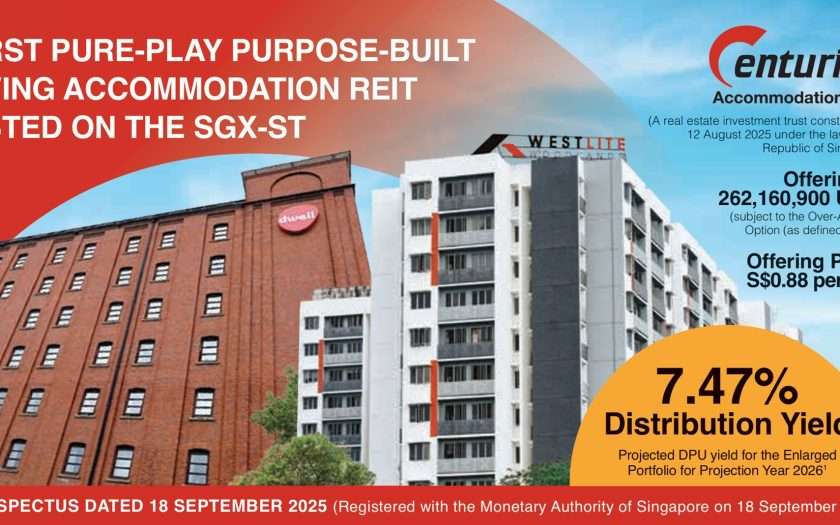

Centurion Accommodation REIT IPO date has been confirmed! Centurion Accommodation REIT (CAREIT) is making waves in Singapore’s real estate investment landscape with its highly anticipated IPO, which officially launched on Thursday, 18th September 2025. This offering marks the second-largest listing on the Singapore Exchange (SGX) this year, underscoring strong investor interest in alternative real estate segments. CAREIT is offering 262.2 million units at S$0.88 a piece, with 13.2 million units allocated for public subscription and the remainder placed with institutional and cornerstone investors. The IPO aims to raise approximately S$771 million, positioning the REIT for a market capitalisation exceeding S$1.5 billion upon listing.

Centurion Accommodation REIT IPO date has been confirmed! Centurion Accommodation REIT (CAREIT) is making waves in Singapore’s real estate investment landscape with its highly anticipated IPO, which officially launched on Thursday, 18th September 2025. This offering marks the second-largest listing on the Singapore Exchange (SGX) this year, underscoring strong investor interest in alternative real estate segments. CAREIT is offering 262.2 million units at S$0.88 a piece, with 13.2 million units allocated for public subscription and the remainder placed with institutional and cornerstone investors. The IPO aims to raise approximately S$771 million, positioning the REIT for a market capitalisation exceeding S$1.5 billion upon listing.

