well-managed response to a changing macroeconomic landscape. While interest rate pressures are real, the bank’s diversified income streams, strong deposit base, and proactive hedging have helped preserve profitability.

With record pre-tax profits, rising fee income, and a generous dividend payout, DBS continues to demonstrate resilience and strategic clarity, positioning itself as a leader among regional banks in the face of global uncertainty.