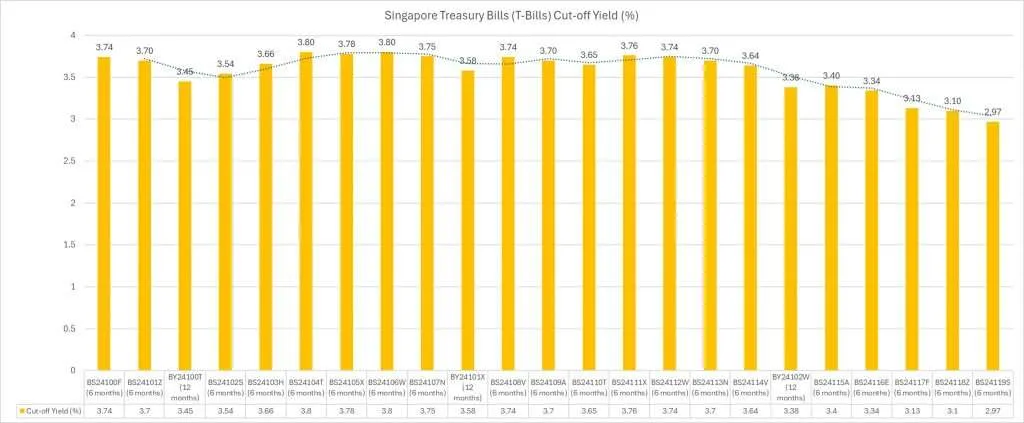

The cutoff yield for 6-Month Singapore Treasury Bills (T Bills) BS24119S is 2.97% per annum. The downward trend of the T Bill cut off yield is expected since the Fed made a jumbo rate cut of 50 bps in September. Similarly, the interest rates for Fixed Deposits and Singapore Savings Bonds have all fallen. If you are trying to park your cash in low-risk investments, perhaps you can consider Singapore Treasury Bills (T Bills) given the low risk involved.

Do you know why Singapore Treasury Bills can pay high interest rates? Singapore Treasury Bills can pay high interest rates for several reasons. Firstly, Singapore is known for its strong and stable economy, which makes its government bonds a safe investment option. Investors are willing to accept lower yields on bonds from countries with a stable economy, so Singapore can offer higher interest rates on its Treasury Bills to attract investors.

Additionally, the Monetary Authority of Singapore (MAS) actively manages its monetary policy to control inflation and ensure economic stability, which can lead to higher interest rates on government bonds.

Lastly, Singapore has a high credit rating, which means that investors have confidence in the government’s ability to repay its debts, allowing the government to offer higher interest rates on its Treasury Bills. Overall, these factors contribute to Singapore Treasury Bills being able to pay high interest rates.

If you still do not know what Singapore Treasury Bills are, find out further below.

What are Singapore Treasury Bills?

Singapore Treasury Bills are short-term debt instruments issued by the Singapore government to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

Investors can purchase these bills directly from the Singapore government or through designated financial institutions. Treasury Bills are often used by investors as a low-risk, liquid investment option with a fixed return.

The Announcement Date and Auction Date of Singapore Treasury Bills can be found at Monetary Authority of Singapore (MAS) website under Auctions and Issuance Calendar. For convenience, you can also download a copy to keep on your computer’s desktop.

Singapore T-Bills Calendar

For convenience, I am sharing the Singapore Treasury Bills (T-Bills) Auction and Issuance Calendar here. If you need the Treasury Bill results such as the status of each issuance, please refer to Treasury Bills at MAS website – Auctions and Issuance Calendar.

6-Months T-Bills Calendar

1-year T-Bills Calendar

As you can see from the above, there is an upcoming 12-month Singapore Treasury Bills (T Bills) to be announced on 10th October 2024. If you are looking at longer term as compared to 6 months, do not miss it.

Singapore Savings Bonds (SSB) versus Singapore Treasury Bills (T-Bills)

If you want to compare the returns between Singapore Savings Bonds and Singapore T Bills, the interest rate (cut of yield) by Singapore T Bills had always been higher. That is also the reason why investors have been telling me why not put your money into Singapore T Bills instead of Singapore Savings Bonds.

The effective return of the latest issue of Singapore Savings Bond (SBNOV24 GX24110N) is 2.56% if you held it for 10 years. If you are going to just hold it for 1 year, the return is 2.25% per annum.

The latest 6-Month Singapore Treasury Bills (T Bills) BS24119S is 2.97% per annum. I believe anyone can do your maths.

Having said that, Singapore Savings Bond still have its benefits. That is, it allows you to lock in the effective interest rates for a longer period of 10 years. And that is why I purchased Singapore Savings Bonds when the effective interest rates were the highest few months ago.