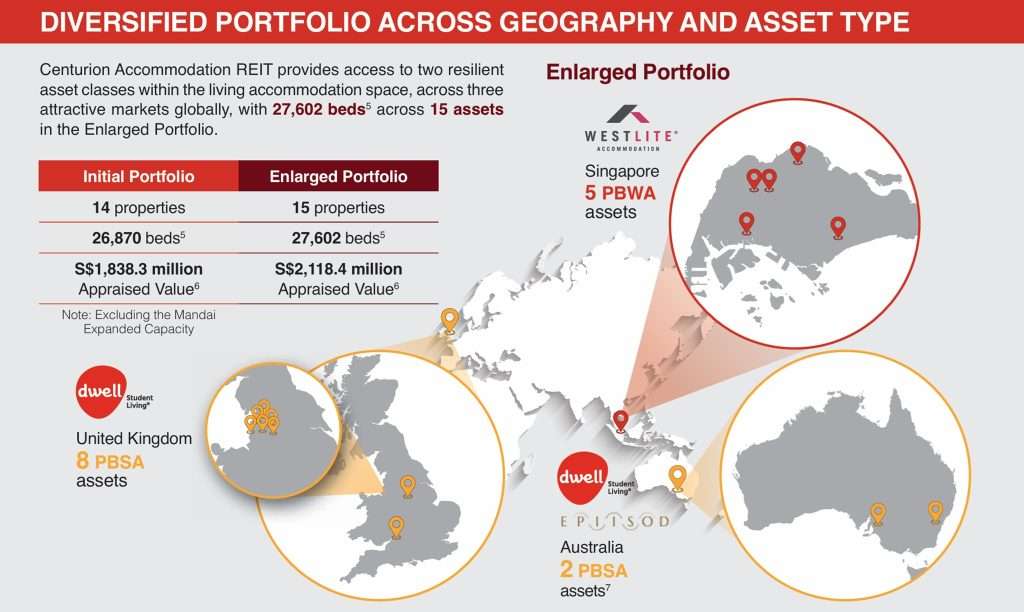

The IPO subscription period is set to close at 12pm on Tuesday, 23rd September 2025. This deadline is critical for retail and institutional investors looking to participate in the REIT’s debut. Following the close of the offering, CAREIT will begin trading on the SGX mainboard at 2pm on Thursday, 25th September 2025. The REIT’s initial portfolio includes 14 properties valued at S$1.8 billion, spanning purpose-built worker accommodation assets in Singapore and student housing assets in the UK and Australia. A fifteenth property in Sydney is slated for acquisition in early 2026, which will expand the portfolio’s value to S$2.1 billion.

Will I Centurion Accommodation REIT IPO? Yes, I will be subscribing to Centurion Accommodation REIT. The number of foreign works in Singapore is growing, and I believe Centurion Accommodation REIT will benefit from this growth. Let us take a look at the rate per bed per month for Westlite Toh Guan which is one of the assets in the REIT’s portfolio. Westlite Toh Guan, operated by Centurion Corporation, is a purpose-built workers’ dormitory located in Singapore’s Jurong area. In H1 2019, the average monthly rent for a bed in Singapore’s commercial dormitories was around S$270. By H1 2025, this figure had climbed to an island wide average of S$490 per bed per month (pb pm), representing an 81.5% increase over six years.

Dormitories in the western region where Westlite Toh Guan is located averaged S$445 per bed per month in H1 2025. Given Westlite Toh Guan’s location and classification as a Class 4 purpose-built dormitory, its rates likely followed this upward trend. Here’s a rough estimate of average monthly rates per bed over the past five years based on market data:

- 2019: estimated S$270 per bed per month

- 2020: estimated S$300 to S$330 per bed per month

- 2021: estimated S$360 to S$390 per bed per month

- 2022: estimated S$410 to S$430 per bed per month

- 2023: estimated S$460 to S$480 per bed per month

- 2024 to 2025: estimated S$445 to S$490 per bed per month

What about the rates per bed on student accommodation in Australia? Let us take a look at Dwell East End Adelaide. Dwell East End Adelaide is a premium student accommodation located in the heart of Adelaide, just minutes from the University of Adelaide and UniSA. In recent years, Dwell East End Adelaide has offered a range of room types, from shared studios with bunk beds to private studios with ensuite bathrooms and kitchenettes. As of 2025, rates for shared studios typically range from AUD 279 to AUD 329 per week, while private studios can go from AUD 379 to over AUD 450 per week depending on size and amenities.

Looking back, student accommodation rates in Adelaide have generally increased by 3 to 5% annually, driven by inflation, rising demand, and improvements in amenities. Based on this trend, here’s a rough estimate of average weekly rates per bed in shared studios at Dwell East End Adelaide:

- 2021: estimated AUD 250 to 270

- 2022: estimated AUD 260 to 280

- 2023: estimated AUD 270 to 300

- 2024: estimated AUD 280 to 320

- 2025: estimated AUD 279 to 329

CAREIT’s unique positioning as a pure-play living accommodation REIT offers investors exposure to resilient asset classes with strong demand fundamentals. With projected distribution yields of 7.47% for 2026 and 8.11% for 2027, the REIT is attracting attention from income-focused investors seeking stability and growth. The closing date of 23rd September 2025 is a key milestone in this journey, marking the final opportunity for investors to get in before CAREIT hits the public market.