Keppel DC REIT has taken a decisive step in expanding its footprint in Asia-Pacific’s data centre landscape with the launch of a preferential offering to fund the acquisition of Tokyo Data Centre 3. This strategic move, announced on September 22, 2025, underscores the REIT’s commitment to long-term growth and portfolio diversification, particularly in high demand hyperscale markets like Japan.

Keppel DC REIT has taken a decisive step in expanding its footprint in Asia-Pacific’s data centre landscape with the launch of a preferential offering to fund the acquisition of Tokyo Data Centre 3. This strategic move, announced on September 22, 2025, underscores the REIT’s commitment to long-term growth and portfolio diversification, particularly in high demand hyperscale markets like Japan.

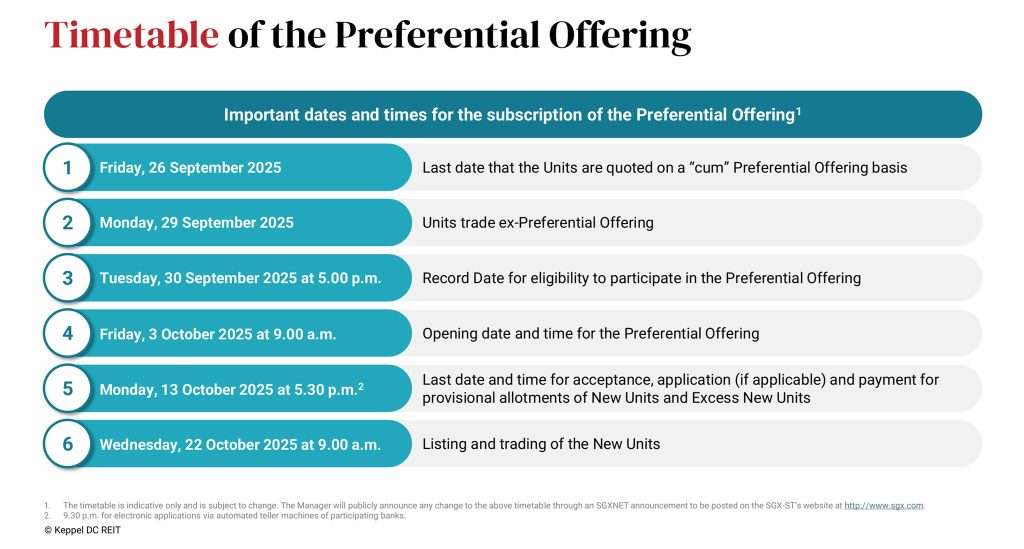

The preferential offering was officially launched on September 22, 2025, with the entitlement record date set for September 30, 2025, at 5:00 p.m. Singapore time. Eligible unitholders, those on the register as of the record date are entitled to subscribe to 80 new units for every 1,000 existing units held, at an issue price of S$2.24 per unit. The new units are expected to be listed and commence trading on the Singapore Exchange (SGX-ST) on October 22, 2025.

This capital-raising exercise aims to generate gross proceeds of approximately S$404.5 million, with a substantial portion earmarked for the acquisition of Tokyo Data Centre 3. The facility, located in Inzai City, Greater Tokyo, is a newly built, five-storey hyperscale data centre contracted to a leading global hyperscaler for a 15-year term. The acquisition price of 82.1 billion Yen (around S$707 million) represents a 1.1% discount to the asset’s valuation, reflecting Keppel DC REIT’s ability to secure high-quality assets at compelling terms.

Beyond the acquisition, the proceeds will also support an asset enhancement initiative at Keppel DC Singapore 8, cover costs associated with a 30-year land lease extension for Keppel DC Singapore 1, and be used for debt repayment. These initiatives reflect a balanced approach to growth and operational optimization, reinforcing the REIT’s commitment to enhancing portfolio resilience and long-term value.

Financially, the acquisition is expected to be immediately accretive. On a pro forma basis, had the acquisition been completed on January 1, 2024, the distribution per unit (DPU) for FY2024 would have increased by 2.8%, from 9.451 cents to 9.712 cents. This uplift signal stronger returns for unitholders and affirms the REIT’s disciplined capital deployment strategy.

The addition of Tokyo Data Centre 3 will also improve key portfolio metrics. Occupancy is projected to rise slightly from 95.8% to 95.9%, while the weighted average lease expiry will extend from 6.92 years to 7.2 years. These enhancements, though incremental, reflect the quality of the asset and the stability of its lease structure. With this acquisition, Keppel DC REIT’s assets under management will grow to S$5.7 billion, comprising 25 data centres across 10 countries in Asia-Pacific and Europe.

Keppel DC REIT’s preferential offering is fully underwritten, reducing execution risk and signalling strong confidence from underwriters and management. While the offering may result in short-term dilution for unitholders who do not participate, it is a calculated move aimed at long-term accretion and strategic portfolio expansion.

In a digital era where data infrastructure is critical, Keppel DC REIT’s proactive capital raising and acquisition strategy reflect a clear vision for sustainable growth. The Tokyo Data Centre 3 acquisition and the accompanying preferential offering are not just financial transactions. They are a testament to the REIT’s ability to navigate complex markets, seize strategic opportunities, and deliver enduring value to its investors.