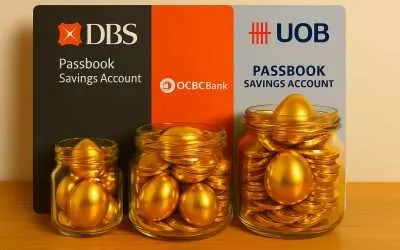

Do you know what are the Best Savings Account in Singapore? The best savings account in Singapore is often those that gives you the highest interests return. Putting your money into a high-interest savings account in Singapore is a smart and low-risk way to grow your wealth while keeping it accessible. These savings products offer a significantly better return than regular savings accounts, which often yield less than 0.1%. High-interest savings accounts reward everyday financial activities like salary crediting, bill payments, and card spending by boosting your interest rates, effectively allowing your money to work harder without additional risk.

High interest savings accounts are ideal for building an emergency fund, saving for short to medium term goals, or simply parking idle cash in a place where it earns meaningful returns while remaining liquid and insured. In a rising interest rate environment, not taking advantage of these accounts means missing out on passive income with virtually no downside.

Unlike basic savings accounts that offer negligible interest (often as low as 0.05% per annum), high interests yielding accounts incentivize specific banking behaviours to unlock higher rates. Common conditions include:

- Salary Crediting: Directing your monthly salary to the account.

- Credit Card Spending: Meeting a minimum monthly spend on an associated credit card.

- Bill Payments: Setting up recurring bill payments via GIRO.

- Balance Growth: Maintaining or increasing your average daily balance.

- Investments/Insurance: Purchasing investment or insurance products through the bank.

It is crucial to look beyond the “maximum advertised interest rate” and understand the effective interest rate (EIR) you can realistically achieve based on your banking habits.

Find out more below on my posts on the best savings account in Singapore to grow your savings while you sleep!