Tracking of Singapore Savings Bonds (SSB) and Treasury Bills (T-Bills) All in One Place

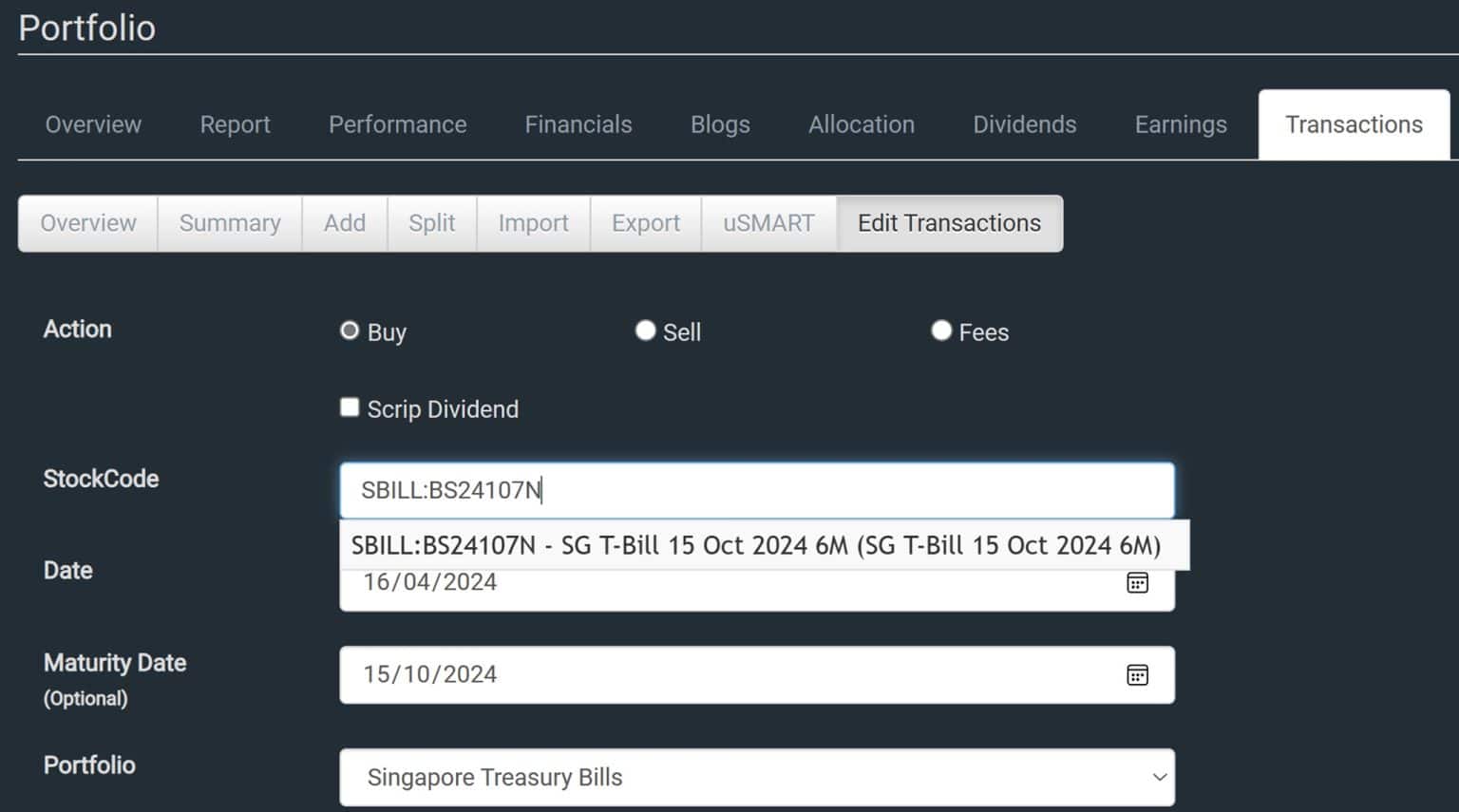

Stocks Café is probably the only software that I know which allows you to track your purchased Singapore Savings Bonds and Treasury Bills (T-Bills) all in one place together with your stock investments. This makes it easy to track your total net investments.

Stocks Café allows you to create portfolios. You can use portfolio to different your investments. For example, I created three portfolios in Stocks Café, namely Stocks, Singapore Savings Bonds and Treasury Bills. This allow me to categorize how much I allocate for each investment.

Where is the Best Place to Park Your Money?

Consistently, the cut of yield for Singapore Treasury Bills (T Bills) has been higher than Fixed Deposits and Singapore Savings Bond. Over the next few months, I foresee that the best place to park your extra money would be in Singapore Treasury Bills (T Bills).

Having said the above, it is still important to monitor the trends and interest rates offered by Bank Fixed Deposits. Sometimes, banks do offer special fixed deposit promotions whereby they can be more attractive than Singapore Treasury Bills.